Key Insights

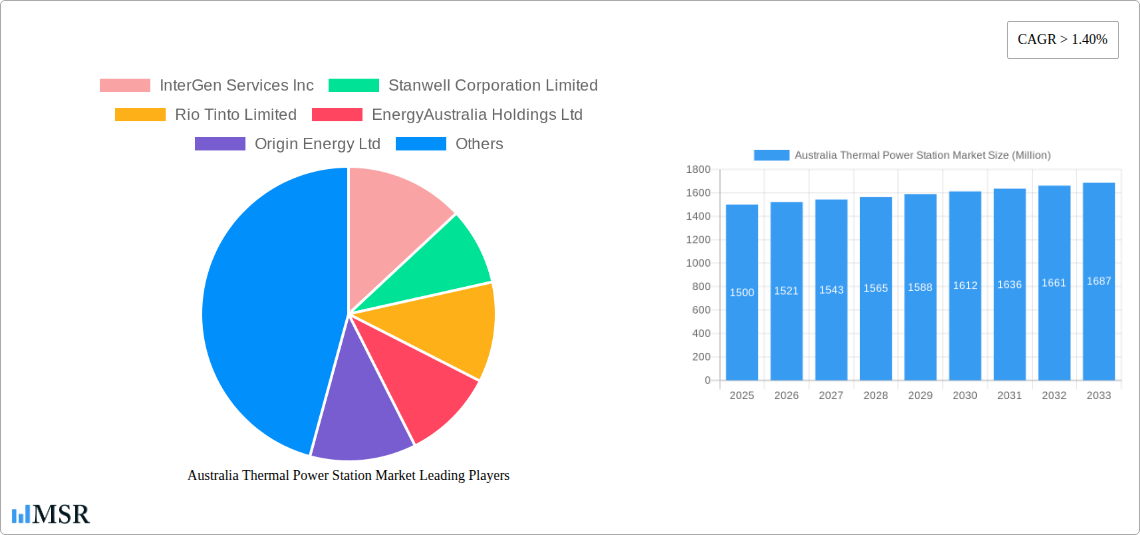

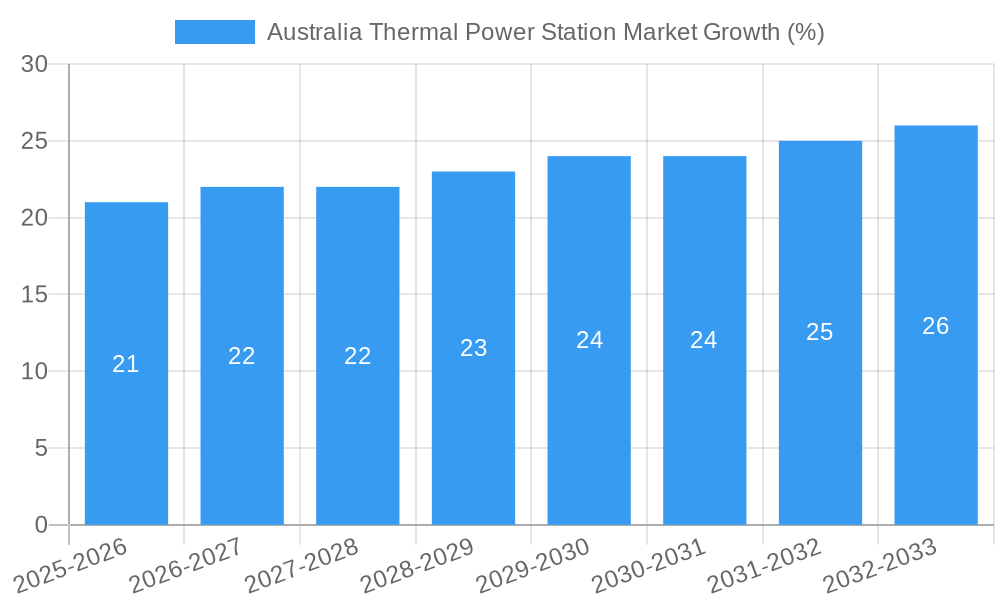

The Australian thermal power station market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided data and considering the CAGR of >1.40%), is projected to experience steady growth through 2033. This growth, however, is expected to be moderated by several factors. While increasing energy demand driven by population growth and industrial expansion provides a strong impetus, the market faces significant headwinds from the Australian government's increasing commitment to renewable energy sources and stricter environmental regulations targeting carbon emissions. This policy shift is leading to a decline in investments in new coal-fired plants, a primary component of the thermal power generation sector. The existing aging infrastructure of many thermal plants also poses a challenge, necessitating substantial upgrades or replacements, adding to the overall market complexity. Nevertheless, the continued need for a reliable baseload power supply, particularly during periods of low renewable energy generation, will ensure that thermal power stations remain a critical component of Australia's energy mix for the foreseeable future. The market segmentation, predominantly consisting of sources like coal, natural gas, and oil-fired plants, will likely see a gradual shift toward gas-fired plants in the coming years due to their relatively lower carbon emissions compared to coal. This transition is expected to be facilitated by continuous advancements in gas power generation technology and potentially government incentives promoting cleaner energy sources.

Major players like InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, and AGL Energy Limited will need to adapt their strategies to navigate this evolving landscape. This includes investing in efficiency improvements for existing plants, exploring opportunities in gas-fired power generation, and possibly exploring partnerships or diversification into renewable energy projects to ensure long-term market viability. The market's trajectory will hinge on the balance between the persistent need for reliable power, the increasing pressure to reduce carbon emissions, and the strategic decisions of key players in the industry. The geographical focus on Australia confines the market analysis to the specific energy policies and economic conditions within the country.

Australia Thermal Power Station Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia Thermal Power Station Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, industry trends, key players, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic planners. The report leverages extensive data analysis and expert forecasts to deliver actionable intelligence for navigating the complexities of this evolving market. The market size in 2025 is estimated at AU$ XX Million.

Australia Thermal Power Station Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the Australian thermal power station market, encompassing market concentration, innovation ecosystems, regulatory frameworks, substitute products, end-user trends, and M&A activities.

The market exhibits a moderately concentrated structure, with a few major players holding significant market share.

- Market Share: AGL Energy Limited holds an estimated xx% market share, followed by EnergyAustralia Holdings Ltd at xx%, and Origin Energy Ltd at xx%. The remaining market share is distributed among several smaller players.

- Innovation Ecosystems: Innovation is primarily driven by advancements in efficiency technologies and emissions reduction strategies. Collaboration between power producers and technology providers is crucial for driving innovation.

- Regulatory Frameworks: The Australian government's policies concerning renewable energy and emissions reductions significantly impact the thermal power sector. Stringent emission regulations are pushing companies towards cleaner technologies or capacity reductions.

- Substitute Products: The increasing adoption of renewable energy sources, such as solar and wind power, presents a significant competitive threat to thermal power stations.

- End-User Trends: Industrial and commercial sectors are major end-users of thermal power, with their energy demands influencing market growth. The shift towards decarbonization is altering end-user preferences.

- M&A Activities: The number of M&A deals in the sector has been relatively stable in recent years, with an average of xx deals annually between 2019 and 2024. These deals are primarily driven by consolidation and expansion strategies.

Australia Thermal Power Station Market Industry Insights & Trends

This section delves into the key drivers shaping the Australian thermal power station market, examining market growth, technological disruptions, and evolving consumer behaviors.

The Australian thermal power station market witnessed a CAGR of xx% during the historical period (2019-2024). Factors contributing to this growth include increasing energy demand from the industrial and commercial sectors and the ongoing reliance on thermal power as a baseload energy source. However, the market is expected to experience a slowdown in growth during the forecast period (2025-2033) due to the increasing penetration of renewable energy and stricter environmental regulations. The market size is projected to reach AU$ XX Million by 2033. Technological advancements such as high-efficiency low-emission (HELE) technologies and carbon capture, utilization, and storage (CCUS) are impacting market dynamics, offering pathways for reducing emissions from thermal power generation. The increasing cost of fossil fuels and the growing awareness of climate change are also influencing consumer behaviors and prompting a shift toward cleaner energy options.

Key Markets & Segments Leading Australia Thermal Power Station Market

This section identifies the dominant segments within the Australian thermal power station market, focusing on the sources: oil, natural gas, and coal.

Coal remains the dominant fuel source for thermal power generation in Australia.

- Drivers: Established infrastructure, readily available domestic coal reserves, and relatively lower initial investment costs compared to other fuel sources.

- Dominance Analysis: Coal-fired power plants still constitute a significant portion of Australia's energy mix, however, their future is uncertain due to environmental concerns and government policies promoting renewable energy.

Natural Gas plays a significant role as a flexible fuel source.

- Drivers: Relatively cleaner emissions profile compared to coal, and its suitability for peak demand and load balancing.

- Dominance Analysis: The increasing availability of liquefied natural gas (LNG) and its role in power generation, however, this dominance is influenced by global gas prices and government policies.

Oil plays a comparatively minor role.

- Drivers: Primarily used in smaller-scale power generation or as a backup fuel source.

- Dominance Analysis: The high cost of oil and its environmental impacts limit its widespread use in large-scale thermal power plants.

The market is geographically concentrated in major industrial and population centers in states like Queensland, New South Wales, and Victoria, with access to fuel sources and established transmission networks shaping regional distribution.

Australia Thermal Power Station Market Product Developments

Technological advancements are driving product innovation in the Australian thermal power station market. High-efficiency, low-emission (HELE) technologies are increasingly being adopted to improve fuel efficiency and reduce emissions. Advances in carbon capture, utilization, and storage (CCUS) technologies are also gaining traction as a means of mitigating the environmental impact of thermal power generation. These innovations are providing a competitive edge for power generation companies striving to meet stricter environmental regulations and maintain operational efficiency.

Challenges in the Australia Thermal Power Station Market Market

The Australian thermal power station market faces numerous challenges, including stringent environmental regulations leading to increased operational costs and capacity reductions (estimated at xx% reduction by 2033). Supply chain disruptions related to fuel sourcing and equipment procurement also pose significant risks. Furthermore, intense competition from renewable energy sources and evolving consumer preferences are impacting the long-term viability of some thermal power plants.

Forces Driving Australia Thermal Power Station Market Growth

The Australian thermal power station market's growth is driven by factors including continued industrial and commercial energy demand, especially in sectors with limited access to renewable sources. Economic growth and population increases further propel energy needs, while technological advancements in efficiency and emissions reduction present ongoing opportunities for market players. Government policies, however, are a double-edged sword; while investments in transmission and grid infrastructure support thermal power, environmental regulations simultaneously restrict its growth.

Long-Term Growth Catalysts in Australia Thermal Power Station Market

Long-term growth relies heavily on strategic partnerships that foster innovation and access to cleaner technologies such as CCUS. Investments in research and development aimed at reducing emissions and enhancing efficiency are vital. Expanding into new markets or diversifying into related energy services could provide additional growth catalysts. The potential for these catalysts to influence long-term growth is estimated to be xx% by 2033.

Emerging Opportunities in Australia Thermal Power Station Market

Emerging opportunities include the integration of thermal power with renewable energy sources through hybrid power plants. This enables flexible and reliable power generation. The development of efficient and cost-effective CCUS technologies presents a significant opportunity to mitigate the environmental impact of thermal power generation. Furthermore, exploring new markets with growing energy demands, particularly in developing regions, offers potential expansion avenues.

Leading Players in the Australia Thermal Power Station Market Sector

- InterGen Services Inc

- Stanwell Corporation Limited

- Rio Tinto Limited

- EnergyAustralia Holdings Ltd

- Origin Energy Ltd

- Sumitomo Corporation

- NRG Energy Inc

- AGL Energy Limited

Key Milestones in Australia Thermal Power Station Market Industry

- 2020: Increased focus on renewable energy targets by the Australian government.

- 2021: Several thermal power plants announce plans for early retirement due to economic and regulatory pressures.

- 2022: Significant investments in CCUS technology announced by several key players.

- 2023: Several mergers and acquisitions reshape the market landscape.

- 2024: Introduction of stricter emission standards for thermal power plants.

Strategic Outlook for Australia Thermal Power Station Market Market

The future of the Australian thermal power station market hinges on adapting to a changing energy landscape. Strategic opportunities lie in leveraging technological advancements to enhance efficiency and reduce emissions. Focus on CCUS and hybrid power plant development will be crucial for maintaining market relevance. Successful players will navigate the regulatory environment and adapt to the increasing adoption of renewable energy sources. The market is expected to witness a transition towards a more diversified energy mix, with thermal power plants playing a reduced, yet crucial, role as a baseload energy provider and possibly integrated with renewable sources for increased energy security.

Australia Thermal Power Station Market Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

Australia Thermal Power Station Market Segmentation By Geography

- 1. Australia

Australia Thermal Power Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Natural Gas-Based Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Thermal Power Station Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 InterGen Services Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stanwell Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rio Tinto Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergyAustralia Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Origin Energy Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NRG Energy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGL Energy Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 InterGen Services Inc

List of Figures

- Figure 1: Australia Thermal Power Station Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Thermal Power Station Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Thermal Power Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Thermal Power Station Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Australia Thermal Power Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia Thermal Power Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia Thermal Power Station Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Australia Thermal Power Station Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Thermal Power Station Market?

The projected CAGR is approximately > 1.40%.

2. Which companies are prominent players in the Australia Thermal Power Station Market?

Key companies in the market include InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, AGL Energy Limited.

3. What are the main segments of the Australia Thermal Power Station Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Natural Gas-Based Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Thermal Power Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Thermal Power Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Thermal Power Station Market?

To stay informed about further developments, trends, and reports in the Australia Thermal Power Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence