Key Insights

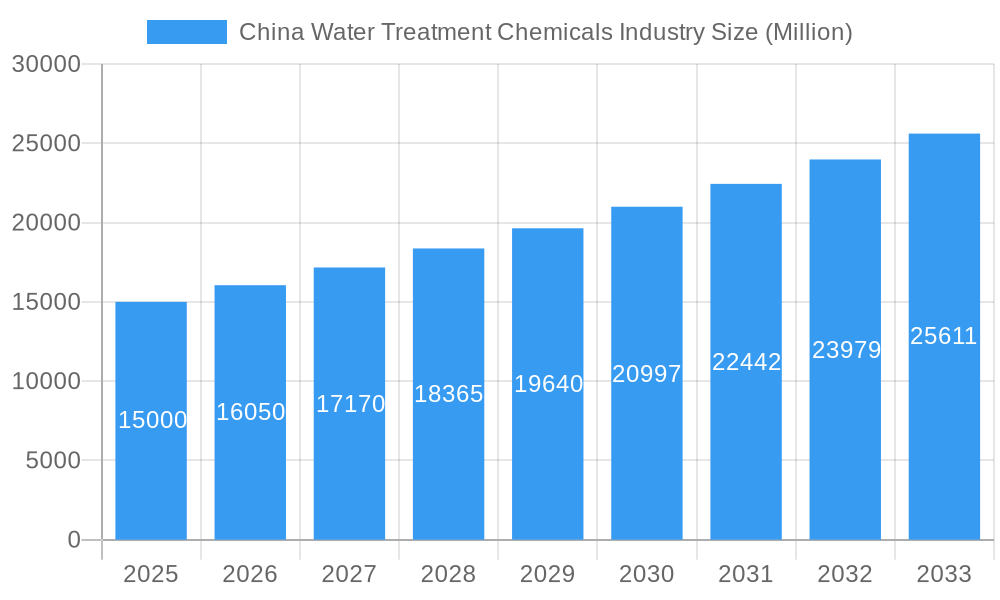

China's water treatment chemicals market is projected for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of 4.2% from a market size of 40.2 billion in the base year of 2025 through 2033. This expansion is propelled by rapid industrialization, escalating urbanization leading to increased water demand and pollution, and increasingly stringent environmental mandates. Key growth catalysts include the burgeoning manufacturing sector, particularly in food & beverage, pharmaceuticals, and power generation, all requiring sophisticated water treatment technologies. Government-led initiatives promoting sustainable water management and infrastructure development further bolster market expansion. The market is segmented by chemical type (coagulants, flocculants, disinfectants), application (municipal, industrial), and region. Major industry participants like SNF (China) Flocculant Co Ltd, Ecolab, and Solenis are actively pursuing technological innovation and strategic alliances to secure a competitive advantage. Despite potential challenges such as raw material price volatility and environmental considerations associated with certain chemical agents, the market's trajectory remains robust, supported by ongoing investments in water infrastructure and a steadfast commitment to enhancing water quality.

China Water Treatment Chemicals Industry Market Size (In Billion)

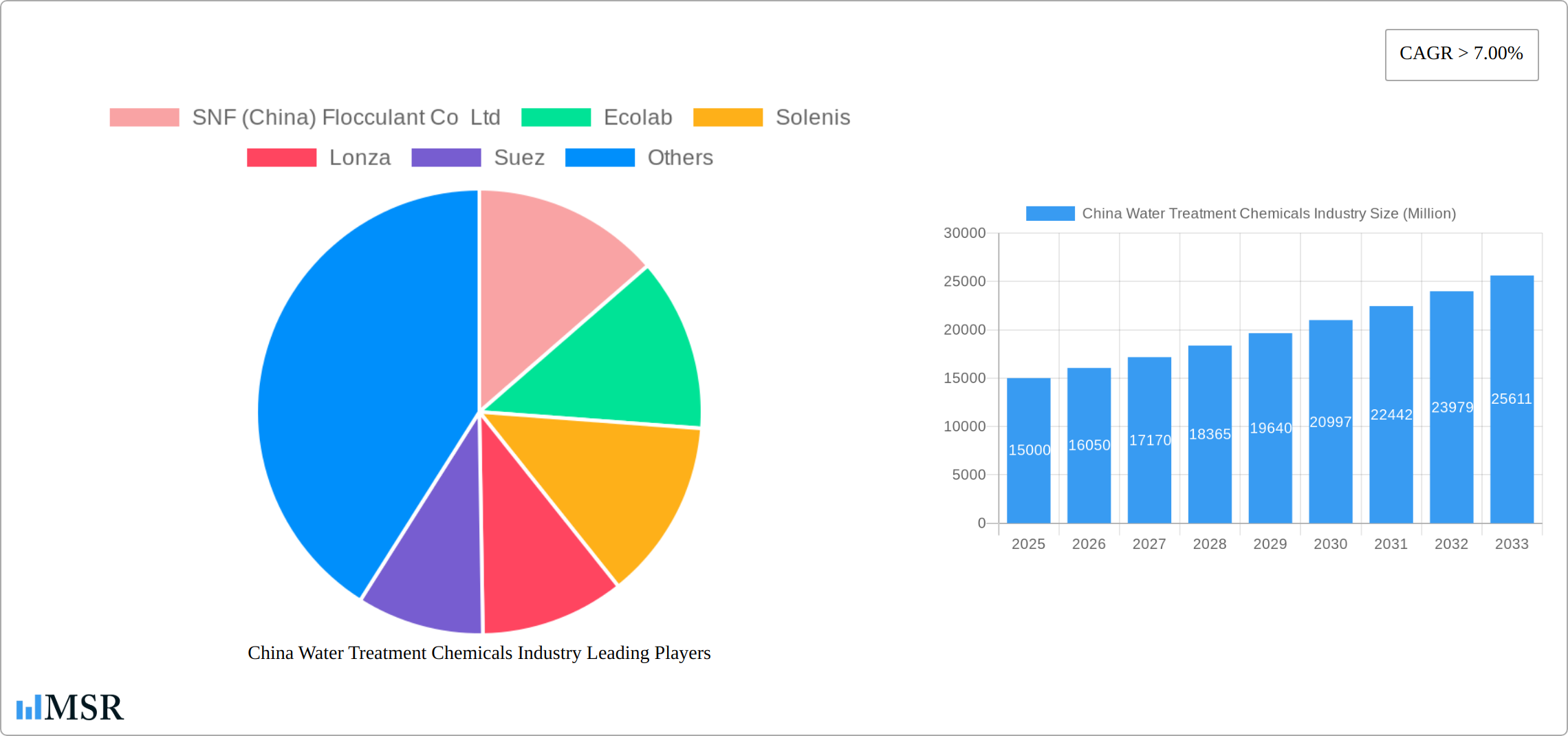

The competitive landscape features a dynamic interplay between domestic and international enterprises. Local companies leverage their deep understanding of regional regulations and market nuances. Conversely, international firms contribute cutting-edge technologies and globally recognized operational standards. This competitive environment stimulates innovation and the creation of more effective and eco-friendly water treatment solutions. Growth is expected to be particularly pronounced in developing regions, while established markets are likely to exhibit steady, albeit slower, expansion. Projections indicate a sustained upward market trend, driven by continued industrial development and government backing for water infrastructure projects. Success in this dynamic market hinges on strategic foresight and adaptability for participating companies.

China Water Treatment Chemicals Industry Company Market Share

China Water Treatment Chemicals Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China water treatment chemicals industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers market size, growth drivers, key players, emerging trends, and future outlook, with data spanning the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The total market value is expected to reach xx Million by 2033.

China Water Treatment Chemicals Industry Market Concentration & Dynamics

The China water treatment chemicals market exhibits a moderately concentrated landscape, with several multinational corporations and domestic players vying for market share. Key players such as SNF (China) Flocculant Co Ltd, Ecolab, Solenis, Lonza, Suez, Kemira Oyj, Dow, Wujin Fine Chemical Factory, Veolia, and Kurita Water Industries Ltd hold significant portions of the market. However, the presence of numerous smaller, specialized companies indicates a dynamic and competitive environment.

- Market Share: The top 5 players account for approximately xx% of the total market share in 2025, with SNF (China) Flocculant Co Ltd holding the largest share. This share is projected to xx% by 2033.

- M&A Activity: The industry has witnessed a notable increase in mergers and acquisitions (M&A) activity in recent years, driven by strategic expansion and consolidation efforts. For instance, the May 2022 acquisition of hazardous waste assets by Suez from Veolia highlights this trend. An estimated xx M&A deals occurred between 2019 and 2024.

- Innovation Ecosystem: The market thrives on technological advancements, particularly in areas like membrane filtration, advanced oxidation processes, and intelligent water management systems.

- Regulatory Framework: Government regulations concerning water quality and environmental protection significantly impact the industry. Stringent emission standards and wastewater treatment regulations drive demand for advanced water treatment chemicals.

- Substitute Products: While limited, some substitute products and technologies, such as membrane filtration, pose competitive pressure on certain chemical applications.

- End-User Trends: The increasing emphasis on industrial water reuse and stricter environmental regulations drives demand for higher-performing and sustainable water treatment solutions.

China Water Treatment Chemicals Industry Industry Insights & Trends

The China water treatment chemicals market is experiencing robust growth, driven by several factors. The market size in 2025 is estimated at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is primarily attributed to increasing industrialization, urbanization, and stringent environmental regulations. Government initiatives focused on water conservation and pollution control further stimulate market demand. Technological advancements, including the development of more efficient and environmentally friendly water treatment chemicals, are also crucial growth drivers. Changing consumer behavior, characterized by increasing environmental awareness and a demand for sustainable products, is another important factor influencing the market's trajectory. The rise of smart water management systems and digitalization within the water treatment sector is further impacting the industry's growth. Competition among industry players is intense, leading to continuous innovations and improvements in product quality and cost-effectiveness.

Key Markets & Segments Leading China Water Treatment Chemicals Industry

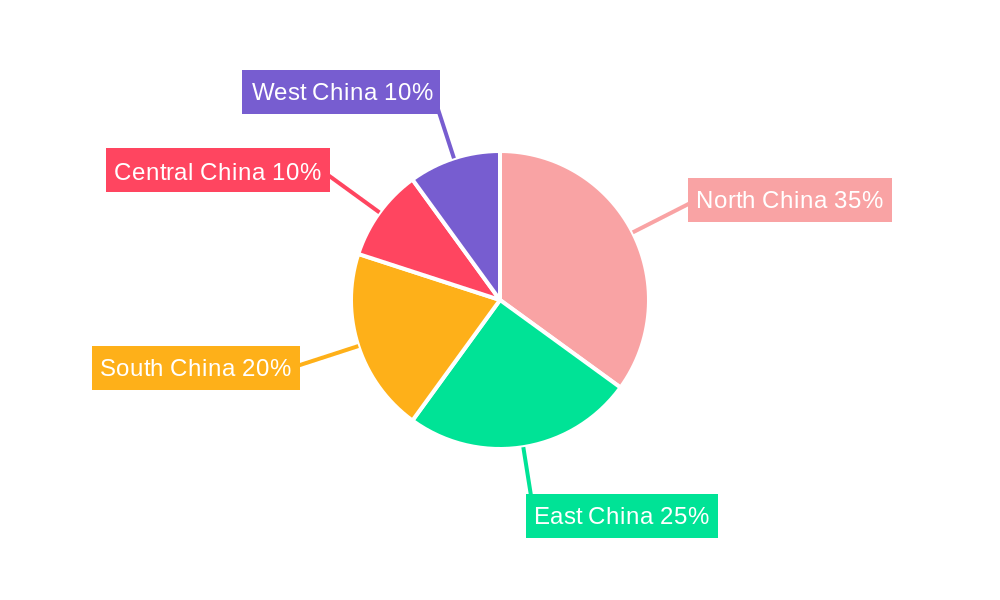

The report identifies key geographical regions and segments driving growth within the China water treatment chemicals industry. The xx region dominates the market due to factors like robust industrial activity, rapid urbanization, and significant government investments in water infrastructure projects.

- Growth Drivers:

- Rapid Industrialization: The expansion of various industries, especially manufacturing and energy, significantly increases demand for industrial water treatment chemicals.

- Urbanization: Growing urban populations lead to higher wastewater volumes, necessitating advanced treatment solutions.

- Government Initiatives: Government policies promoting water conservation and environmental protection stimulate demand.

- Infrastructure Development: Significant investments in water infrastructure projects, including wastewater treatment plants and desalination facilities, significantly impact market growth.

The dominance of this region stems from a confluence of factors, including the high concentration of industrial activity, rapid urbanization creating increased wastewater treatment needs, and substantial government spending on water infrastructure upgrades. Detailed analysis within the report dives deeper into regional variations, highlighting specific market dynamics and growth prospects.

China Water Treatment Chemicals Industry Product Developments

The China water treatment chemicals industry is experiencing a dynamic phase of product evolution, marked by a strong emphasis on innovation and sustainability. Manufacturers are actively developing next-generation chemistries that offer superior performance, enhanced environmental profiles, and greater cost-effectiveness. Key areas of advancement include the refinement of coagulants and flocculants, leading to more efficient removal of suspended solids and impurities, as well as the exploration of novel antiscalants and corrosion inhibitors designed for longer equipment life and reduced maintenance. Furthermore, the industry is increasingly investing in research and development for specialty chemicals catering to specific industrial needs, such as those required for advanced oxidation processes (AOPs) to tackle recalcitrant organic pollutants in complex wastewater streams. The overarching trend is a shift towards 'green chemistry' principles, with a focus on biodegradability, reduced toxicity, and minimized by-product formation. These cutting-edge developments not only empower manufacturers with a competitive edge but also play a crucial role in advancing China's broader water resource management and environmental protection goals.

Challenges in the China Water Treatment Chemicals Industry Market

The China water treatment chemicals market navigates a complex landscape of challenges. A primary concern is the increasingly stringent framework of environmental regulations, which mandate adherence to rigorous emission and discharge standards. This necessitates substantial investment in compliance, often requiring the adoption of more advanced and specialized treatment solutions. Additionally, the market is susceptible to supply chain volatility and raw material price fluctuations, impacting production costs and profitability. Intense and often aggressive competition, stemming from both established domestic enterprises and global chemical giants, further compresses profit margins and demands continuous innovation and operational efficiency. Navigating these multifaceted challenges is crucial for sustained growth and market resilience within this vital sector.

Forces Driving China Water Treatment Chemicals Industry Growth

The sustained expansion of the China water treatment chemicals industry is propelled by a confluence of potent drivers:

- Technological Advancements: Ongoing research and development are yielding more potent, eco-friendly, and application-specific water treatment chemicals and processes. These innovations enhance treatment efficacy, reduce operational costs, and minimize environmental footprints.

- Stringent Environmental Regulations: The Chinese government's commitment to improving water quality and protecting the environment has resulted in progressively stricter regulations. This regulatory push directly translates into increased demand for a wide array of advanced water treatment chemicals to meet compliance requirements across industrial and municipal sectors.

- Economic Growth and Urbanization: China's robust economic development continues to fuel industrial expansion and accelerate urbanization. This growth inherently increases the demand for clean water for both industrial processes and domestic consumption, consequently driving the market for water treatment chemicals.

- Growing Awareness of Water Scarcity and Quality: A heightened societal and industrial awareness regarding the critical importance of water conservation and the need for high-quality water resources is fostering a greater willingness to invest in effective water treatment solutions.

- Industrial Sector Expansion: The burgeoning growth in key industrial sectors such as petrochemicals, power generation, and manufacturing necessitates sophisticated water management strategies, thereby boosting the demand for specialized water treatment chemicals tailored to these industries.

Long-Term Growth Catalysts in the China Water Treatment Chemicals Industry Market

Long-term growth will be propelled by innovations in water treatment technologies, strategic partnerships between chemical companies and water infrastructure developers, and expansions into new geographic markets within China. These factors will create new opportunities and drive sustainable industry growth in the long term.

Emerging Opportunities in China Water Treatment Chemicals Industry

The industry is ripe with emerging opportunities. New markets are opening up within the rapidly expanding agricultural sector, which requires specialized water treatment solutions. Furthermore, the increasing focus on water reuse and recycling creates opportunities for innovative chemical solutions. Advancements in nanotechnology and biotechnology are also presenting new avenues for developing advanced water treatment chemicals.

Leading Players in the China Water Treatment Chemicals Industry Sector

- SNF (China) Flocculant Co Ltd

- Ecolab

- Solenis

- Lonza

- Suez

- Kemira Oyj

- Dow

- Wujin Fine Chemical Factory

- Veolia

- Kurita Water Industries Ltd

- List Not Exhaustive

Key Milestones in China Water Treatment Chemicals Industry Industry

- November 2022: Ecolab partnered with the Egyptian Government on the National Water Project, demonstrating the growing importance of international collaborations in addressing global water challenges.

- May 2022: Suez's acquisition of Veolia's hazardous waste assets signifies significant consolidation within the broader water management sector, impacting the competitive landscape.

Strategic Outlook for China Water Treatment Chemicals Industry Market

The China water treatment chemicals market is poised for significant and sustained growth. The strategic imperative for companies operating within this sector lies in their ability to foster continuous innovation, particularly in the realm of sustainable and high-performance chemistries. Agility in adapting to evolving regulatory landscapes and proactively meeting new environmental standards will be paramount. Furthermore, the cultivation of strong collaborative partnerships, encompassing both upstream raw material suppliers and downstream end-users, will be instrumental in navigating market complexities and unlocking new opportunities. A steadfast commitment to developing and offering efficient, environmentally responsible solutions will undoubtedly define success and drive leadership in this dynamic and rapidly transforming market.

China Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides & Disinfectants

- 1.2. Coagulants & Flocculants

- 1.3. Corrosion & Scale Inhibitors

- 1.4. Defoamer and Defoaming Agent

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. Application

- 2.1. Boiling Water Treatment

- 2.2. Cooling Water Treatment

- 2.3. Membrane Treatment

- 2.4. Green Water Treatment

- 2.5. Raw Water/Potable Water Preparation

- 2.6. Wastewater Treatment

-

3. End-user Industry

- 3.1. Commercial and Institutional

- 3.2. Power Generation

- 3.3. Chemical Manufacturing

- 3.4. Mining & Mineral Processing

- 3.5. Municipal

- 3.6. Other End-user Industries

China Water Treatment Chemicals Industry Segmentation By Geography

- 1. China

China Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of China Water Treatment Chemicals Industry

China Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers

- 3.4. Market Trends

- 3.4.1. Corrosion & Scale Inhibitors to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides & Disinfectants

- 5.1.2. Coagulants & Flocculants

- 5.1.3. Corrosion & Scale Inhibitors

- 5.1.4. Defoamer and Defoaming Agent

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Boiling Water Treatment

- 5.2.2. Cooling Water Treatment

- 5.2.3. Membrane Treatment

- 5.2.4. Green Water Treatment

- 5.2.5. Raw Water/Potable Water Preparation

- 5.2.6. Wastewater Treatment

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial and Institutional

- 5.3.2. Power Generation

- 5.3.3. Chemical Manufacturing

- 5.3.4. Mining & Mineral Processing

- 5.3.5. Municipal

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SNF (China) Flocculant Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecolab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solenis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lonza

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suez

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kemira Oyj

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dow

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wujin Fine Chemical Factory

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Veolia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kurita Water Industries Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SNF (China) Flocculant Co Ltd

List of Figures

- Figure 1: China Water Treatment Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: China Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: China Water Treatment Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: China Water Treatment Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: China Water Treatment Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: China Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: China Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Water Treatment Chemicals Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the China Water Treatment Chemicals Industry?

Key companies in the market include SNF (China) Flocculant Co Ltd, Ecolab, Solenis, Lonza, Suez, Kemira Oyj, Dow, Wujin Fine Chemical Factory, Veolia, Kurita Water Industries Ltd *List Not Exhaustive.

3. What are the main segments of the China Water Treatment Chemicals Industry?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers.

6. What are the notable trends driving market growth?

Corrosion & Scale Inhibitors to Dominate the market.

7. Are there any restraints impacting market growth?

Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers.

8. Can you provide examples of recent developments in the market?

November 2022: Ecolab, a US-based water treatment and purification solutions company, partnered with the Egyptian Government on the National Water Project to mitigate the country's water challenges. The collaboration between the Government and the company was planned for four years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the China Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence