Key Insights

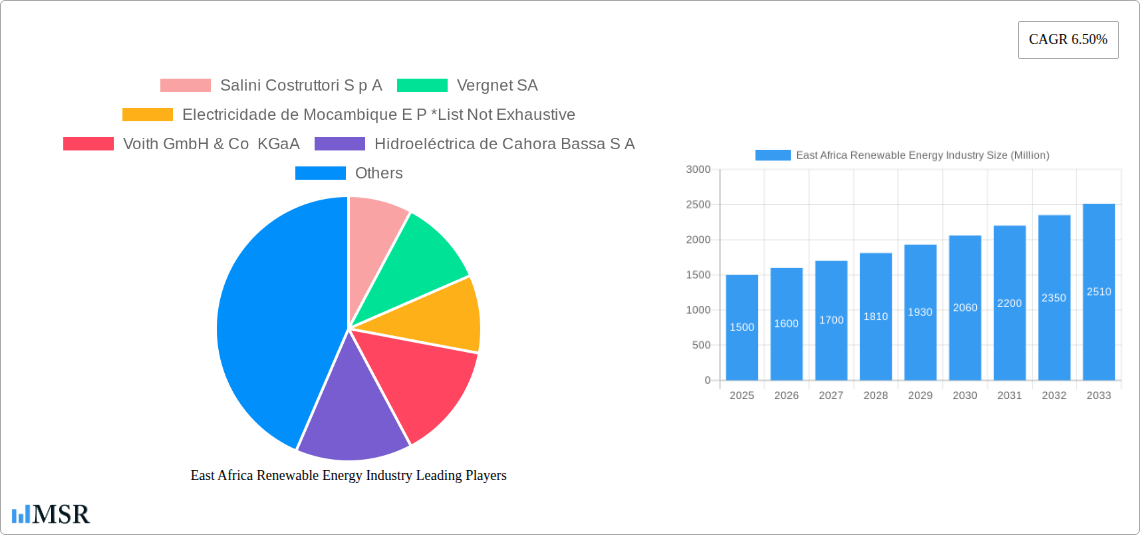

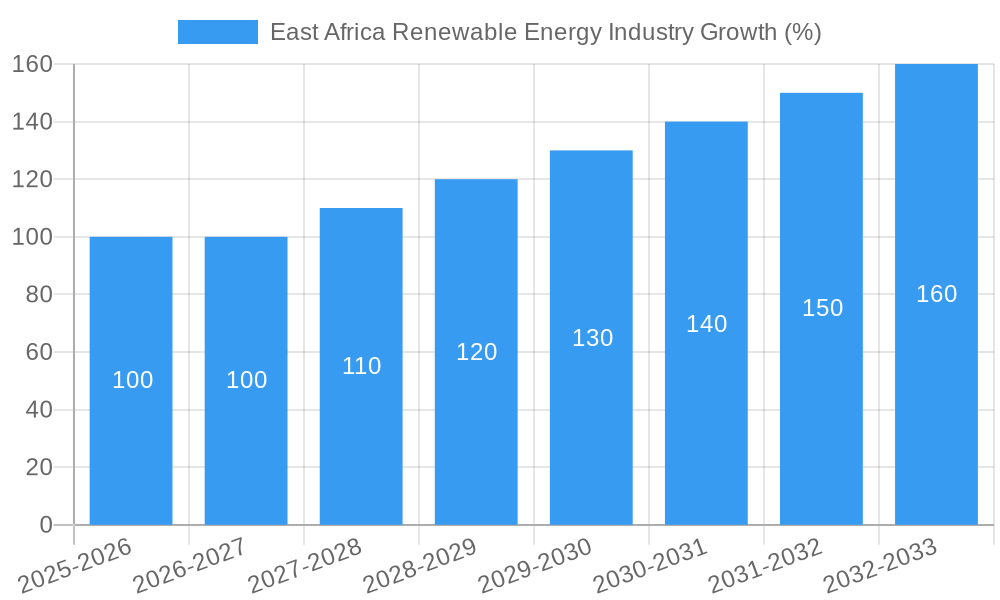

The East African renewable energy market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing energy demand from a rapidly growing population and expanding economies necessitates diversification beyond traditional fossil fuels. Government initiatives promoting renewable energy adoption through supportive policies, investment incentives, and grid infrastructure development are significantly boosting market penetration. Furthermore, the abundance of solar and wind resources across the region presents a compelling opportunity for large-scale renewable energy projects. Hydropower, while already established, continues to play a significant role, although its expansion may be subject to environmental concerns and regulatory hurdles. The market is segmented across various renewable energy sources, with hydropower, solar, and wind power dominating. Key players include both international companies and local players actively participating in project development, financing, and operation & maintenance.

However, challenges persist. The high initial investment costs associated with renewable energy projects, particularly large-scale installations, represent a significant barrier to entry for smaller players. Furthermore, inconsistent regulatory frameworks across different East African nations can lead to uncertainty and hinder investment. Limited grid infrastructure in certain areas also creates challenges in integrating renewable energy into the existing power systems. Addressing these challenges through improved regulatory environments, investment in grid infrastructure, and innovative financing mechanisms will be crucial in unleashing the full potential of the East African renewable energy market. The continued growth of the sector strongly hinges on overcoming these obstacles and realizing the substantial economic and environmental benefits of sustainable energy solutions.

East Africa Renewable Energy Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the East Africa renewable energy industry, offering crucial insights for investors, stakeholders, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, and future potential. The analysis encompasses key segments like hydropower, solar, wind, and others, highlighting leading players such as Salini Costruttori S p A, Vergnet SA, Voith GmbH & Co KGaA, Hidroeléctrica de Cahora Bassa S A, Eleqtra Inc, REDAVIA GmbH, and Kenya Electricity Generating Company PLC, and Electricidade de Mocambique E P.

East Africa Renewable Energy Industry Market Concentration & Dynamics

The East African renewable energy market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is witnessing increased participation from smaller independent power producers (IPPs) and international investors, fostering competition. Innovation is driven by a combination of government incentives, technological advancements, and the pressing need for energy security. The regulatory landscape is evolving, with various countries implementing policies to attract investments and streamline project approvals. Substitute products such as fossil fuels still present competition, but their impact is diminishing due to rising fuel costs and environmental concerns. End-user trends show a strong preference for reliable and affordable renewable energy solutions. M&A activity is increasing, with several deals in the recent past.

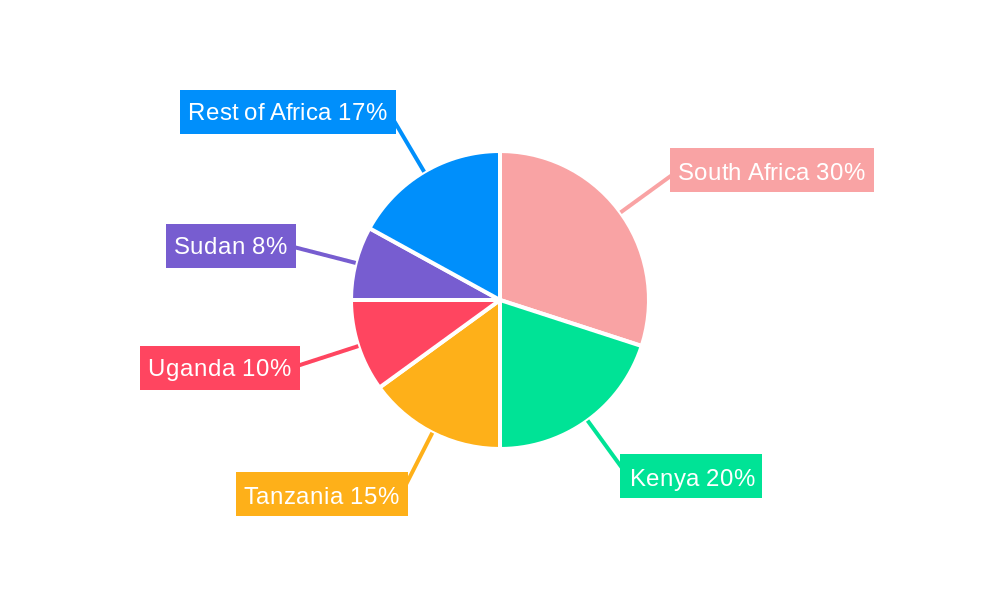

- Market Share: Kenya holds the largest market share (xx%), followed by Tanzania (xx%) and Ethiopia (xx%).

- M&A Deal Counts: An estimated xx M&A deals were recorded between 2019 and 2024.

East Africa Renewable Energy Industry Industry Insights & Trends

The East African renewable energy market is experiencing robust growth, driven by increasing energy demand, supportive government policies, and declining renewable energy technology costs. The market size in 2025 is estimated at $XX Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Technological disruptions, such as advancements in solar PV technology and improved energy storage solutions, are further accelerating market expansion. Shifting consumer behaviors, characterized by greater awareness of environmental sustainability and the desire for cleaner energy sources, are bolstering the adoption of renewable energy technologies. Government initiatives, including feed-in tariffs and tax incentives, are attracting significant investments into the sector. The increasing affordability of renewable energy, compared to traditional fossil fuel-based power generation, is playing a key role in driving market growth.

Key Markets & Segments Leading East Africa Renewable Energy Industry

Kenya, Tanzania, and Ethiopia are the leading markets for renewable energy in East Africa. Hydropower currently dominates the market, but solar and wind energy are witnessing rapid expansion.

Drivers of Dominance:

- Kenya: Strong government support, established infrastructure, and a relatively advanced electricity grid.

- Tanzania: Significant untapped renewable energy potential, particularly in solar and wind.

- Ethiopia: Large hydropower resources and government initiatives to diversify the energy mix.

Segment Analysis:

- Hydropower: Continues to be the leading segment, driven by existing large-scale hydropower projects. However, growth is expected to slow compared to solar and wind.

- Solar: Fastest-growing segment due to declining technology costs and ease of deployment. Significant growth potential in off-grid and decentralized solar power systems.

- Wind: Experiencing steady growth, with increasing investments in large-scale wind farms. Potential for significant expansion in coastal regions with high wind speeds.

- Others: Includes geothermal and biomass, with potential for growth in specific regions.

East Africa Renewable Energy Industry Product Developments

Recent product innovations include advancements in solar PV technology, leading to higher efficiency and lower costs. Improved battery storage solutions are addressing the intermittency challenge associated with solar and wind power. Smart grid technologies are enhancing grid stability and integrating renewable energy sources more efficiently. These advancements provide cost-competitive solutions to the region, boosting their market relevance.

Challenges in the East Africa Renewable Energy Industry Market

Significant challenges remain, including limited access to financing, inadequate grid infrastructure in many regions, and regulatory uncertainties. Supply chain disruptions and the high upfront capital costs of renewable energy projects pose considerable barriers. Furthermore, competition from cheaper fossil fuels, particularly in remote areas, continues to slow down adoption rates. The lack of skilled workforce in many areas also hampers the industry's development.

Forces Driving East Africa Renewable Energy Industry Growth

Technological advancements (e.g., more efficient solar panels), economic factors (e.g., decreasing costs of renewable energy technologies, increasing energy demand) and regulatory reforms (e.g., supportive government policies, feed-in tariffs) are key growth drivers. The rising global awareness of climate change and the increasing need for energy independence are also pushing the adoption of renewable energy sources in the region.

Long-Term Growth Catalysts in the East Africa Renewable Energy Industry

Long-term growth will be driven by innovative financing models, public-private partnerships, and regional cooperation on energy infrastructure development. Technological breakthroughs in energy storage and grid integration will be crucial. Expansion into new markets and leveraging the potential of mini-grids in rural areas will unlock further growth.

Emerging Opportunities in East Africa Renewable Energy Industry

Opportunities exist in developing off-grid renewable energy solutions for rural communities, implementing smart grid technologies, and expanding the use of hybrid renewable energy systems. The growing demand for energy storage solutions creates significant opportunities for investors. Furthermore, the exploration of untapped geothermal resources presents an exciting area for development.

Leading Players in the East Africa Renewable Energy Industry Sector

- Salini Costruttori S p A

- Vergnet SA

- Electricidade de Mocambique E P

- Voith GmbH & Co KGaA

- Hidroeléctrica de Cahora Bassa S A

- Eleqtra Inc

- REDAVIA GmbH

- Kenya Electricity Generating Company PLC

Key Milestones in East Africa Renewable Energy Industry Industry

- August 2022: Masdar's agreement with TANESCO to develop 2 GW of renewable energy capacity in Tanzania, demonstrating significant investment in the sector.

- May 2022: Rwanda's deal with Goldsol II to install a 10 MW solar power plant, showcasing the growing interest in smaller-scale renewable energy projects.

Strategic Outlook for East Africa Renewable Energy Industry Market

The East African renewable energy market possesses immense growth potential. Strategic partnerships, technological innovation, and conducive regulatory environments will be critical for unlocking this potential. Continued investment in grid infrastructure and workforce development are crucial for long-term sustainable growth. The market is poised for substantial expansion, driven by increasing energy demand and the region's commitment to cleaner energy.

East Africa Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Hydropower

- 1.2. Solar

- 1.3. Wind

- 1.4. Others

-

2. Geography

- 2.1. Tanzania

- 2.2. Uganda

- 2.3. Kenya

- 2.4. Rest of East Africa

East Africa Renewable Energy Industry Segmentation By Geography

- 1. Tanzania

- 2. Uganda

- 3. Kenya

- 4. Rest of East Africa

East Africa Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Emphasis on Renewable Energy Integration4.; Significant Hydropower Potential

- 3.3. Market Restrains

- 3.3.1. 4.; Competition From Other Energy Storage Technologies

- 3.4. Market Trends

- 3.4.1. Hydropower Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydropower

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Tanzania

- 5.2.2. Uganda

- 5.2.3. Kenya

- 5.2.4. Rest of East Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Tanzania

- 5.3.2. Uganda

- 5.3.3. Kenya

- 5.3.4. Rest of East Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Tanzania East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydropower

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Tanzania

- 6.2.2. Uganda

- 6.2.3. Kenya

- 6.2.4. Rest of East Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Uganda East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydropower

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Tanzania

- 7.2.2. Uganda

- 7.2.3. Kenya

- 7.2.4. Rest of East Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Kenya East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydropower

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Tanzania

- 8.2.2. Uganda

- 8.2.3. Kenya

- 8.2.4. Rest of East Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of East Africa East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydropower

- 9.1.2. Solar

- 9.1.3. Wind

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Tanzania

- 9.2.2. Uganda

- 9.2.3. Kenya

- 9.2.4. Rest of East Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Salini Costruttori S p A

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Vergnet SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Electricidade de Mocambique E P *List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Voith GmbH & Co KGaA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hidroeléctrica de Cahora Bassa S A

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Eleqtra Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 REDAVIA GmbH

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Kenya Electricity Generating Company PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Salini Costruttori S p A

List of Figures

- Figure 1: East Africa Renewable Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: East Africa Renewable Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: East Africa Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 5: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 7: East Africa Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: South Africa East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Sudan East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Uganda East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Tanzania East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Kenya East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 23: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 25: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 27: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 29: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 31: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 33: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 35: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 37: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 39: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 41: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 43: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 45: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Africa Renewable Energy Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the East Africa Renewable Energy Industry?

Key companies in the market include Salini Costruttori S p A, Vergnet SA, Electricidade de Mocambique E P *List Not Exhaustive, Voith GmbH & Co KGaA, Hidroeléctrica de Cahora Bassa S A, Eleqtra Inc, REDAVIA GmbH, Kenya Electricity Generating Company PLC.

3. What are the main segments of the East Africa Renewable Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Emphasis on Renewable Energy Integration4.; Significant Hydropower Potential.

6. What are the notable trends driving market growth?

Hydropower Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition From Other Energy Storage Technologies.

8. Can you provide examples of recent developments in the market?

August 2022: Masdar signed an agreement with TANESCO, a Tanzanian company, to develop a 2 GW renewable energy capacity. In this agreement, the project would be set in two phases; in the first phase of the collaboration, the company would generate approximately 600 MW; in the second phase, the total renewable capacity would reach 2,000 MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Africa Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Africa Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Africa Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the East Africa Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence