Key Insights

The green ammonia market is experiencing explosive growth, driven by the urgent need for decarbonization across various sectors. A CAGR of 68.23% from 2019-2033 signifies a rapid expansion, fueled primarily by the increasing demand for sustainable fertilizers, the burgeoning hydrogen economy, and stringent environmental regulations aiming to reduce greenhouse gas emissions. Key drivers include government incentives promoting renewable energy sources, advancements in electrolysis technology leading to more efficient and cost-effective green ammonia production, and growing investments from both public and private sectors. The market's segmentation likely includes production methods (e.g., electrolysis, natural gas reforming with carbon capture), applications (fertilizers, power generation, transportation fuel), and geographical regions. While challenges remain, such as the high initial capital investment required for green ammonia plants and the need for robust infrastructure development for ammonia storage and transportation, the long-term outlook remains exceptionally positive. The significant market size projection for 2025 (estimated based on the provided CAGR and extrapolation from 2019-2024) demonstrates substantial commercial interest and the potential for rapid scaling. Competition is intense among established players like Siemens Energy and Nel ASA, alongside emerging companies focusing on innovative production techniques and expanding market share.

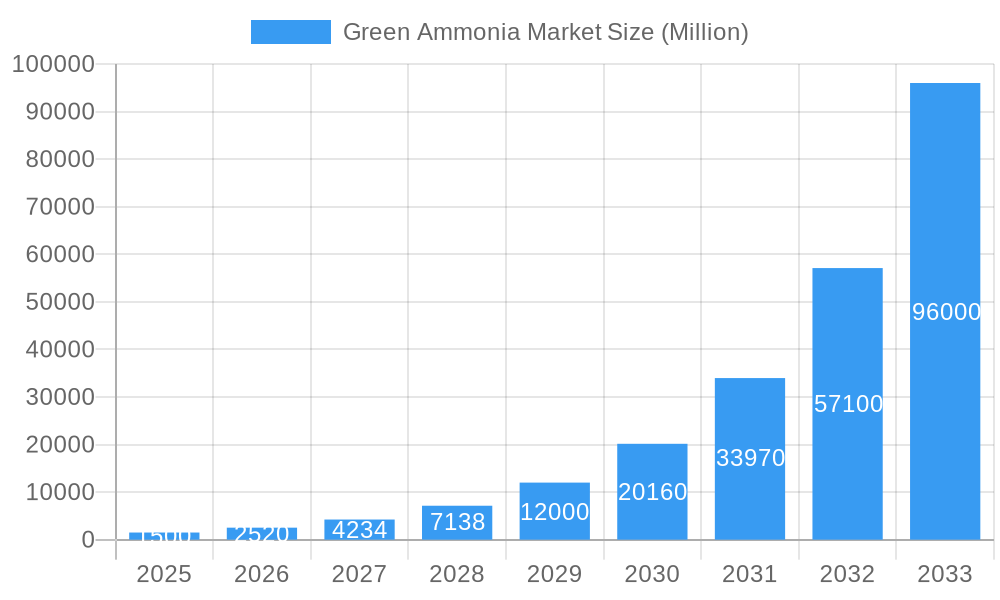

Green Ammonia Market Market Size (In Billion)

The market's trajectory is heavily reliant on continued technological advancements, particularly in lowering production costs and increasing efficiency. Successful large-scale deployment of renewable energy sources like solar and wind power, essential for powering green ammonia production, will be crucial. Furthermore, overcoming logistical hurdles related to ammonia storage, transportation, and distribution networks is vital for achieving widespread market penetration. Policy support from governments remains critical in fostering market growth by providing incentives, setting emission standards, and facilitating infrastructure development. Regional variations in market growth are likely influenced by the availability of renewable energy resources, governmental policies, and the existing industrial infrastructure. The companies listed represent a diversified landscape, encompassing both established energy players and specialized green ammonia producers, highlighting the sector's dynamic and competitive nature.

Green Ammonia Market Company Market Share

Green Ammonia Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Green Ammonia Market, encompassing market dynamics, industry trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report leverages data from the historical period (2019-2024) to provide a robust foundation for future projections. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Green Ammonia Market Concentration & Dynamics

The Green Ammonia market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, innovative companies indicates a dynamic and evolving competitive environment. Market share data for 2025 indicates that the top 5 players collectively hold approximately xx% of the market. Innovation ecosystems are thriving, driven by substantial R&D investments and a focus on improving production efficiency and reducing costs. Regulatory frameworks are increasingly supportive of green ammonia production, with governments worldwide implementing policies to incentivize renewable energy sources and reduce carbon emissions. Substitute products, such as traditional ammonia produced from fossil fuels, face growing pressure due to environmental concerns and stricter regulations. End-user trends are shifting towards the adoption of green ammonia in various sectors, including fertilizers, power generation, and transportation, fueled by the increasing demand for sustainable solutions. M&A activity is significant, with xx major deals recorded in the last five years. This signifies consolidation within the industry and the pursuit of synergies by larger corporations.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation: Focus on improving production efficiency and cost reduction.

- Regulatory Framework: Increasingly supportive of green ammonia production globally.

- Substitute Products: Traditional ammonia faces growing competition from environmentally friendly alternatives.

- End-User Trends: Growing demand from fertilizers, power, and transportation sectors.

- M&A Activity: xx major deals in the last five years indicate industry consolidation.

Green Ammonia Market Industry Insights & Trends

The Green Ammonia market is experiencing substantial growth, driven by increasing global demand for sustainable energy solutions and stringent environmental regulations. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033. Technological advancements in green hydrogen production, a key feedstock for green ammonia, are significantly accelerating market expansion. Evolving consumer behaviors, particularly among environmentally conscious consumers, are pushing for the adoption of green ammonia-based products. This demand is creating a positive feedback loop, stimulating further investment and innovation in the sector. The primary growth drivers include the increasing need for decarbonization across various industries, government support through subsidies and tax incentives, and the falling cost of renewable energy. The market's growth is primarily hindered by the high capital expenditure required for green ammonia production plants and the challenges associated with establishing a robust green hydrogen supply chain.

Key Markets & Segments Leading Green Ammonia Market

The Asia-Pacific region currently dominates the Green Ammonia market, driven by its large fertilizer industry and substantial investments in renewable energy infrastructure.

- Regional Dominance: Asia-Pacific is the leading region due to its significant fertilizer industry and renewable energy investments.

- Country-Specific Drivers:

- India: Growing demand for sustainable fertilizers and government support for renewable energy.

- China: Large-scale investments in green ammonia production facilities and expanding renewable energy capacity.

- Other regions: Europe and North America are also showing strong growth potential.

- Segment Analysis: The fertilizer segment is the largest end-use segment, followed by power generation and transportation.

This dominance is due to a combination of factors:

- Strong Economic Growth: Rapid industrialization and economic expansion in many Asian countries are driving demand.

- Favorable Government Policies: Several Asian governments are actively promoting the adoption of green ammonia through subsidies and incentives.

- Existing Infrastructure: The pre-existing infrastructure for ammonia production provides a base for transitioning to green alternatives.

Green Ammonia Market Product Developments

Significant advancements in electrolysis technology, crucial for green hydrogen production, are improving the efficiency and reducing the cost of green ammonia production. New catalysts and process optimization techniques are also enhancing overall production efficiency and reducing energy consumption. This technological progress improves the competitiveness of green ammonia compared to its traditional counterparts. Applications are expanding beyond fertilizers to encompass various sectors including power generation, fuel cells, and industrial feedstock.

Challenges in the Green Ammonia Market Market

The Green Ammonia market faces several challenges. High capital costs associated with green ammonia production facilities are a significant barrier to entry for smaller players. Furthermore, the development of reliable and cost-effective green hydrogen supply chains remains a crucial challenge, as it directly impacts the overall cost and scalability of green ammonia production. Stricter environmental regulations in some regions can also pose hurdles for manufacturers, though these are also catalysts driving adoption. The competitive landscape, with large established players and many emerging competitors, is another aspect to consider.

Forces Driving Green Ammonia Market Growth

Several factors propel the growth of the Green Ammonia market. The global push towards decarbonization and the urgent need to reduce greenhouse gas emissions are major drivers. Government policies supporting renewable energy and green technologies, alongside significant investments in renewable energy infrastructure, are further accelerating market expansion. Technological advancements in electrolysis and other related technologies also contribute significantly to cost reduction and efficiency improvements in green ammonia production.

Long-Term Growth Catalysts in Green Ammonia Market

Long-term growth in the green ammonia market will be fueled by continued innovation in production technologies, strategic partnerships between energy companies and ammonia producers, and the expansion of green ammonia into new markets, such as shipping and aviation fuels. The ongoing reduction in the cost of renewable energy and increased government incentives will further stimulate growth.

Emerging Opportunities in Green Ammonia Market

Emerging opportunities lie in the development of novel applications for green ammonia, including its use as a carbon-free fuel in various sectors. Expansion into new geographical markets and strategic collaborations between industry players are poised to unlock further growth potential. The development of efficient storage and transportation solutions will be vital in broadening the market's reach and impact.

Leading Players in the Green Ammonia Market Sector

- Casale SA

- EXYTRON GmbH

- Green Hydrogen Systems

- Greenko

- ITM Power PLC

- KAPSOM PLC

- MAN Energy Solutions

- McPhy Energy SA

- Nel ASA

- Siemens Energy

- Technip Energies NV

- thyssenkrupp Uhde GmbH

- Yara *List Not Exhaustive

Key Milestones in Green Ammonia Market Industry

- November 2023: Adani Power initiates a pilot project for green ammonia combustion, co-firing up to 20% green ammonia in a 330 MW unit. This signifies a significant step towards integrating green ammonia into existing power generation infrastructure.

- February 2023: Uniper and Greenko sign an agreement for the purchase of 250,000 tons of green ammonia annually, demonstrating the growing demand and commitment from major energy players.

- December 2022: OCP, a Moroccan state-owned company, announces a USD 13 billion investment for green ammonia production, aiming for 1 million tons by 2027 and 3 million tons by 2032. This highlights the substantial investment and commitment from governments and large corporations towards scaling up green ammonia production.

Strategic Outlook for Green Ammonia Market Market

The Green Ammonia market holds immense potential for future growth, driven by increasing global demand for sustainable energy solutions and proactive government policies. Strategic opportunities lie in developing cost-effective production technologies, strengthening supply chains, and exploring new applications across various sectors. Early adoption and strategic partnerships are key factors for success in this rapidly evolving market. The long-term outlook remains optimistic, with significant growth potential across multiple geographic regions and application sectors.

Green Ammonia Market Segmentation

-

1. Application

- 1.1. Fertilizers

- 1.2. Maritime/Shipping Fuel

- 1.3. Power Generation

- 1.4. Other Applications (Hydrogen Carrier, etc.)

Green Ammonia Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Green Ammonia Market Regional Market Share

Geographic Coverage of Green Ammonia Market

Green Ammonia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Agricultural Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fertilizers

- 5.1.2. Maritime/Shipping Fuel

- 5.1.3. Power Generation

- 5.1.4. Other Applications (Hydrogen Carrier, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fertilizers

- 6.1.2. Maritime/Shipping Fuel

- 6.1.3. Power Generation

- 6.1.4. Other Applications (Hydrogen Carrier, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fertilizers

- 7.1.2. Maritime/Shipping Fuel

- 7.1.3. Power Generation

- 7.1.4. Other Applications (Hydrogen Carrier, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fertilizers

- 8.1.2. Maritime/Shipping Fuel

- 8.1.3. Power Generation

- 8.1.4. Other Applications (Hydrogen Carrier, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fertilizers

- 9.1.2. Maritime/Shipping Fuel

- 9.1.3. Power Generation

- 9.1.4. Other Applications (Hydrogen Carrier, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Casale SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EXYTRON GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Green Hydrogen Systems

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Greenko

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ITM Power PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KAPSOM PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MAN Energy Solutions

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 McPhy Energy SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nel ASA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Siemens Energy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Technip Energies NV

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 thyssenkrupp Uhde GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Yara*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Casale SA

List of Figures

- Figure 1: Global Green Ammonia Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Rest of the World Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Green Ammonia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Green Ammonia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 6: China Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: India Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Japan Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: South Korea Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of Asia Pacific Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: France Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Italy Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Middle East and Africa Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Ammonia Market?

The projected CAGR is approximately 32%.

2. Which companies are prominent players in the Green Ammonia Market?

Key companies in the market include Casale SA, EXYTRON GmbH, Green Hydrogen Systems, Greenko, ITM Power PLC, KAPSOM PLC, MAN Energy Solutions, McPhy Energy SA, Nel ASA, Siemens Energy, Technip Energies NV, thyssenkrupp Uhde GmbH, Yara*List Not Exhaustive.

3. What are the main segments of the Green Ammonia Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers.

6. What are the notable trends driving market growth?

Growing Agricultural Production.

7. Are there any restraints impacting market growth?

Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers.

8. Can you provide examples of recent developments in the market?

November 2023: Adani Power, as part of its decarbonization initiatives, started a pilot project for green ammonia combustion that will co-fire up to 20% green ammonia in its coal-fired 330 MW Unit at the Mundra plant in Gujarat, India.February 2023: Uniper and Greenko signed an agreement for the purchase of 250,000 tons of green ammonia per annum from Greenko’s Kakinada green ammonia project.December 2022: Moroccan state-owned company OCP announced an investment of USD 13 billion for its Green Investment Strategy for 2023-2027, as part of which the company aims to produce 1 million tons of green ammonia by 2027 and will triple it to 3 million tons by 2032.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Ammonia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Ammonia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Ammonia Market?

To stay informed about further developments, trends, and reports in the Green Ammonia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence