Key Insights

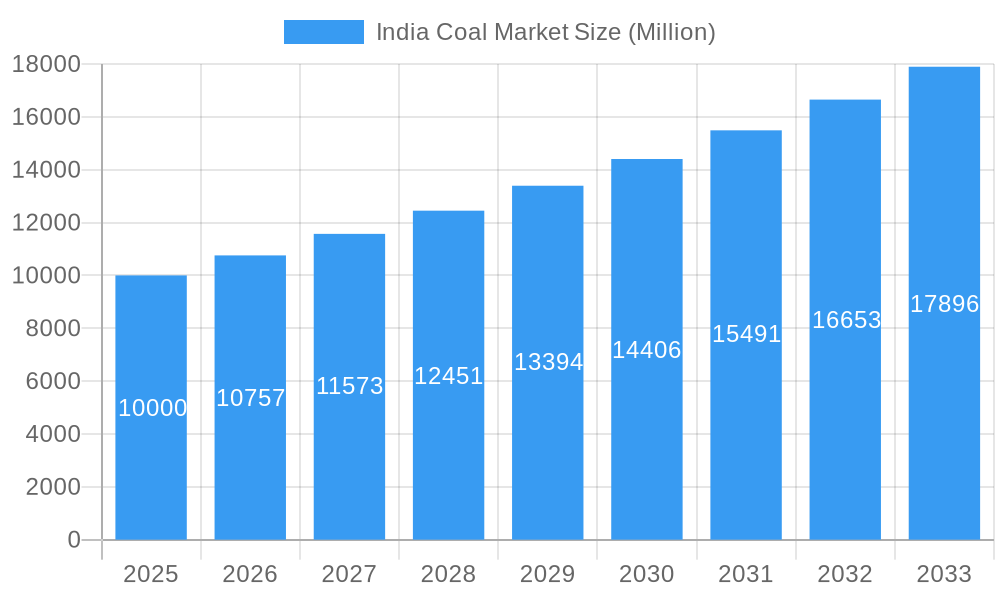

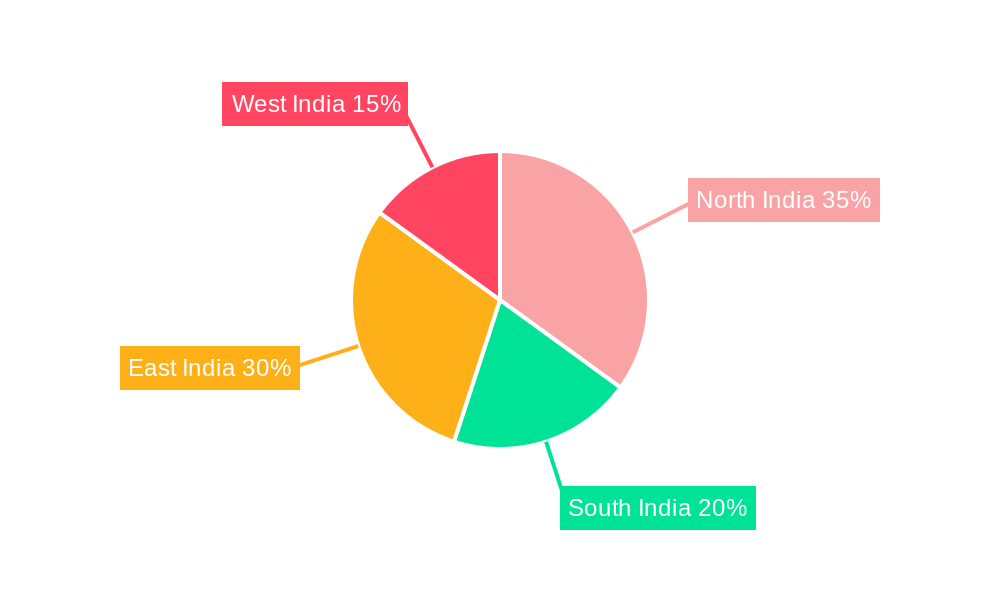

The Indian coal market, projected at 1.04 billion in 2025, is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.57% from 2025 to 2033. This growth is driven by escalating energy demands from India's expanding industrial sector, particularly in power generation (thermal coal) and steel production (coking coal). Government-led infrastructure development and economic expansion initiatives are further propelling market growth. Despite environmental considerations and the global shift towards renewables, coal's role in baseload power generation ensures its continued market importance. The market is segmented by application, with power generation and coking feedstock being the primary segments, followed by other niche applications. Major contributors to market dynamics include Coal India Limited, NTPC Ltd, Adani Power Ltd, and JSW Energy Limited, leveraging their extensive production and distribution capabilities. Regional demand is concentrated in North and East India, attributed to established industrial centers and power infrastructure.

India Coal Market Market Size (In Billion)

The forecast period (2025-2033) indicates sustained market expansion, subject to potential policy shifts in coal mining and environmental regulations. Detailed regional analysis across North, South, East, and West India is essential for identifying localized market trends and opportunities. Understanding these regional specificities is vital for effective market entry and strategic development within the Indian coal industry. Comprehensive data analysis is recommended for precise market sizing and refined forecasting, especially regarding the 2025 market valuation. In-depth competitive landscape analysis of leading players' strategies will offer critical insights into market dynamics and future prospects.

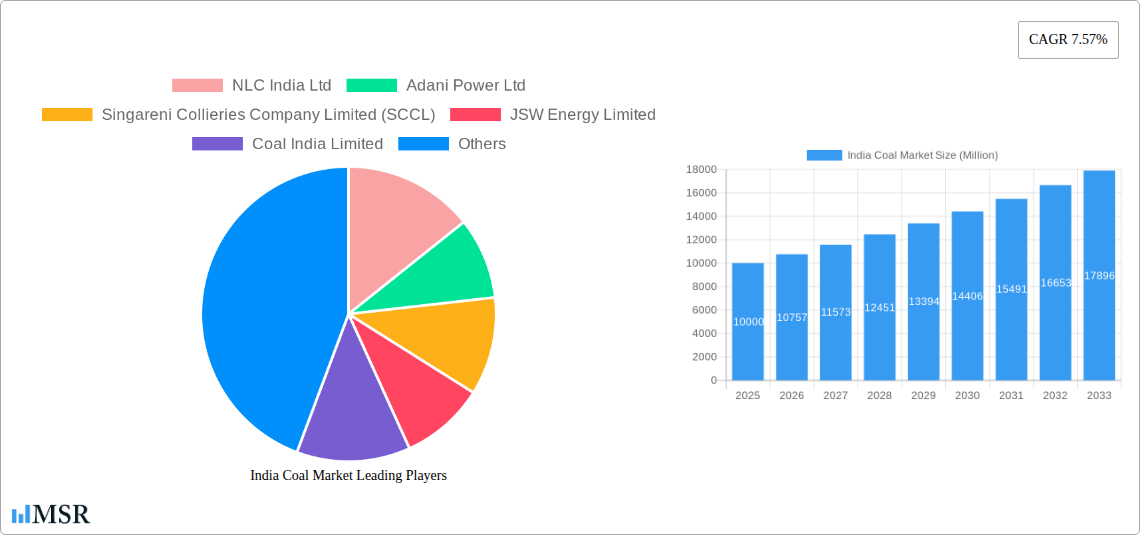

India Coal Market Company Market Share

India Coal Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Coal Market, covering market dynamics, industry trends, key players, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report offers crucial insights for industry stakeholders, investors, and strategic decision-makers seeking a clear understanding of this vital sector. This report includes detailed analysis of the market size, CAGR, market share, M&A activities and much more.

India Coal Market Market Concentration & Dynamics

The Indian coal market exhibits a moderately concentrated structure, dominated by a few large players like Coal India Limited, Coal India Limited, NTPC Ltd, and Adani Power Ltd. However, the market is also characterized by a competitive landscape with several mid-sized and smaller companies vying for market share. Coal India Limited, with a xx% market share in 2024, holds the leading position. The market concentration ratio (CR4) for 2024 is estimated at xx%.

Innovation in the sector is primarily driven by efficiency improvements in mining techniques, coal beneficiation, and cleaner combustion technologies. The regulatory framework, primarily governed by the Ministry of Coal, is undergoing evolution to balance energy security needs with environmental concerns. Key regulations focus on mine safety, environmental protection, and sustainable mining practices. Substitute products, such as renewable energy sources (solar, wind), are gaining traction, putting pressure on coal demand.

End-user trends indicate a continued reliance on coal for power generation, particularly in thermal power plants. However, the increasing emphasis on cleaner energy sources is influencing demand dynamics. M&A activity in the coal sector has been moderate in recent years, with xx major deals recorded between 2019 and 2024. These deals primarily focused on consolidation, expansion of mining operations, and securing coal supply chains.

India Coal Market Industry Insights & Trends

The Indian coal market is projected to witness significant growth over the forecast period (2025-2033). The market size was valued at xx Million USD in 2024 and is anticipated to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is propelled by several factors: the persistent demand for electricity from a rapidly growing economy, increasing industrialization, and expanding infrastructure projects. However, challenges remain, including environmental concerns and government initiatives promoting renewable energy sources.

Technological advancements in coal mining and utilization are impacting market dynamics. Automated mining techniques and improved beneficiation processes are enhancing efficiency and reducing operational costs. The adoption of cleaner coal technologies and carbon capture utilization and storage (CCUS) are also influencing the sector's sustainability efforts. Furthermore, evolving consumer behaviors, driven by increasing awareness of environmental issues, are creating pressure for cleaner energy alternatives.

Key Markets & Segments Leading India Coal Market

The power generation segment, particularly thermal coal, dominates the Indian coal market, accounting for approximately xx% of total consumption in 2024.

Drivers for Power Generation (Thermal Coal):

- Rapid economic growth and rising electricity demand.

- Expansion of the thermal power plant capacity.

- Government support for infrastructure development.

Dominance Analysis:

The dominance of the power generation segment is primarily due to the significant role of coal in India's energy mix. Despite the growing importance of renewable energy sources, coal remains the backbone of electricity generation. This segment is expected to continue its dominance during the forecast period. However, the growth rate may moderate slightly due to the increasing adoption of renewable energy and government policies promoting a shift towards cleaner energy sources. The coking coal segment, primarily used in the steel industry, also constitutes a significant portion of the market, with xx% of total consumption in 2024, and is driven by the expansion of the steel industry and rising infrastructure development. The "others" segment includes coal used for various industrial and domestic applications, which accounts for xx% in 2024.

India Coal Market Product Developments

Recent product innovations focus on enhancing coal quality through advanced beneficiation techniques and developing cleaner combustion technologies to minimize environmental impact. These advancements aim to improve the efficiency and sustainability of coal utilization. The development of superior coking coal varieties to improve the quality of steel production is also crucial.

Challenges in the India Coal Market Market

The India Coal Market faces several challenges, including stringent environmental regulations, resulting in increased compliance costs, and supply chain disruptions due to infrastructure limitations. Moreover, the growing competitiveness from renewable energy sources puts significant pressure on coal demand. These factors collectively impact the profitability and sustainability of coal operations.

Forces Driving India Coal Market Growth

Key growth drivers include India's robust economic growth, leading to increased energy demand, and significant government investments in infrastructure projects, which increase coal consumption. Furthermore, technological advancements in coal mining and utilization efficiency contribute to sustainable growth in the market.

Long-Term Growth Catalysts in the India Coal Market

Long-term growth in the India Coal Market will be driven by continued investment in efficient coal mining technologies, strategic partnerships between coal producers and power generation companies, and expansion into new markets. Focus on environmental improvements and exploration for new coal reserves will also drive long-term growth.

Emerging Opportunities in India Coal Market

Emerging opportunities lie in the development of advanced coal gasification technologies for cleaner energy production and the exploration of carbon capture and storage (CCS) solutions to reduce greenhouse gas emissions. Furthermore, improved coal beneficiation techniques to enhance quality and reduce waste will also create opportunities.

Leading Players in the India Coal Market Sector

- NLC India Ltd

- Adani Power Ltd

- Singareni Collieries Company Limited (SCCL)

- JSW Energy Limited

- Coal India Limited

- Jindal Steel & Power Ltd

- NTPC Ltd

Key Milestones in India Coal Market Industry

- February 2023: The 2600 megawatt Singareni Thermal Power Plant (STPP) in Telangana becomes operational, marking a significant expansion in South India's coal-based power generation capacity.

- November 2022: NTPC Ltd. secures contracts for four additional coal-fired power projects, totaling 4.8 GW, demonstrating continued investment in coal-based energy.

Strategic Outlook for India Coal Market Market

The India Coal Market is poised for continued growth, albeit at a potentially moderated pace due to the increasing emphasis on renewable energy. Strategic opportunities for companies lie in focusing on efficiency improvements, adopting sustainable practices, and exploring collaborations to develop and implement cleaner coal technologies. The market's future will depend on the balancing act between meeting energy demands and addressing environmental concerns.

India Coal Market Segmentation

-

1. Application

- 1.1. Power Generation (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

India Coal Market Segmentation By Geography

- 1. India

India Coal Market Regional Market Share

Geographic Coverage of India Coal Market

India Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Thermal Power Generation is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NLC India Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Singareni Collieries Company Limited (SCCL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSW Energy Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coal India Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jindal Steel & Power Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NTPC Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NLC India Ltd

List of Figures

- Figure 1: India Coal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Coal Market Share (%) by Company 2025

List of Tables

- Table 1: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: India Coal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Coal Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Coal Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Coal Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Coal Market?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the India Coal Market?

Key companies in the market include NLC India Ltd, Adani Power Ltd, Singareni Collieries Company Limited (SCCL), JSW Energy Limited, Coal India Limited, Jindal Steel & Power Ltd, NTPC Ltd.

3. What are the main segments of the India Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Increasing Thermal Power Generation is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023, the 2600 megawatt Singareni Thermal Power Plant (STPP) at Pegadapalli in Mancherial district is all set to become South India's first public sector coal-based power generating station and the country's first among State Public Sector Undertakings (PSU).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Coal Market?

To stay informed about further developments, trends, and reports in the India Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence