Key Insights

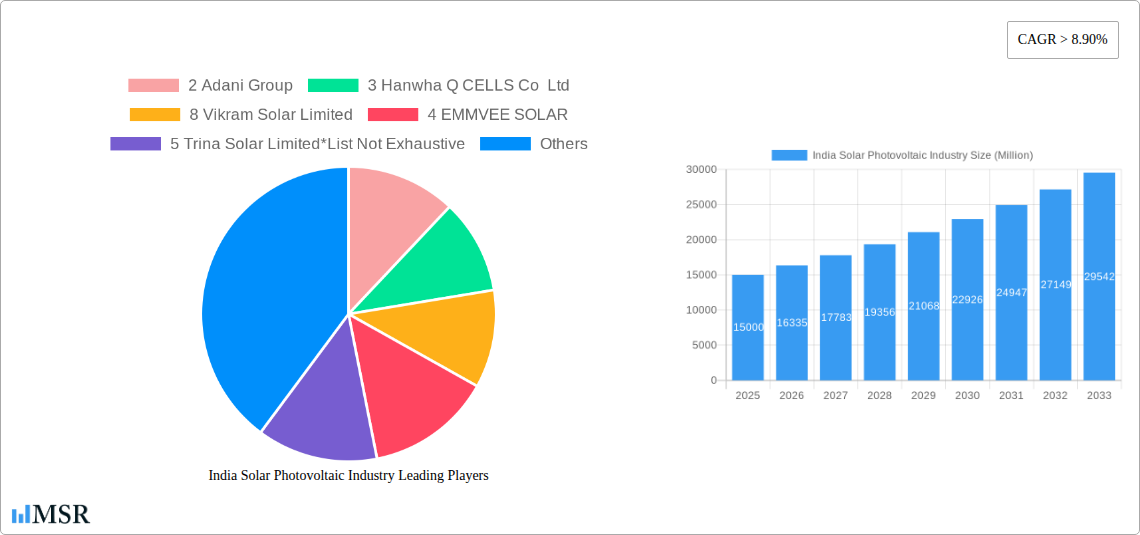

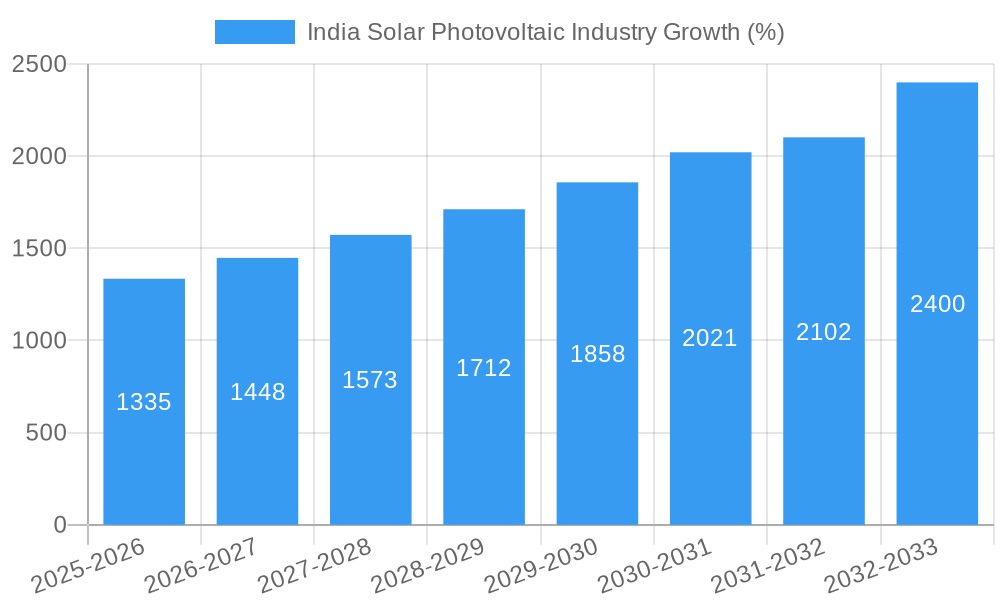

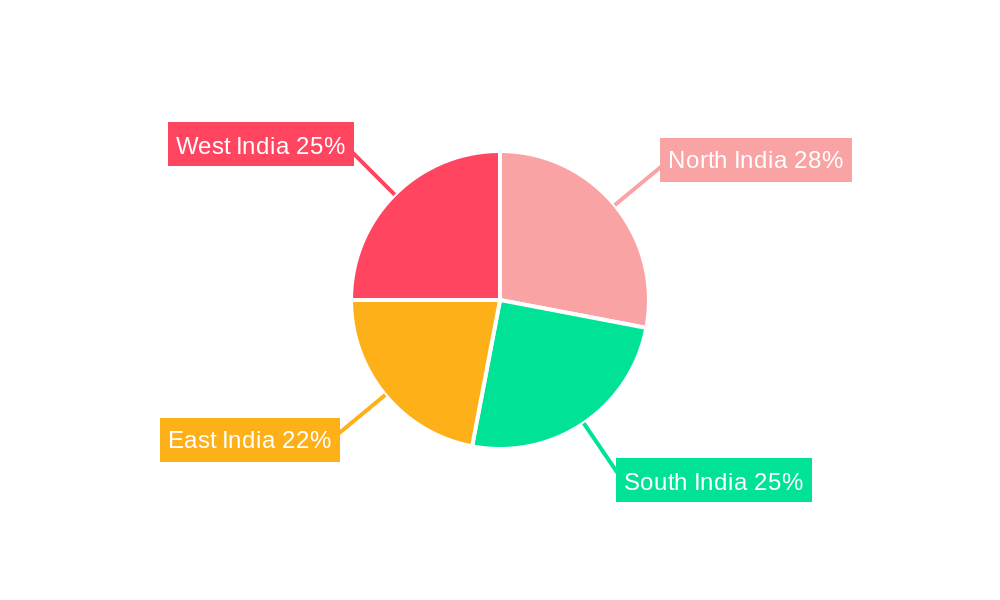

The India solar photovoltaic (PV) industry is experiencing robust growth, driven by supportive government policies aimed at increasing renewable energy adoption, decreasing solar panel costs, and rising energy demands. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of >8.90% and a known 2019-2024 historical period), is projected to maintain a significant Compound Annual Growth Rate (CAGR) exceeding 8.90% through 2033. This expansion is fueled by several factors: a substantial increase in large-scale solar power projects, particularly in the utility segment; growing adoption of rooftop solar systems in residential and commercial sectors; and continuous technological advancements leading to higher efficiency and lower costs for solar panels. Key market segments include thin-film and crystalline silicon PV technologies, with crystalline silicon dominating the market share due to its established technology and cost-effectiveness. The geographical distribution is diverse, with growth observed across North, South, East, and West India, although specific regional variations may exist based on policy support and infrastructure availability. Leading players in the Indian solar PV market include both domestic giants like Adani Group, Tata Power Solar, and Mahindra Susten, and international corporations such as First Solar, ABB, and Trina Solar. Competitive intensity is expected to remain high, driven by new entrants and ongoing technological innovations.

The growth trajectory of the Indian solar PV market is further influenced by several trends. The increasing focus on energy independence and sustainability is boosting demand. Government initiatives promoting solar energy through subsidies and tax incentives are accelerating market penetration. Furthermore, the declining cost of solar energy, coupled with improved storage solutions, is making it increasingly competitive with traditional energy sources. Despite these positive factors, challenges remain, including grid integration issues, land acquisition complexities, and financing hurdles for large-scale projects. These restraints, however, are unlikely to significantly deter the overall positive growth trend predicted for the next decade. The continuous improvement in technology and the consistent government support will be crucial drivers in shaping the industry's future trajectory.

India Solar Photovoltaic Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the booming India solar photovoltaic (PV) industry, offering crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report presents a robust overview of market dynamics, key players, and future growth opportunities. The report leverages extensive data analysis to predict a market size of xx Million by 2033, showcasing a significant Compound Annual Growth Rate (CAGR) of xx%.

India Solar Photovoltaic Industry Market Concentration & Dynamics

The Indian solar PV market exhibits a dynamic interplay of domestic and international players, with increasing market concentration among leading companies. Adani Group, Hanwha Q CELLS Co Ltd, Vikram Solar Limited, EMMVEE SOLAR, Trina Solar Limited, Sterling And Wilson Pvt Ltd, Tata Power Solar Systems Ltd, and Mahindra Susten Pvt Ltd represent significant domestic players. Foreign players include First Solar Inc, ABB, ACME Solar, Azure Power Global Limited, and SMA Solar Technology AG. While precise market share data fluctuates, Adani Group and Tata Power Solar Systems Ltd consistently hold prominent positions.

- Market Concentration: The market is gradually consolidating, with larger players acquiring smaller companies and expanding their market share. The number of M&A deals in the sector has seen an increase in recent years with xx deals recorded in 2024.

- Innovation Ecosystems: India boasts a burgeoning ecosystem of startups and research institutions focusing on solar PV technology advancements, driving innovation in areas like thin-film solar cells and improved energy storage solutions.

- Regulatory Frameworks: Government initiatives such as the Jawaharlal Nehru National Solar Mission (JNNSM) and Production-Linked Incentive (PLI) schemes have significantly influenced market growth by promoting domestic manufacturing and reducing reliance on imports. However, regulatory hurdles and bureaucratic processes continue to pose challenges.

- Substitute Products: While solar PV enjoys a dominant position, competitive pressures exist from other renewable energy sources like wind power and hydropower. The cost-competitiveness of solar PV, however, remains a significant advantage.

- End-User Trends: The residential sector is experiencing robust growth, driven by decreasing solar PV system costs and government incentives. The C&I and utility sectors also display significant potential, especially for large-scale projects.

- M&A Activities: The increase in M&A activity signifies strategic positioning by larger players aiming to increase market share and technological capabilities.

India Solar Photovoltaic Industry Industry Insights & Trends

The Indian solar PV market is experiencing exponential growth, propelled by increasing energy demand, favorable government policies, and decreasing solar PV system costs. The market size is projected to reach xx Million by 2025 and xx Million by 2033. This growth is fueled by several factors. Technological advancements, such as improved cell efficiency and reduced manufacturing costs, contribute significantly. Furthermore, consumer behavior shifts towards adopting renewable energy solutions due to environmental awareness and cost savings are also major drivers. The country's ambitious renewable energy targets, aiming to achieve xx% of electricity from renewable sources by 2030, significantly boosts market expansion. The CAGR during the forecast period (2025-2033) is estimated to be xx%. However, challenges such as land acquisition, grid infrastructure limitations, and financing constraints need to be addressed for sustainable market growth.

Key Markets & Segments Leading India Solar Photovoltaic Industry

Crystalline silicon technology currently dominates the Indian solar PV market, holding a significantly larger share than thin-film technology. This is primarily due to its higher efficiency and lower cost. The utility segment, particularly large-scale ground-mounted solar farms, is the largest end-user segment. The residential and C&I sectors are also experiencing rapid growth, driven by government support and decreasing installation costs.

- By Type: Crystalline Silicon dominates, Thin film exhibits growth potential but faces challenges in competing with crystalline silicon's cost-effectiveness and efficiency.

- By End-User:

- Utility: Largest segment due to large-scale projects and government support.

- Commercial and Industrial (C&I): Rapid growth driven by cost savings and environmental consciousness.

- Residential: Significant growth fueled by decreasing costs and government incentives.

- By Deployment:

- Ground-mounted: Largest deployment type due to economies of scale.

- Rooftop-Solar: Growing rapidly, especially in the residential and C&I segments.

Drivers:

- Economic growth driving increased energy demand.

- Government policies and incentives promoting renewable energy adoption.

- Decreasing solar PV system costs making it increasingly competitive.

- Increasing environmental awareness among consumers and businesses.

- Development of robust grid infrastructure in several regions.

India Solar Photovoltaic Industry Product Developments

The Indian solar PV industry is witnessing significant technological advancements, focusing on improving cell efficiency, reducing manufacturing costs, and enhancing energy storage solutions. Innovations in bifacial solar panels, which capture sunlight from both sides, are increasing energy generation. Advanced tracking systems optimize solar panel orientation throughout the day to maximize energy output. The integration of battery energy storage systems (BESS) is also gaining traction, addressing the intermittency of solar energy generation. These developments are shaping the competitive landscape, creating new market opportunities for manufacturers and installers.

Challenges in the India Solar Photovoltaic Industry Market

The Indian solar PV market faces several challenges, including land acquisition complexities, regulatory hurdles, and grid integration constraints, leading to project delays and cost overruns. The intermittent nature of solar energy necessitates investments in energy storage solutions, adding to project costs. Fluctuations in raw material prices and supply chain disruptions can impact manufacturing costs and profitability. Furthermore, intense competition among manufacturers and installers requires businesses to adopt efficient strategies to remain competitive. These issues collectively represent a restraint on the rate of expansion.

Forces Driving India Solar Photovoltaic Industry Growth

The Indian solar PV industry's growth is driven by a confluence of technological advancements, supportive government policies, and increasing energy demand. Government initiatives like the JNNSM and PLI schemes have significantly incentivized domestic manufacturing and deployment. Technological improvements have reduced solar PV system costs, making it more affordable. The growing awareness of climate change and the need for sustainable energy sources has also contributed to the industry's expansion. These factors collectively create a positive environment for continued growth.

Long-Term Growth Catalysts in the India Solar Photovoltaic Industry

Long-term growth in the Indian solar PV sector hinges on sustained innovation, strategic partnerships, and expansion into new markets. The development of more efficient solar cells, improved energy storage solutions, and smart grid technologies will be crucial for enhancing the sector's competitiveness and reliability. Collaborations between domestic and international players can leverage technological expertise and financial resources to drive innovation and accelerate market growth. Expanding into rural areas and underserved regions will unlock significant untapped potential.

Emerging Opportunities in India Solar Photovoltaic Industry

The Indian solar PV market presents numerous opportunities. The increasing adoption of rooftop solar systems in both residential and commercial sectors provides significant potential for growth. The integration of solar PV with other renewable energy sources, such as wind and biomass, offers opportunities for hybrid energy solutions. Furthermore, the growing demand for energy storage solutions creates a promising market for battery technologies. Exploring off-grid solar solutions for rural electrification can unlock further expansion opportunities.

Leading Players in the India Solar Photovoltaic Industry Sector

- Adani Group

- Hanwha Q CELLS Co Ltd

- Vikram Solar Limited

- EMMVEE SOLAR

- Trina Solar Limited

- Sterling And Wilson Pvt Ltd

- Tata Power Solar Systems Ltd

- Mahindra Susten Pvt Ltd

- First Solar Inc

- ABB

- ACME Solar

- Azure Power Global Limited

- SMA Solar Technology AG

Key Milestones in India Solar Photovoltaic Industry Industry

- January 2022: SJVN secures a 125MW solar project in Uttar Pradesh, comprising 75MW in Jalaun and 50MW in Kanpur Dehat. This highlights the growing interest in large-scale solar projects.

- December 2021: Tata Power wins India's largest solar plus battery project (100MW solar, 120MWh BESS) from SECI, demonstrating the increasing adoption of energy storage solutions.

Strategic Outlook for India Solar Photovoltaic Industry Market

The Indian solar PV market is poised for sustained growth, driven by favorable government policies, technological advancements, and increasing energy demand. Strategic opportunities lie in expanding into new markets, developing innovative products, and forging strategic partnerships. Companies that can navigate the challenges of land acquisition, grid integration, and financing will be best positioned to capitalize on the immense growth potential of the Indian solar PV sector. Focus on technological innovation and efficient project management will be crucial for success in this rapidly evolving market.

India Solar Photovoltaic Industry Segmentation

-

1. Type

- 1.1. Thin film

- 1.2. Crystalline Silicon

-

2. End-User

- 2.1. Residential

- 2.2. Commercial and Indudstrial (C&I)

- 2.3. Utility

-

3. Deployment

- 3.1. Ground-mounted

- 3.2. Rooftop-Solar

India Solar Photovoltaic Industry Segmentation By Geography

- 1. India

India Solar Photovoltaic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology

- 3.3. Market Restrains

- 3.3.1. 4.; Unpredictability in the Continuity of Power Supply

- 3.4. Market Trends

- 3.4.1. Rooftop Solar PV Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Photovoltaic Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Thin film

- 5.1.2. Crystalline Silicon

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial and Indudstrial (C&I)

- 5.2.3. Utility

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Ground-mounted

- 5.3.2. Rooftop-Solar

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Solar Photovoltaic Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Solar Photovoltaic Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Solar Photovoltaic Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Solar Photovoltaic Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 2 Adani Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 3 Hanwha Q CELLS Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 8 Vikram Solar Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 4 EMMVEE SOLAR

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 5 Trina Solar Limited*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Domestic Players

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 6 Sterling And Wilson Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 7 Tata Power Solar Systems Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 5 Mahindra Susten Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Foreign Players

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 2 First Solar Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 1 ABB

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 1 ACME Solar

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 3 Azure Power Global Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 SMA Solar Technology AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 2 Adani Group

List of Figures

- Figure 1: India Solar Photovoltaic Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Solar Photovoltaic Industry Share (%) by Company 2024

List of Tables

- Table 1: India Solar Photovoltaic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Solar Photovoltaic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Solar Photovoltaic Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: India Solar Photovoltaic Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 5: India Solar Photovoltaic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Solar Photovoltaic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Solar Photovoltaic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Solar Photovoltaic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Solar Photovoltaic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Solar Photovoltaic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Solar Photovoltaic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Solar Photovoltaic Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 13: India Solar Photovoltaic Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: India Solar Photovoltaic Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Photovoltaic Industry?

The projected CAGR is approximately > 8.90%.

2. Which companies are prominent players in the India Solar Photovoltaic Industry?

Key companies in the market include 2 Adani Group, 3 Hanwha Q CELLS Co Ltd, 8 Vikram Solar Limited, 4 EMMVEE SOLAR, 5 Trina Solar Limited*List Not Exhaustive, Domestic Players, 6 Sterling And Wilson Pvt Ltd, 7 Tata Power Solar Systems Ltd, 5 Mahindra Susten Pvt Ltd, Foreign Players, 2 First Solar Inc, 1 ABB, 1 ACME Solar, 3 Azure Power Global Limited, 4 SMA Solar Technology AG.

3. What are the main segments of the India Solar Photovoltaic Industry?

The market segments include Type, End-User, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology.

6. What are the notable trends driving market growth?

Rooftop Solar PV Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Unpredictability in the Continuity of Power Supply.

8. Can you provide examples of recent developments in the market?

In January 2022, SJVN (Satluj Jal Vidyut Nigam Ltd.) bagged a solar project of 125MW in Uttar Pradesh, through a bidding process held by Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA). It includes a 75MW grid-connected solar PV project in Jalaun and a 50MW solar project in Kanpur Dehat districts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Photovoltaic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Photovoltaic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Photovoltaic Industry?

To stay informed about further developments, trends, and reports in the India Solar Photovoltaic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence