Key Insights

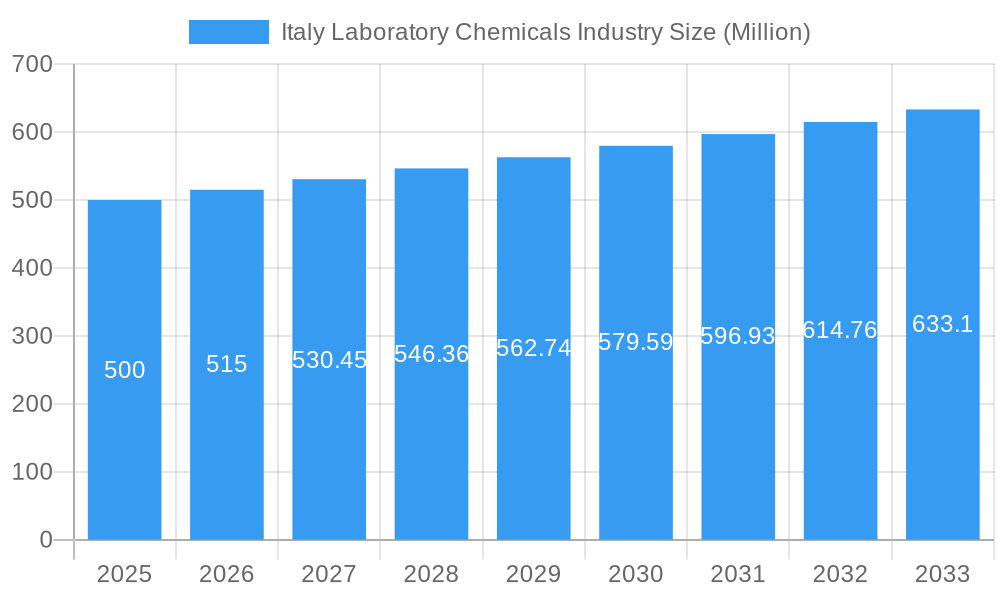

The Italian laboratory chemicals market is projected to experience substantial growth, driven by escalating R&D investments in pharmaceuticals and biotechnology, expanding academic research, and a rising demand for advanced diagnostic solutions. Key industry players, alongside a growing emphasis on precision medicine and personalized healthcare, further bolster this expansion. While stringent regulations and competitive pricing present challenges, the market is set for continued development. The market is expected to reach a size of 4.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.69% from 2025 to 2033.

Italy Laboratory Chemicals Industry Market Size (In Billion)

Reagents and solvents are anticipated to dominate market segments due to their widespread laboratory applications. The pharmaceutical and biotechnology sectors are likely to remain the largest consumers, reflecting their significant R&D expenditures. Technological advancements in automation and high-throughput screening, coupled with the development of novel chemical compounds, will be pivotal for future market success. Northern Italian regions, housing prominent research institutions and pharmaceutical firms, are expected to command a larger market share. Continuous investment in healthcare infrastructure and laboratory technology across Italy will support sustained market growth. The competitive landscape features a blend of multinational corporations and specialized firms, offering opportunities for diverse market strategies.

Italy Laboratory Chemicals Industry Company Market Share

Italy Laboratory Chemicals Industry: Market Analysis & Growth Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Italy laboratory chemicals industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, key players, and future growth potential, this report covers the period from 2019 to 2033, with a base year of 2025. The report utilizes rigorous data analysis and industry expertise to provide actionable intelligence on this dynamic market. The Italian laboratory chemicals market is poised for significant growth, driven by technological advancements, increasing research and development activities, and expanding healthcare infrastructure. This report helps you understand the landscape and capitalize on emerging opportunities.

Italy Laboratory Chemicals Industry Market Concentration & Dynamics

The Italian laboratory chemicals market exhibits a moderately concentrated structure, with several multinational corporations and domestic players vying for market share. Major players like BD (Becton Dickinson and Company), BIOMÉRIEUX, BiosYnth s r l, FUJIFILM Corporation, GE Healthcare, Merck KGaA, Avantor Inc, Thermo Fisher Scientific Inc, and DASIT Group SPA hold significant positions, but smaller, specialized companies also contribute meaningfully. The market share of the top five players is estimated at xx%.

- Market Concentration: Moderate, with a few dominant players and numerous smaller niche players.

- Innovation Ecosystems: Active collaborations between universities, research institutions, and companies drive innovation in specialized chemicals and diagnostic tools.

- Regulatory Frameworks: Stringent regulations regarding safety, quality, and environmental impact influence market dynamics and create barriers to entry for some players.

- Substitute Products: The availability of substitute products and the increasing use of alternative technologies impact the growth of certain segments.

- End-User Trends: The increasing demand for advanced analytical techniques across various sectors drives demand for high-purity chemicals and specialized reagents.

- M&A Activities: The market has witnessed xx M&A deals in the past five years, indicating industry consolidation and expansion efforts. Recent examples include Merck's acquisition of M Chemicals Inc. in January 2023.

Italy Laboratory Chemicals Industry Industry Insights & Trends

The Italy laboratory chemicals market is projected to reach €xx Million by 2025, expanding at a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several key factors. The healthcare sector's expansion, driven by an aging population and rising prevalence of chronic diseases, fuels the demand for diagnostic tools and reagents. Government initiatives supporting research and development further stimulate growth. Technological advancements, such as automation and miniaturization in laboratory techniques, also contribute significantly. Consumer behavior is shifting towards more sophisticated and reliable diagnostic methods, impacting product preference and demand for high-quality chemicals. The market witnesses steady growth in segments like analytical chemistry, life sciences, and clinical diagnostics. However, economic fluctuations and price volatility of raw materials can pose challenges to market stability.

Key Markets & Segments Leading Italy Laboratory Chemicals Industry

The dominant segment within the Italian laboratory chemicals market is the life sciences sector, driven by the strong pharmaceutical and biotechnology industries. Northern Italy, particularly the Lombardy region, houses major pharmaceutical companies and research institutions, contributing significantly to the market's overall growth.

- Drivers in Northern Italy (Lombardy):

- Strong presence of pharmaceutical and biotechnology companies

- Well-established research infrastructure and universities

- Favorable government policies and investments in R&D

- Highly skilled workforce

The robust growth of the life sciences sector is primarily attributable to increasing investments in R&D by pharmaceutical companies and the rising demand for advanced diagnostic tools. Moreover, growing awareness of health issues among consumers and government initiatives focused on preventive healthcare are further contributing to this segment's dominance. This sector is expected to maintain its leadership position over the forecast period.

Italy Laboratory Chemicals Industry Product Developments

Recent product innovations include the introduction of advanced analytical instruments with enhanced sensitivity and precision, along with specialized reagents for various applications in life sciences and clinical diagnostics. Companies are focusing on developing eco-friendly and sustainable chemical solutions to meet growing environmental concerns. These innovations are creating competitive advantages for companies, particularly those focusing on high-value niche markets. The ongoing development of rapid diagnostic tests and point-of-care diagnostic tools are further driving product innovation within the market.

Challenges in the Italy Laboratory Chemicals Industry Market

The Italy laboratory chemicals market faces challenges including stringent regulatory requirements that increase product development costs and time-to-market. Supply chain disruptions and the price volatility of raw materials also pose significant challenges to market stability. Intense competition among existing players and the entry of new participants add to the pressure on profit margins. These factors can constrain market growth if not addressed effectively.

Forces Driving Italy Laboratory Chemicals Industry Growth

Several factors contribute to the growth of the Italian laboratory chemicals market. Technological advancements in analytical techniques and automation are driving efficiency and demand. The expanding healthcare sector, particularly in diagnostics and drug development, creates substantial demand. Government support for research and development initiatives also stimulates market expansion. Finally, increasing investments from both domestic and foreign players fuel further growth within the sector.

Long-Term Growth Catalysts in the Italy Laboratory Chemicals Industry

Long-term growth will be fueled by continued innovation in analytical technologies and the development of novel chemical solutions for life sciences research. Strategic partnerships and collaborations between research institutions and industry players will accelerate product development and market expansion. The growing demand for personalized medicine and advanced diagnostics will further drive market growth over the long term.

Emerging Opportunities in Italy Laboratory Chemicals Industry

The market presents opportunities in developing specialized reagents and chemicals for emerging fields like personalized medicine, genomics, and proteomics. The demand for sustainable and environmentally friendly laboratory chemicals also presents a significant opportunity for companies adopting green chemistry practices. Finally, tapping into the growing demand for point-of-care diagnostics represents a substantial area for future growth.

Leading Players in the Italy Laboratory Chemicals Industry Sector

- BD (Becton Dickinson and Company)

- BIOMÉRIEUX

- BiosYnth s r l

- FUJIFILM Corporation

- GE Healthcare

- Merck KGaA

- Avantor Inc

- Thermo Fisher Scientific Inc

- DASIT Group SPA

- *List Not Exhaustive

Key Milestones in Italy Laboratory Chemicals Industry Industry

- January 2023: Merck completed the acquisition of M Chemicals Inc., expanding its chemical business portfolio and market presence.

- December 2022: Merck announced a collaboration with Mersana Therapeutics to develop novel immunostimulatory antibody-drug conjugates, signifying a move towards innovative drug discovery and development.

Strategic Outlook for Italy Laboratory Chemicals Industry Market

The Italy laboratory chemicals market presents significant opportunities for growth driven by technological advancements, increasing R&D investments, and expanding healthcare needs. Companies adopting strategic approaches that emphasize innovation, collaboration, and sustainable practices are poised to benefit most from this growing market. Focusing on niche segments, developing high-value products, and addressing the evolving needs of end-users are key to achieving long-term success in this competitive industry.

Italy Laboratory Chemicals Industry Segmentation

-

1. Type

- 1.1. Molecular Biology

- 1.2. Cytokine and Chemokine Testing

- 1.3. Carbohydrate Analysis

- 1.4. Immunochemistry

- 1.5. Cell Culture

- 1.6. Environmental Testing

- 1.7. Biochemistry

- 1.8. Other Types

-

2. Application

- 2.1. Industrial

- 2.2. Education

- 2.3. Government

- 2.4. Healthcare

Italy Laboratory Chemicals Industry Segmentation By Geography

- 1. Italy

Italy Laboratory Chemicals Industry Regional Market Share

Geographic Coverage of Italy Laboratory Chemicals Industry

Italy Laboratory Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Healthcare Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Expanding Healthcare Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Industrial Application to Witness Substantial Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Laboratory Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Molecular Biology

- 5.1.2. Cytokine and Chemokine Testing

- 5.1.3. Carbohydrate Analysis

- 5.1.4. Immunochemistry

- 5.1.5. Cell Culture

- 5.1.6. Environmental Testing

- 5.1.7. Biochemistry

- 5.1.8. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Education

- 5.2.3. Government

- 5.2.4. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BD (Becton Dickinson and Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BIOMÉRIEUX

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BiosYnth s r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FUJIFILM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Merck KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avantor Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DASIT Group SPA*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 BD (Becton Dickinson and Company)

List of Figures

- Figure 1: Italy Laboratory Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Laboratory Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Laboratory Chemicals Industry?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the Italy Laboratory Chemicals Industry?

Key companies in the market include BD (Becton Dickinson and Company), BIOMÉRIEUX, BiosYnth s r l, FUJIFILM Corporation, GE Healthcare, Merck KGaA, Avantor Inc, Thermo Fisher Scientific Inc, DASIT Group SPA*List Not Exhaustive.

3. What are the main segments of the Italy Laboratory Chemicals Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Healthcare Sector; Other Drivers.

6. What are the notable trends driving market growth?

Industrial Application to Witness Substantial Growth.

7. Are there any restraints impacting market growth?

Expanding Healthcare Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

January 2023: Merck Completed the acquisition of M Chemicals Inc., the company recently incorporated by Mecaro Co. Ltd. to operate its chemical business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Laboratory Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Laboratory Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Laboratory Chemicals Industry?

To stay informed about further developments, trends, and reports in the Italy Laboratory Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence