Key Insights

The Middle East and Africa (MEA) Cooling Systems market is poised for significant expansion, driven by escalating temperatures, industrial growth, and burgeoning energy and construction sectors. Projected to achieve a compound annual growth rate (CAGR) of 9.5%, the market is forecast to reach $14.9 billion by 2025. This upward trend is propelled by the escalating demand for robust cooling solutions across diverse applications, including power generation, chemical processing, and major infrastructure projects. The market predominantly features heat exchangers, fans, and blowers, indicating a preference for established cooling technologies. Opportunities exist for advanced, energy-efficient cooling equipment to address emerging sustainability requirements. Leading companies such as Danfoss, Thermax, and Xylem are strategically positioned to leverage this growth, supported by regional players like Gmark Middle East FZC and Reitz Middle East FZE. Future market performance will be shaped by supportive government regulations on energy efficiency, technological innovations, and ongoing industrial sector expansion across the MEA region. The adoption of sustainable cooling solutions, particularly within the energy sector, will be crucial for sustained success.

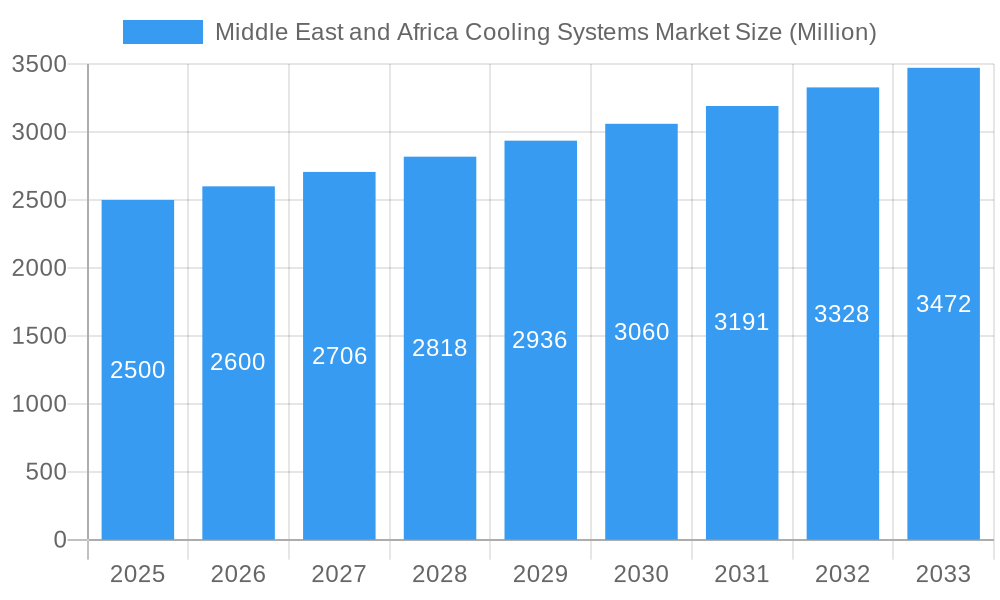

Middle East and Africa Cooling Systems Market Market Size (In Billion)

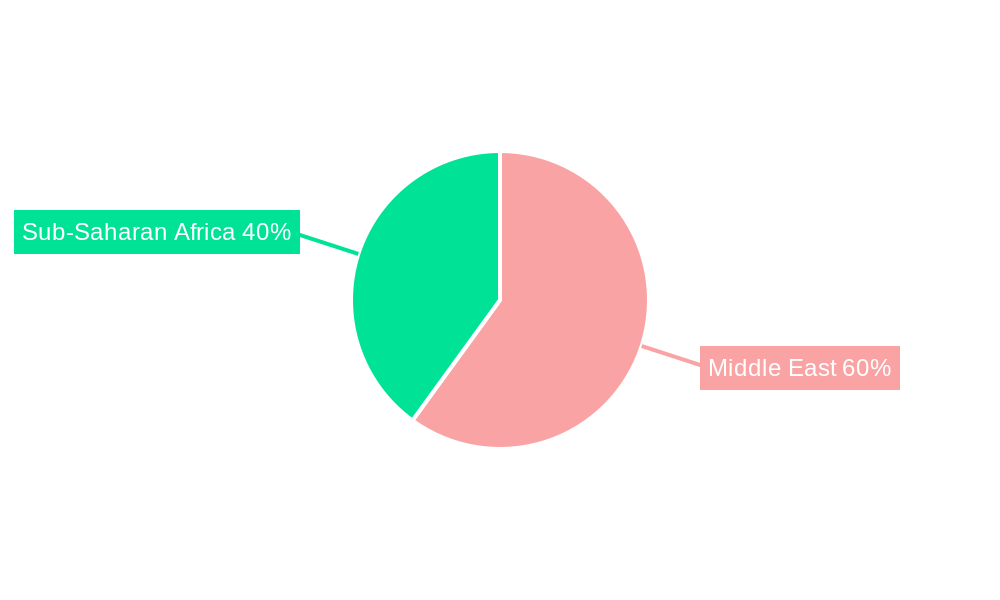

Sub-Saharan Africa, including key economies like South Africa and Kenya, represents a substantial growth avenue within the MEA Cooling Systems market. While specific market size data for this sub-region is not detailed, industry insights suggest a multi-billion dollar contribution to the overall market value. Continued infrastructure development, rising industrial activities, and population growth are key drivers for this expansion. However, potential challenges such as regional economic volatility and the need for robust infrastructure investment warrant careful consideration. Emphasizing energy-efficient and eco-friendly cooling solutions will be paramount for achieving long-term market success in this dynamic landscape. The competitive environment is characterized by a healthy mix of global and local enterprises, offering a balance of expertise and localized market understanding.

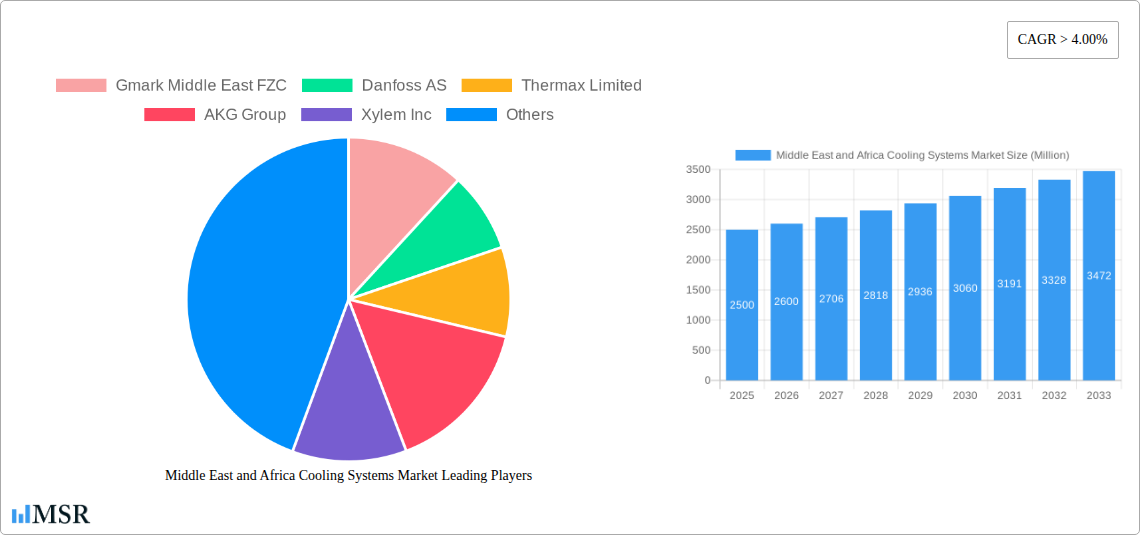

Middle East and Africa Cooling Systems Market Company Market Share

Middle East and Africa Cooling Systems Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa cooling systems market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market is segmented by cooling equipment (heat exchangers, fans & blowers, other cooling equipment) and end-user (energy sector, chemical & petrochemicals, construction, other end-users). Key players analyzed include Gmark Middle East FZC, Danfoss AS, Thermax Limited, AKG Group, Xylem Inc, Reitz Middle East FZE, Infinair Arabia Co Ltd, Hydac International GmbH, Parker Hannifin Corp, and Alfa Laval AB. The report projects a market size of xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Middle East and Africa Cooling Systems Market Concentration & Dynamics

The Middle East and Africa cooling systems market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous regional and specialized players fosters competition. The market displays a dynamic interplay of innovation, stringent regulatory frameworks, and the increasing adoption of energy-efficient technologies. Substitute products, such as evaporative cooling systems, pose a challenge, although the demand for advanced cooling solutions remains strong. End-user trends, particularly in the energy and petrochemical sectors, are driving demand for sophisticated and reliable cooling systems. M&A activity within the sector has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding regional presence and technological capabilities. Market share data is currently unavailable, however, it can be inferred that larger multinational corporations hold a larger share of the total revenue than smaller regional players.

Middle East and Africa Cooling Systems Market Industry Insights & Trends

The Middle East and Africa cooling systems market is experiencing robust growth, driven by several factors. The expanding energy sector, particularly in renewable energy, is a significant contributor, demanding efficient cooling solutions for power generation and transmission. The burgeoning construction industry across the region further fuels market expansion, with increasing demand for HVAC systems in residential, commercial, and industrial buildings. Technological disruptions, such as the adoption of smart cooling systems and advanced refrigerants, are shaping market trends. Evolving consumer behaviors, emphasizing energy efficiency and sustainability, are influencing product choices. The market size is expected to reach xx Million by 2025, demonstrating the substantial growth potential of this sector. Continued expansion in the industrial, energy, and construction sectors, coupled with investments in smart cooling technologies, should sustain a robust market expansion over the forecast period.

Key Markets & Segments Leading Middle East and Africa Cooling Systems Market

The energy sector constitutes a dominant end-user segment, driven by the region's substantial oil and gas reserves and growing investments in renewable energy projects. Within cooling equipment, heat exchangers hold a significant market share due to their crucial role in various industrial processes and power generation.

Key Drivers:

- Energy Sector Growth: Massive investments in oil, gas, and renewable energy projects fuel demand for robust and efficient cooling systems.

- Construction Boom: Rapid urbanization and infrastructural development across the region drive demand for HVAC systems.

- Industrial Expansion: Growth in manufacturing, chemical, and petrochemical sectors boosts demand for industrial cooling solutions.

Dominance Analysis: Saudi Arabia, UAE, and Egypt emerge as key regional markets, supported by robust economic growth and significant government investments in infrastructure development. The high ambient temperatures across these regions necessitate high-capacity cooling solutions.

Middle East and Africa Cooling Systems Market Product Developments

Recent product developments focus on energy-efficient technologies, such as advanced refrigerants and smart control systems, to reduce operational costs and environmental impact. The integration of IoT (Internet of Things) capabilities allows for real-time monitoring and optimization of cooling systems. These advancements enhance the efficiency and reliability of cooling equipment, providing significant competitive advantages. The development and incorporation of sustainable materials and manufacturing processes is also gaining prominence, reflecting a heightened environmental consciousness within the industry.

Challenges in the Middle East and Africa Cooling Systems Market Market

The Middle East and Africa cooling systems market faces several challenges, including stringent regulatory requirements for energy efficiency and environmental compliance. These regulatory hurdles can increase the cost and complexity of product development and market entry. Supply chain disruptions and price volatility for raw materials, particularly during periods of geopolitical uncertainty, can also impact market stability. Intense competition from both established multinational companies and local players adds to market complexity. These factors collectively impose constraints on market expansion, impacting overall growth projections by an estimated xx%.

Forces Driving Middle East and Africa Cooling Systems Market Growth

Technological advancements in energy-efficient cooling technologies, coupled with the region's expanding energy and industrial sectors, are major growth drivers. Government initiatives promoting sustainable practices and energy efficiency further fuel market expansion. Economic growth across several key nations in the region ensures continued investment in infrastructure, including advanced cooling solutions. These trends collectively create a robust environment for market expansion and innovation.

Long-Term Growth Catalysts in the Middle East and Africa Cooling Systems Market

Long-term growth will be driven by continued innovation in energy-efficient cooling technologies, strategic partnerships between multinational corporations and local companies, and market expansion into less-developed regions within Africa. Investments in R&D and the development of sustainable solutions will be pivotal in shaping the future of this sector. Strategic partnerships offer opportunities for technology transfer, market access, and shared expertise, leading to mutual growth.

Emerging Opportunities in Middle East and Africa Cooling Systems Market

Emerging opportunities include the growing demand for sustainable and eco-friendly cooling solutions, the potential for growth in the renewable energy sector, and expanding market penetration in the less-developed regions of Africa. These areas offer potential for both established players and startups to explore and capitalize on significant market opportunities. The focus on sustainable practices will also attract investments and support from governmental agencies further promoting growth.

Leading Players in the Middle East and Africa Cooling Systems Market Sector

- Gmark Middle East FZC

- Danfoss AS

- Thermax Limited

- AKG Group

- Xylem Inc

- Reitz Middle East FZE

- Infinair Arabia Co Ltd

- Hydac International GmbH

- Parker Hannifin Corp

- Alfa Laval AB

Key Milestones in Middle East and Africa Cooling Systems Market Industry

- November 2022: Alfa Laval signed an agreement to supply heat exchangers to the green hydrogen production plant in Neom City, Saudi Arabia, signaling growing investment in sustainable energy solutions and related cooling technologies.

- August 2022: HK Huichuan International Petroleum Equipment Co. Ltd supplied a shell-and-tube heat exchanger for a project in Nigeria, demonstrating the continued demand for cooling equipment in the oil and gas sector.

Strategic Outlook for Middle East and Africa Cooling Systems Market Market

The Middle East and Africa cooling systems market holds significant future potential, driven by strong economic growth, infrastructural development, and increasing adoption of energy-efficient technologies. Strategic partnerships and investments in R&D will be crucial for companies to capitalize on emerging opportunities and maintain a competitive edge. Focus on sustainability and the development of innovative cooling solutions will be key for achieving long-term success in this dynamic and rapidly growing market.

Middle East and Africa Cooling Systems Market Segmentation

-

1. Cooling Equipment

- 1.1. Heat Exchangers

- 1.2. Fans & Blowers

- 1.3. Other Cooling Equipment

-

2. End User

- 2.1. Energy Sector

- 2.2. Chemical & Petrochemicals

- 2.3. Construction

- 2.4. Other End Users

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. Nigeria

- 3.5. Rest of Middle East and Africa

Middle East and Africa Cooling Systems Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Nigeria

- 5. Rest of Middle East and Africa

Middle East and Africa Cooling Systems Market Regional Market Share

Geographic Coverage of Middle East and Africa Cooling Systems Market

Middle East and Africa Cooling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Energy Sector Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Cooling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 5.1.1. Heat Exchangers

- 5.1.2. Fans & Blowers

- 5.1.3. Other Cooling Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Energy Sector

- 5.2.2. Chemical & Petrochemicals

- 5.2.3. Construction

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Nigeria

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Nigeria

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 6. Saudi Arabia Middle East and Africa Cooling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 6.1.1. Heat Exchangers

- 6.1.2. Fans & Blowers

- 6.1.3. Other Cooling Equipment

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Energy Sector

- 6.2.2. Chemical & Petrochemicals

- 6.2.3. Construction

- 6.2.4. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. Nigeria

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 7. United Arab Emirates Middle East and Africa Cooling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 7.1.1. Heat Exchangers

- 7.1.2. Fans & Blowers

- 7.1.3. Other Cooling Equipment

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Energy Sector

- 7.2.2. Chemical & Petrochemicals

- 7.2.3. Construction

- 7.2.4. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. Nigeria

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 8. Qatar Middle East and Africa Cooling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 8.1.1. Heat Exchangers

- 8.1.2. Fans & Blowers

- 8.1.3. Other Cooling Equipment

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Energy Sector

- 8.2.2. Chemical & Petrochemicals

- 8.2.3. Construction

- 8.2.4. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. Nigeria

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 9. Nigeria Middle East and Africa Cooling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 9.1.1. Heat Exchangers

- 9.1.2. Fans & Blowers

- 9.1.3. Other Cooling Equipment

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Energy Sector

- 9.2.2. Chemical & Petrochemicals

- 9.2.3. Construction

- 9.2.4. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. Nigeria

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 10. Rest of Middle East and Africa Middle East and Africa Cooling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 10.1.1. Heat Exchangers

- 10.1.2. Fans & Blowers

- 10.1.3. Other Cooling Equipment

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Energy Sector

- 10.2.2. Chemical & Petrochemicals

- 10.2.3. Construction

- 10.2.4. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. Nigeria

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gmark Middle East FZC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danfoss AS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermax Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AKG Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xylem Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Reitz Middle East FZE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Infinair Arabia Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hydac International GmbH*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Parker Hannifin Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alfa Laval AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gmark Middle East FZC

List of Figures

- Figure 1: Middle East and Africa Cooling Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Cooling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Cooling Equipment 2020 & 2033

- Table 2: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Cooling Equipment 2020 & 2033

- Table 6: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Cooling Equipment 2020 & 2033

- Table 10: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Cooling Equipment 2020 & 2033

- Table 14: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Cooling Equipment 2020 & 2033

- Table 18: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Cooling Equipment 2020 & 2033

- Table 22: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle East and Africa Cooling Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Cooling Systems Market?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the Middle East and Africa Cooling Systems Market?

Key companies in the market include Gmark Middle East FZC, Danfoss AS, Thermax Limited, AKG Group, Xylem Inc, Reitz Middle East FZE, Infinair Arabia Co Ltd, Hydac International GmbH*List Not Exhaustive, Parker Hannifin Corp, Alfa Laval AB.

3. What are the main segments of the Middle East and Africa Cooling Systems Market?

The market segments include Cooling Equipment, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

Energy Sector Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

November 2022: Alfa Laval signed an agreement to supply heat exchangers to the green hydrogen production plant to be built in Neom City, Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Cooling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Cooling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Cooling Systems Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Cooling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence