Key Insights

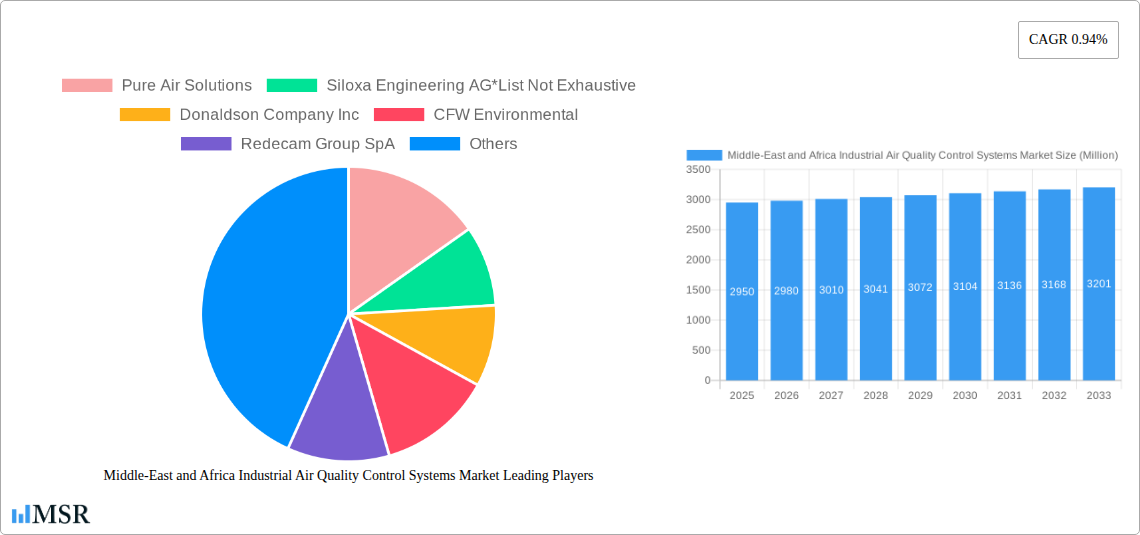

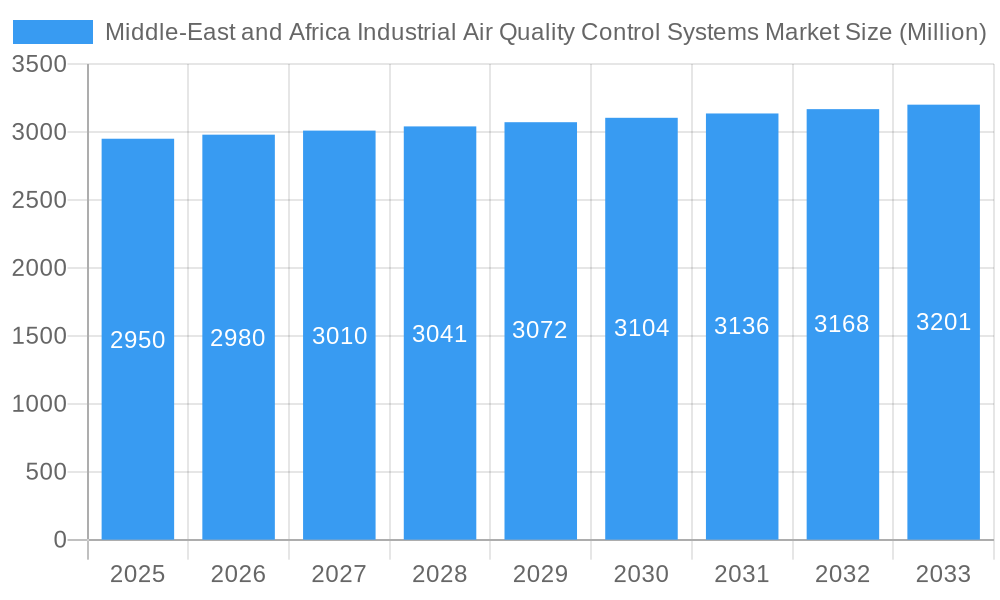

The Middle East and Africa Industrial Air Quality Control Systems market, valued at $2.95 billion in 2025, is projected to experience steady growth, driven by increasing industrialization and stringent environmental regulations across the region. A Compound Annual Growth Rate (CAGR) of 0.94% from 2025 to 2033 indicates a moderate but consistent expansion. Key growth drivers include the burgeoning power generation, cement, and oil & gas sectors, all of which are significant contributors to air pollution and therefore necessitate robust air quality control solutions. The rising awareness of the health impacts of air pollution, coupled with governmental initiatives promoting cleaner production practices, further fuels market demand. While the market faces challenges such as high initial investment costs for advanced technologies and potential economic fluctuations impacting industrial expansion, the long-term outlook remains positive. Specific segments like Electrostatic Precipitators (ESPs), Flue Gas Desulfurization (FGD) systems, and Selective Catalytic Reduction (SCR) technologies are expected to witness considerable demand due to their effectiveness in controlling particulate matter, sulfur oxides (SO2), and nitrogen oxides (NOx) emissions, respectively. Geographic growth will likely be concentrated in regions with rapidly developing industrial sectors, such as North Africa and the Gulf Cooperation Council (GCC) countries. The adoption of advanced technologies like Fabric Filters and increasingly sophisticated monitoring systems will shape future market dynamics, particularly as environmental regulations become more stringent and penalties for non-compliance increase.

Middle-East and Africa Industrial Air Quality Control Systems Market Market Size (In Billion)

The market's segmentation offers diverse opportunities for vendors. Power generation remains the largest application sector, followed by cement and oil & gas. While companies like Pure Air Solutions, Siloxa Engineering AG, Donaldson Company Inc., and others already hold significant market share, the presence of numerous smaller players indicates a competitive landscape. Future growth will likely be influenced by technological advancements, focusing on enhanced efficiency, reduced operational costs, and integration with smart monitoring systems for predictive maintenance. Furthermore, collaborations between technology providers and end-use industries are expected to enhance the adoption of air quality control systems, driving the market toward a more sustainable future. Given the growing emphasis on environmental responsibility and the long-term implications of air pollution, the Middle East and Africa Industrial Air Quality Control Systems market is poised for continued, albeit moderate, expansion over the forecast period.

Middle-East and Africa Industrial Air Quality Control Systems Market Company Market Share

Middle-East & Africa Industrial Air Quality Control Systems Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle-East and Africa Industrial Air Quality Control Systems market, offering valuable insights for stakeholders across the value chain. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by type (Electrostatic Precipitators (ESP), Flue Gas Desulfurization (FGD) and Scrubbers, Selective Catalytic Reduction (SCR), Fabric Filters, Others), application (Power Generation Industry, Cement Industry, Chemicals and Fertilizers, Iron and Steel Industry, Automotive Industry, Oil & Gas Industry, Other Applications), and emissions (Nitrogen Oxides (NOX), Sulphur Oxide (SO2), Particulate Matter (PM)). Key players analyzed include Pure Air Solutions, Siloxa Engineering AG, Donaldson Company Inc, CFW Environmental, Redecam Group SpA, Aircure, Dürr AG, The ERG Group, FLSmidth & Co A/S, and Alfa Laval AB. The report values are expressed in Millions.

Middle-East & Africa Industrial Air Quality Control Systems Market Concentration & Dynamics

The Middle East and Africa industrial air quality control systems market exhibits a moderately concentrated landscape, with a few large multinational corporations and several regional players holding significant market share. The exact market share distribution for 2025 is currently being calculated (xx%). Innovation in this sector is driven by stringent environmental regulations and the increasing focus on sustainability across various industries. The regulatory framework varies across different countries in the region, influencing the adoption and type of air quality control systems. Substitute products, such as alternative energy sources, are exerting some competitive pressure, but the overall demand for robust and reliable air pollution control remains strong.

- Market Concentration: Moderately concentrated, with xx% market share held by top 5 players in 2025.

- Innovation Ecosystems: Strong focus on technological advancements to meet increasingly stringent emission standards.

- Regulatory Frameworks: Vary across the region, impacting adoption rates and system choices.

- Substitute Products: Alternative energy sources pose a moderate competitive threat.

- End-User Trends: Growing emphasis on sustainability and corporate social responsibility is a key driver.

- M&A Activities: A moderate number of M&A deals (xx) were observed between 2019 and 2024, indicating ongoing consolidation in the market.

Middle-East & Africa Industrial Air Quality Control Systems Market Industry Insights & Trends

The Middle East and Africa industrial air quality control systems market is projected to witness significant growth during the forecast period (2025-2033), driven by factors such as rapid industrialization, increasing urbanization, and the implementation of stricter environmental regulations across the region. The market size in 2025 is estimated at $xx Million, and a Compound Annual Growth Rate (CAGR) of xx% is anticipated from 2025 to 2033. Technological advancements, including the development of more efficient and cost-effective air pollution control technologies, are further fueling market growth. Consumer behavior is evolving towards greater environmental awareness, influencing the demand for sustainable solutions in various industries. Significant investments in infrastructure projects across the region also contribute positively to the market's expansion.

Key Markets & Segments Leading Middle-East & Africa Industrial Air Quality Control Systems Market

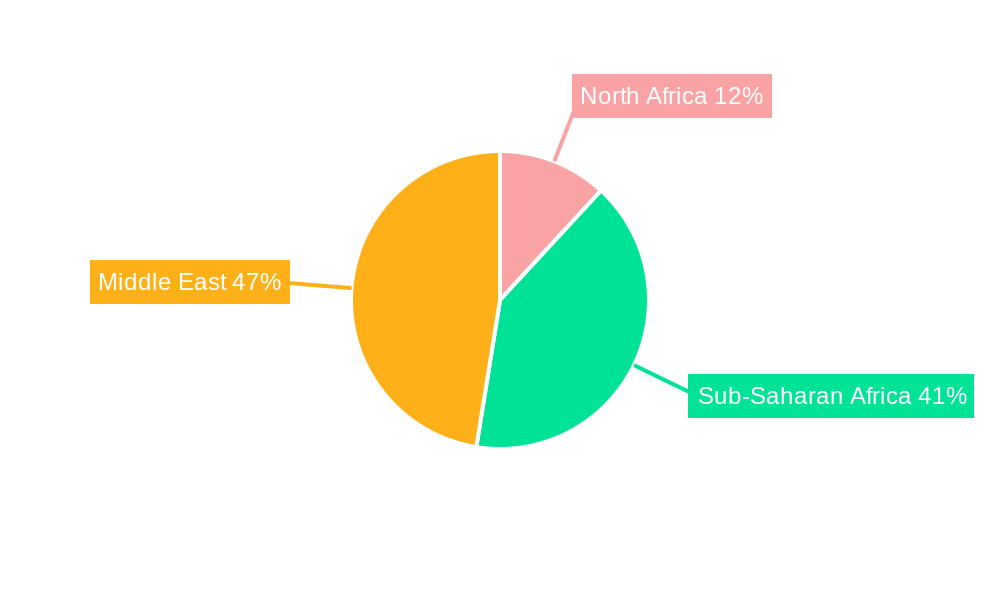

The Oil & Gas industry is currently the dominant application segment within the Middle East and Africa industrial air quality control systems market, followed by the Power Generation and Cement industries. The high concentration of these industries in the region, coupled with stringent environmental regulations, drives substantial demand for air pollution control solutions. Geographically, Saudi Arabia, the UAE, and Egypt are key markets exhibiting high growth potential.

Drivers of Market Growth:

- Economic Growth: Rapid economic expansion across several countries fuels industrial activity.

- Infrastructure Development: Large-scale infrastructure projects necessitate robust air pollution control systems.

- Stringent Environmental Regulations: Increasingly strict emission standards mandate the adoption of advanced air quality control systems.

- Growing Environmental Awareness: Increased consumer and corporate awareness of environmental issues boosts demand.

Dominance Analysis:

The Oil & Gas industry's dominance stems from its significant presence and the stringent emission norms associated with its operations. Similarly, the Power Generation sector, with its large-scale power plants, creates a significant demand for air quality control systems. The geographic dominance of Saudi Arabia, the UAE, and Egypt reflects their high levels of industrial activity and government initiatives promoting environmental sustainability.

Middle-East & Africa Industrial Air Quality Control Systems Market Product Developments

Recent product developments focus on improving efficiency, reducing operating costs, and enhancing the ability to handle diverse pollutant streams. Innovations include advanced filter technologies, improved ESP designs, and the integration of AI and IoT for optimized system performance and predictive maintenance. These advancements provide companies with a competitive edge by offering superior performance and reduced lifecycle costs, meeting the growing need for sustainable and efficient air quality control in the Middle East and Africa.

Challenges in the Middle-East & Africa Industrial Air Quality Control Systems Market Market

The market faces several challenges, including the high initial investment cost associated with adopting advanced air quality control systems, which can be a barrier for smaller companies. Supply chain disruptions, particularly the availability of specialized components and materials, can also impact project timelines and costs. Furthermore, intense competition among existing players requires continuous innovation and adaptation to stay competitive. These factors can affect the overall market growth rate.

Forces Driving Middle-East & Africa Industrial Air Quality Control Systems Market Growth

Several factors are accelerating market growth. Technological advancements, such as the development of more efficient and cost-effective air quality control systems, are pivotal. Government regulations and initiatives promoting cleaner industrial practices further drive adoption. Economic growth and infrastructure development across the region lead to increased industrial activity and subsequently demand for air pollution control solutions.

Challenges in the Middle-East & Africa Industrial Air Quality Control Systems Market Market

Long-term growth is fueled by continued investment in R&D leading to improved technology and cost reductions. Strategic partnerships between technology providers and industrial end-users promote the adoption of advanced solutions. Market expansion into less developed regions with burgeoning industrial activities will contribute significantly to future growth.

Emerging Opportunities in Middle-East & Africa Industrial Air Quality Control Systems Market

Emerging opportunities include the expansion into newer industrial sectors, such as renewable energy and waste management, requiring specialized air quality control solutions. The adoption of digital technologies, such as AI and IoT, for optimized system performance and predictive maintenance presents a significant opportunity. Growing awareness of the health impacts of air pollution further strengthens the market potential for air quality control systems.

Leading Players in the Middle-East & Africa Industrial Air Quality Control Systems Market Sector

- Pure Air Solutions

- Siloxa Engineering AG

- Donaldson Company Inc

- CFW Environmental

- Redecam Group SpA

- Aircure

- Dürr AG

- The ERG Group

- FLSmidth & Co A/S

- Alfa Laval AB

Key Milestones in Middle-East & Africa Industrial Air Quality Control Systems Market Industry

- December 2022: Khalifa University's collaboration with Levidian Nanosystems on carbon reduction technology opens avenues for applications in various waste gas streams, including oil & gas.

- March 2022: Gaussian Robotics' product showcase at The Big 5 Saudi expo highlights the growing adoption of automated cleaning solutions in industrial settings.

Strategic Outlook for Middle-East & Africa Industrial Air Quality Control Systems Market Market

The Middle East and Africa industrial air quality control systems market presents significant growth potential due to continued industrial expansion, stricter environmental regulations, and increasing investments in sustainable technologies. Strategic partnerships, technological advancements, and targeted market expansion into rapidly developing regions will be key drivers for long-term success in this market.

Middle-East and Africa Industrial Air Quality Control Systems Market Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions

- 3.1. Nitrogen Oxides (NOX)

- 3.2. Sulphur Oxide (SO2)

- 3.3. Particulate Matter (PM)

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. South Africa

- 4.3. Algeria

- 4.4. Rest of Middle East and Africa

Middle-East and Africa Industrial Air Quality Control Systems Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Algeria

- 4. Rest of Middle East and Africa

Middle-East and Africa Industrial Air Quality Control Systems Market Regional Market Share

Geographic Coverage of Middle-East and Africa Industrial Air Quality Control Systems Market

Middle-East and Africa Industrial Air Quality Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand from the Downstream Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Renewable and Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Iron and Steel is Expected to Have Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions

- 5.3.1. Nitrogen Oxides (NOX)

- 5.3.2. Sulphur Oxide (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Algeria

- 5.4.4. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Algeria

- 5.5.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions

- 6.3.1. Nitrogen Oxides (NOX)

- 6.3.2. Sulphur Oxide (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. South Africa

- 6.4.3. Algeria

- 6.4.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions

- 7.3.1. Nitrogen Oxides (NOX)

- 7.3.2. Sulphur Oxide (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. South Africa

- 7.4.3. Algeria

- 7.4.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Algeria Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions

- 8.3.1. Nitrogen Oxides (NOX)

- 8.3.2. Sulphur Oxide (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. South Africa

- 8.4.3. Algeria

- 8.4.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electrostatic Precipitators (ESP)

- 9.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 9.1.3. Selective Catalytic Reduction (SCR)

- 9.1.4. Fabric Filters

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation Industry

- 9.2.2. Cement Industry

- 9.2.3. Chemicals and Fertilizers

- 9.2.4. Iron and Steel Industry

- 9.2.5. Automotive Industry

- 9.2.6. Oil & Gas Industry

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Emissions

- 9.3.1. Nitrogen Oxides (NOX)

- 9.3.2. Sulphur Oxide (SO2)

- 9.3.3. Particulate Matter (PM)

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. South Africa

- 9.4.3. Algeria

- 9.4.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Pure Air Solutions

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siloxa Engineering AG*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Donaldson Company Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CFW Environmental

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Redecam Group SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aircure

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Durr AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The ERG Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 FLSmidth & Co A/S

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alfa Laval AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pure Air Solutions

List of Figures

- Figure 1: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Industrial Air Quality Control Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 4: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 9: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 14: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 19: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 24: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Industrial Air Quality Control Systems Market?

The projected CAGR is approximately 0.94%.

2. Which companies are prominent players in the Middle-East and Africa Industrial Air Quality Control Systems Market?

Key companies in the market include Pure Air Solutions, Siloxa Engineering AG*List Not Exhaustive, Donaldson Company Inc, CFW Environmental, Redecam Group SpA, Aircure, Durr AG, The ERG Group, FLSmidth & Co A/S, Alfa Laval AB.

3. What are the main segments of the Middle-East and Africa Industrial Air Quality Control Systems Market?

The market segments include Type, Application, Emissions, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand from the Downstream Industry.

6. What are the notable trends driving market growth?

Iron and Steel is Expected to Have Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Renewable and Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In December 2022, Khalifa University of Science and Technology joined forces to find local applications for Levidian Nanosystems' carbon reduction LOOP technology. The RIC-2D at Khalifa University and Zero Carbon Ventures has built a technology facility at the Arzanah Complex on the university's Sas Al Nakhl (SAN) Campus in Abu Dhabi. The system's input and outputs will be studied to create applications for various waste gas blends, such as those used in the oil and gas industry, agriculture, landfills, and wastewater treatment plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Industrial Air Quality Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Industrial Air Quality Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Industrial Air Quality Control Systems Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Industrial Air Quality Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence