Key Insights

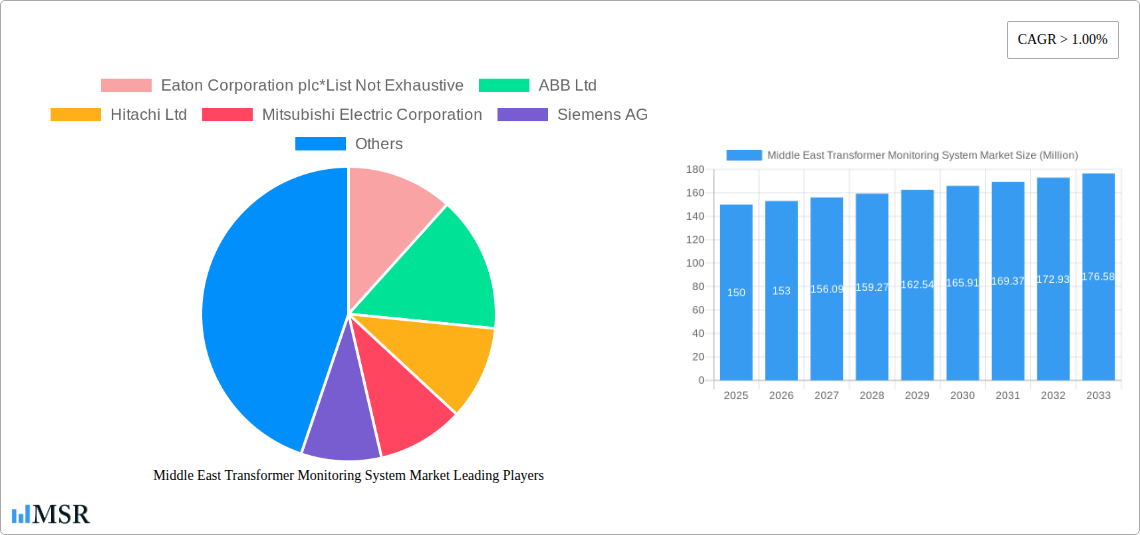

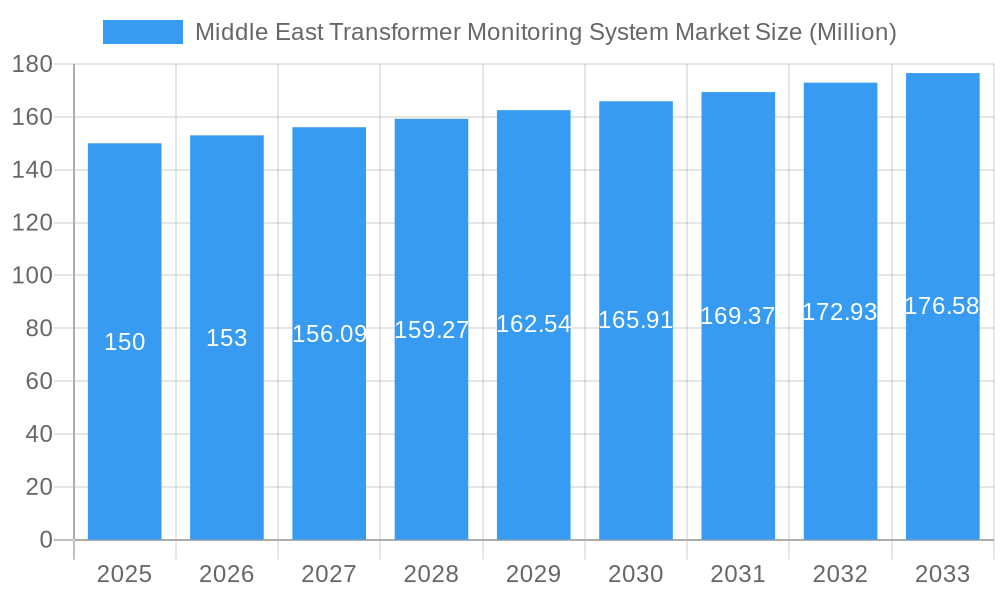

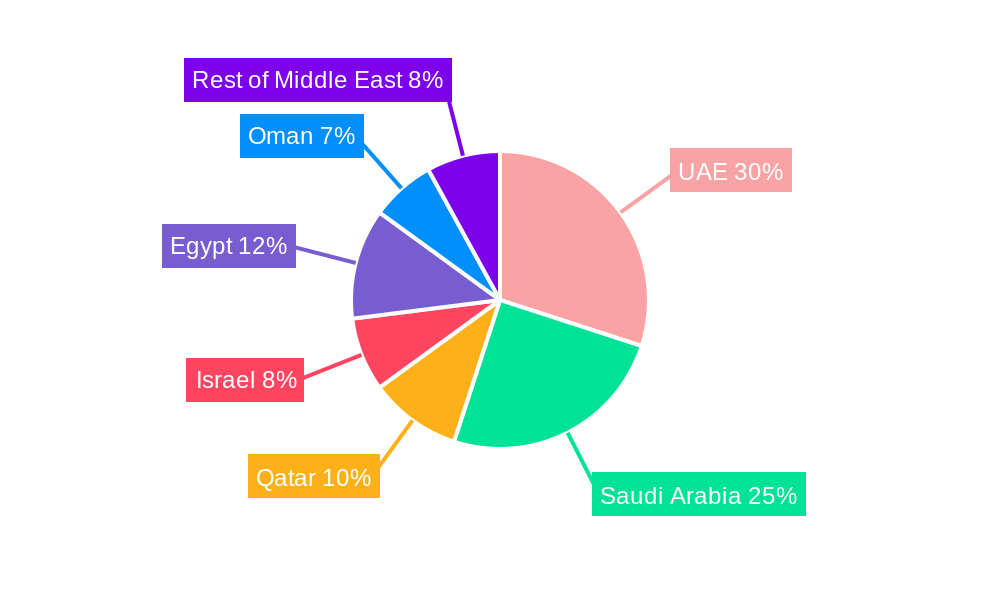

The Middle East Transformer Monitoring System market is experiencing robust growth, driven by the region's expanding power infrastructure and increasing demand for reliable electricity supply. The market's Compound Annual Growth Rate (CAGR) exceeding 1.00% reflects a steady upward trajectory, projected to continue through 2033. Key drivers include the modernization of existing power grids, the integration of renewable energy sources (requiring sophisticated monitoring for grid stability), and stringent government regulations emphasizing grid reliability and efficiency. Furthermore, the increasing prevalence of smart grids and the adoption of advanced analytics for predictive maintenance are fueling market expansion. The market is segmented by transformer type, with distribution and power transformers representing the primary application areas. Major players like Eaton, ABB, Hitachi, Mitsubishi Electric, Siemens, and Schneider Electric are actively competing in this space, offering a wide range of monitoring solutions. The United Arab Emirates, Saudi Arabia, and Qatar are currently leading the market due to their substantial investments in infrastructure development and ambitious renewable energy targets. However, growth opportunities are also present in other Middle Eastern countries as they strive to improve their power infrastructure and meet rising energy demands. The market's growth will likely be influenced by factors such as fluctuating oil prices (affecting investment budgets), geopolitical stability, and the pace of technological advancements in monitoring technologies.

Middle East Transformer Monitoring System Market Market Size (In Million)

The forecast for the Middle East Transformer Monitoring System market indicates continued expansion, particularly within the power transformer segment. The increasing adoption of digital technologies and the focus on improving grid resilience will drive demand for advanced monitoring systems capable of real-time data analysis and predictive maintenance capabilities. The market is expected to see considerable investment in IoT-enabled monitoring systems, improving efficiency and reducing downtime. While challenges remain such as the initial capital expenditure associated with implementing monitoring systems, the long-term benefits of improved grid reliability and reduced maintenance costs are incentivizing adoption. Competitive dynamics will remain intense, with companies focusing on innovation and strategic partnerships to strengthen their market position. The geographical distribution of the market is expected to diversify gradually as more Middle Eastern countries prioritize infrastructure modernization and renewable energy integration.

Middle East Transformer Monitoring System Market Company Market Share

Middle East Transformer Monitoring System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Transformer Monitoring System market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period (2025-2033), utilizing 2025 as the base year and estimated year. The report meticulously analyzes market dynamics, key segments (Distribution Transformers and Power Transformers), leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Middle East Transformer Monitoring System Market Concentration & Dynamics

The Middle East transformer monitoring system market exhibits a moderately concentrated landscape, with key players like Eaton Corporation plc, ABB Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Crompton Greaves, Schneider Electric SE, SPX Transformer Solutions Inc, and General Electric Company holding significant market share. The exact market share distribution varies across segments and countries but demonstrates a clear dominance of established multinational corporations.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Ecosystem: Significant investments in R&D by major players and the emergence of specialized startups drive innovation, focusing on advanced analytics, AI integration, and IoT capabilities within transformer monitoring systems.

- Regulatory Framework: Government initiatives promoting grid modernization and smart city projects across the Middle East contribute to market growth, though varying regulatory standards across different nations could present some challenges.

- Substitute Products: While direct substitutes are limited, alternative approaches such as manual inspection and basic protection systems exist, but their limitations in terms of efficiency and real-time monitoring are driving the adoption of advanced monitoring systems.

- End-User Trends: The increasing adoption of smart grids and the growing need for improved grid reliability and efficiency are key drivers of market growth. Utilities are increasingly prioritizing predictive maintenance strategies.

- M&A Activities: The past five years have witnessed xx M&A deals in the Middle East transformer monitoring systems market, mostly focused on enhancing technological capabilities and expanding market reach. This activity is expected to continue.

Middle East Transformer Monitoring System Market Industry Insights & Trends

The Middle East transformer monitoring system market is experiencing robust growth fueled by several key factors. The region's rapid infrastructure development, driven by economic expansion and urbanization, is a major contributor. The increasing demand for reliable electricity supply necessitates advanced monitoring solutions to improve grid stability, reduce outages, and enhance overall efficiency. The rising adoption of smart grids and the integration of renewable energy sources are further accelerating market growth. The market size in 2025 is estimated at xx Million, reflecting a substantial increase from the xx Million recorded in 2019.

Technological advancements, such as the integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), are revolutionizing transformer monitoring systems. These advancements enable predictive maintenance, real-time fault detection, and improved grid management capabilities, leading to enhanced operational efficiency and cost savings. Furthermore, evolving consumer behavior, driven by increasing awareness of the importance of reliable power supply, supports the growing demand for sophisticated monitoring solutions.

Key Markets & Segments Leading Middle East Transformer Monitoring System Market

The Power Transformers segment dominates the Middle East transformer monitoring system market, driven by the higher capital investment associated with these assets and the critical role they play in the transmission and distribution of electricity. The GCC region (specifically Saudi Arabia and the UAE) represents the largest market due to substantial investments in infrastructure projects, large-scale power plants, and the continuous expansion of the electrical grid.

Drivers for Power Transformers Segment Dominance:

- High Capital Investment: The higher value of power transformers necessitates robust monitoring systems to mitigate risks associated with equipment failure.

- Critical Infrastructure: Power transformers are crucial components of the electricity grid, and their reliable operation is paramount for national economies.

- Government Initiatives: Government spending on grid modernization and renewable energy integration projects directly supports the adoption of advanced monitoring systems.

Drivers for Distribution Transformers Segment Growth:

- Rising Electrification: The continued urbanization and economic development across the Middle East is boosting electricity demand at the distribution level.

- Improved Grid Efficiency: Smart grid initiatives are increasingly focused on optimizing the distribution network, creating opportunities for advanced monitoring solutions.

- Enhanced Reliability: Monitoring distribution transformers helps prevent outages and ensures a reliable electricity supply for end consumers.

Middle East Transformer Monitoring System Market Product Developments

Recent product innovations have focused on enhancing data analytics capabilities, integrating AI and ML algorithms for predictive maintenance, and improving the user-friendliness of monitoring systems through intuitive dashboards and mobile applications. These advancements provide utilities with real-time insights into transformer health, enabling proactive maintenance and reduced downtime. Features like remote monitoring and automated alerts are becoming standard, enhancing operational efficiency and reducing the need for on-site inspections. The competitive edge is increasingly determined by the sophistication of the data analytics and predictive capabilities offered.

Challenges in the Middle East Transformer Monitoring System Market Market

The Middle East transformer monitoring system market faces several challenges. These include high initial investment costs for advanced systems, the need for skilled personnel to operate and maintain the technology, and potential cyber security vulnerabilities associated with connected devices. Furthermore, variations in regulatory standards across different countries can create complexities for vendors seeking regional market penetration. Supply chain disruptions can also impact the availability and timely delivery of essential components, leading to project delays. Finally, intense competition among established players and new entrants could impact pricing and profitability.

Forces Driving Middle East Transformer Monitoring System Market Growth

Several factors contribute to the market's growth. Firstly, increasing government investment in infrastructure development and grid modernization initiatives throughout the Middle East fuels demand for advanced monitoring technologies. Secondly, the rising adoption of renewable energy sources requires sophisticated grid management solutions to optimize the integration of intermittent energy supplies. Thirdly, the growing focus on enhancing grid reliability and reducing power outages creates an imperative for proactive maintenance strategies supported by advanced monitoring capabilities. Lastly, technological advancements continue to drive improvements in the accuracy, reliability, and analytical capabilities of monitoring systems.

Long-Term Growth Catalysts in the Middle East Transformer Monitoring System Market

Long-term growth is projected to be sustained by ongoing investments in smart grid technologies, the expansion of renewable energy infrastructure, and the increasing adoption of predictive maintenance strategies. Strategic partnerships between technology providers and utilities will also contribute to market expansion. The development of more integrated, data-driven solutions that combine various aspects of grid management will further stimulate growth. Continuous technological innovation, including the integration of advanced sensor technologies, and more powerful AI and ML capabilities, will drive market expansion.

Emerging Opportunities in Middle East Transformer Monitoring System Market

Emerging opportunities lie in the development of cloud-based monitoring solutions, enabling cost-effective data storage and accessibility. The expansion of 5G networks provides enhanced connectivity and faster data transmission, enabling real-time monitoring and control. There is substantial potential for growth within the smaller distribution transformer segment as these become increasingly critical to effective grid management. The development of more sophisticated analytics that predict and mitigate transformer failures before they occur represents a significant opportunity. Finally, focusing on customer support and service will enhance vendor loyalty and competitiveness.

Leading Players in the Middle East Transformer Monitoring System Market Sector

- Eaton Corporation plc

- ABB Ltd

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Crompton Greaves

- Schneider Electric SE

- SPX Transformer Solutions Inc

- General Electric Company

Key Milestones in Middle East Transformer Monitoring System Market Industry

- 2020: Several major utilities in the UAE implemented large-scale transformer monitoring system upgrades.

- 2021: ABB launched a new generation of AI-powered transformer monitoring systems.

- 2022: Siemens and a leading Saudi Arabian utility partnered to deploy a smart grid monitoring system.

- 2023: Eaton announced a significant investment in R&D for advanced transformer monitoring technologies.

Strategic Outlook for Middle East Transformer Monitoring System Market Market

The Middle East transformer monitoring system market presents significant long-term growth potential, driven by continuous investments in grid infrastructure modernization and the increasing focus on grid reliability and efficiency. Strategic partnerships between technology vendors and utilities will play a crucial role in accelerating market adoption and expanding the use of advanced monitoring capabilities throughout the region. The continued integration of AI, ML, and IoT technologies will further shape the market landscape, offering sophisticated solutions for predictive maintenance and proactive grid management.

Middle East Transformer Monitoring System Market Segmentation

-

1. Type

- 1.1. Distribution Transformers

- 1.2. Power Transformers

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Rest of the Middle-East

Middle East Transformer Monitoring System Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Rest of the Middle East

Middle East Transformer Monitoring System Market Regional Market Share

Geographic Coverage of Middle East Transformer Monitoring System Market

Middle East Transformer Monitoring System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand from the Commercial and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Distribution Transformers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Distribution Transformers

- 5.1.2. Power Transformers

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Rest of the Middle-East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Rest of the Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Distribution Transformers

- 6.1.2. Power Transformers

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Rest of the Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Distribution Transformers

- 7.1.2. Power Transformers

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Rest of the Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the Middle East Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Distribution Transformers

- 8.1.2. Power Transformers

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Rest of the Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United Arab Emirates Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 10. Saudi Arabia Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 11. Qatar Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 12. Israel Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 13. Egypt Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 14. Oman Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 15. Rest of Middle East Middle East Transformer Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Eaton Corporation plc*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ABB Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Hitachi Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mitsubishi Electric Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Siemens AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Crompton Greaves

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Schneider Electric SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 SPX Transformer Solutions Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 General Electric Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Eaton Corporation plc*List Not Exhaustive

List of Figures

- Figure 1: Middle East Transformer Monitoring System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Transformer Monitoring System Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United Arab Emirates Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Saudi Arabia Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Egypt Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Oman Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Middle East Middle East Transformer Monitoring System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Middle East Transformer Monitoring System Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Transformer Monitoring System Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Middle East Transformer Monitoring System Market?

Key companies in the market include Eaton Corporation plc*List Not Exhaustive, ABB Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Crompton Greaves, Schneider Electric SE, SPX Transformer Solutions Inc, General Electric Company.

3. What are the main segments of the Middle East Transformer Monitoring System Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand from the Commercial and Industrial Sectors.

6. What are the notable trends driving market growth?

Distribution Transformers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Transformer Monitoring System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Transformer Monitoring System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Transformer Monitoring System Market?

To stay informed about further developments, trends, and reports in the Middle East Transformer Monitoring System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence