Key Insights

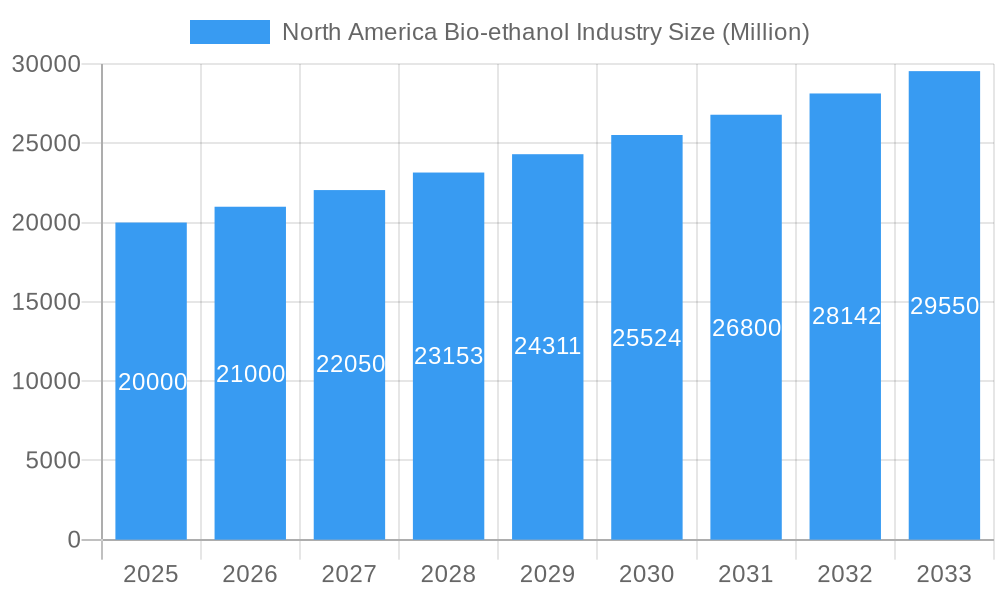

The North American bioethanol industry, currently valued at approximately $X billion in 2025 (assuming a logical estimation based on the provided CAGR of >5% and a missing market size XX), is projected to experience robust growth throughout the forecast period (2025-2033). This expansion is driven by several key factors. Firstly, increasing government mandates and incentives promoting the use of renewable fuels are significantly impacting market adoption. Secondly, the burgeoning automotive and transportation sectors, striving to meet stringent emission regulations, are creating a substantial demand for bioethanol as a sustainable fuel alternative. Furthermore, expanding applications within the food and beverage, pharmaceutical, and cosmetics industries are further bolstering market growth. Sugarcane, corn, and wheat remain dominant feedstocks, although research into alternative feedstocks is opening new avenues for growth and diversification. The United States, as the largest market within North America, is expected to drive a significant portion of regional growth, fueled by its established infrastructure and substantial agricultural production. However, challenges such as feedstock price volatility and competition from other renewable energy sources present potential restraints.

North America Bio-ethanol Industry Market Size (In Billion)

Despite these potential headwinds, the long-term outlook remains positive. The industry's continued innovation in feedstock utilization and production efficiency, coupled with growing environmental consciousness and supportive government policies, points towards a sustained period of expansion. The North American bioethanol market is poised to benefit from ongoing technological advancements, particularly in cellulosic ethanol production, which promises to unlock even greater potential and improve sustainability. Companies like ADM, Green Plains Inc, and Poet LLC are expected to play key roles in shaping the market's future, driving further innovation and market penetration within both established and emerging applications. The diversification of feedstocks and applications will continue to be a critical factor in mitigating risks and ensuring long-term stability.

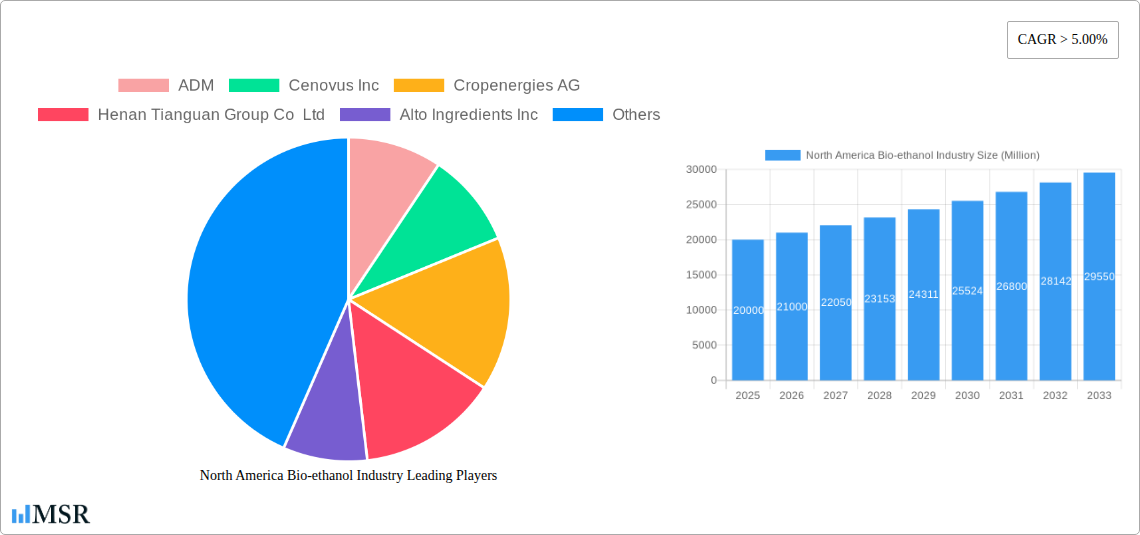

North America Bio-ethanol Industry Company Market Share

North America Bio-ethanol Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America bio-ethanol industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market. The report analyzes a market valued at xx Million in 2025, with a projected CAGR of xx% during the forecast period.

North America Bio-ethanol Industry Market Concentration & Dynamics

This section assesses the competitive landscape, regulatory environment, and market trends within the North American bio-ethanol industry. Market concentration is moderately high, with several major players holding significant market share. However, the presence of numerous smaller companies indicates a dynamic and competitive environment. Innovation is driven by ongoing research into more efficient production methods and new feedstock sources, such as cellulosic biomass. The regulatory framework, including government incentives and environmental regulations, significantly influences industry growth. Substitute products, such as gasoline and other biofuels, pose competitive challenges. End-user trends, particularly the increasing demand for sustainable transportation fuels, are key drivers of market growth. The industry has witnessed significant M&A activity in recent years, with xx major deals recorded between 2019 and 2024, reflecting consolidation and strategic expansion within the sector. Key metrics like market share and M&A deal counts are analyzed to provide a comprehensive overview of the industry's dynamics.

North America Bio-ethanol Industry Industry Insights & Trends

The North American bio-ethanol market demonstrates robust growth, driven primarily by increasing demand for renewable fuels, government support for biofuel mandates, and the growing awareness of environmental concerns. Technological advancements in fermentation processes, feedstock utilization, and byproduct valorization further contribute to market expansion. Shifting consumer preferences toward sustainable and environmentally friendly products are propelling the industry's growth. The market size is estimated at xx Million in 2025, exhibiting a significant rise from xx Million in 2019. The CAGR during this period is anticipated to be xx%. Emerging trends such as the integration of bio-refineries and the production of cellulosic ethanol are reshaping the industry landscape.

Key Markets & Segments Leading North America Bio-ethanol Industry

The dominant feedstock type in North America remains corn, accounting for xx% of the total production in 2025. However, sugarcane and other feedstocks, including wheat and agricultural residues, are gaining traction. The automotive and transportation sector remains the primary application for bio-ethanol, consuming xx% of the total production. The food and beverage industry is another significant consumer, followed by the pharmaceutical and cosmetic sectors, which utilize bio-ethanol as a solvent and ingredient.

Drivers for Dominant Segments:

- Corn: Abundant supply, established infrastructure, and government support.

- Automotive & Transportation: Stringent emission regulations and growing demand for renewable fuels.

North America Bio-ethanol Industry Product Developments

Significant product innovations have focused on enhancing ethanol production efficiency, reducing costs, and exploring new feedstock sources. Advancements in fermentation technology, enzyme development, and process optimization have improved yields and reduced energy consumption. The development of cellulosic ethanol, derived from non-food sources like agricultural residues, represents a major breakthrough in diversifying feedstocks and reducing reliance on food crops. These advancements provide a significant competitive edge, driving sustainable growth in the sector.

Challenges in the North America Bio-ethanol Industry Market

The North American bio-ethanol industry faces several challenges. These include fluctuating feedstock prices, competition from conventional fuels, and environmental concerns related to land use and water consumption. Regulatory uncertainties and evolving government policies also pose risks. Supply chain disruptions and increasing transportation costs can negatively impact production and profitability. The intensity of competition among established players and the emergence of new entrants also contribute to these challenges.

Forces Driving North America Bio-ethanol Industry Growth

Several factors are driving the growth of the North American bio-ethanol industry. Government policies promoting renewable fuels through tax credits and mandates are a major driver. Technological advancements in ethanol production efficiency and feedstock utilization are reducing costs and increasing competitiveness. Growing consumer awareness of environmental concerns and the demand for sustainable transportation solutions also fuel market expansion. Furthermore, the integration of bio-refineries, maximizing byproduct utilization and generating additional revenue streams, supports industry growth.

Long-Term Growth Catalysts in the North America Bio-ethanol Industry

Long-term growth will be fueled by continued technological innovations, strategic partnerships between industry players and research institutions, and expanding markets for bio-ethanol in new applications. The development of advanced biofuels, such as cellulosic ethanol and other bio-based chemicals, offers significant opportunities. Geographic expansions and partnerships to develop new markets, especially in developing economies, hold substantial potential for growth.

Emerging Opportunities in North America Bio-ethanol Industry

Emerging opportunities include the development of advanced biofuels, the expansion into new applications (e.g., bioplastics and bio-based chemicals), and the integration of bio-refineries with other renewable energy technologies. Growing demand for sustainable aviation fuel (SAF) represents a significant market opportunity. The use of waste streams as feedstocks offers the potential for increased sustainability and reduced reliance on food crops. Furthermore, the development of carbon capture and storage technologies could enhance the environmental profile of bio-ethanol.

Leading Players in the North America Bio-ethanol Industry Sector

- ADM

- Cenovus Inc

- Cropenergies AG

- Henan Tianguan Group Co Ltd

- Alto Ingredients Inc

- Green Plains Inc

- Suncor Energy Inc

- Valero

- Ethanol Technologies

- Verbio Vereinigte Bioenergie AG

- Abengoa

- Granbio Investimentos SA

- Sekab

- Blue Bio Fuels Inc

- Lantmannen

- Cristalco

- Poet LLC

- Jilin Fuel Ethanol Co Ltd

- Raizen

- KWST

Key Milestones in North America Bio-ethanol Industry Industry

- October 2021: ADM signed an agreement to sell its ethanol manufacturing plant in Peoria, Illinois, signaling a strategic shift in its dry mill ethanol assets.

- May 2022: VERBIO AG launched the first cellulosic RNG plant in the US, achieving 7 Million EGE of RNG annually by mid-summer and projecting 60 Million gallons of corn-based ethanol annually in 2023.

Strategic Outlook for North America Bio-ethanol Industry Market

The North American bio-ethanol industry is poised for continued growth, driven by increasing demand for renewable fuels, technological advancements, and supportive government policies. Strategic opportunities exist in the development of advanced biofuels, expansion into new markets, and the optimization of bio-refinery operations. Companies focusing on innovation, sustainability, and efficient production will be best positioned to capitalize on future growth opportunities. The market’s future potential is significant, and strategic investments in research, technology, and infrastructure will be crucial to achieving its full potential.

North America Bio-ethanol Industry Segmentation

-

1. Feedstock Type

- 1.1. Sugarcane

- 1.2. Corn

- 1.3. Wheat

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Food and Beverage

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

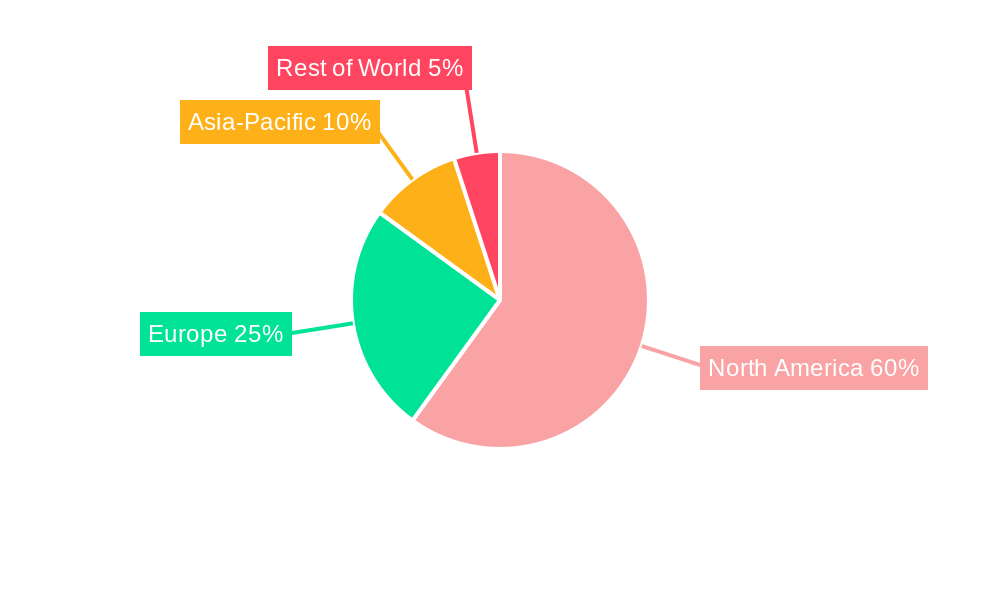

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Bio-ethanol Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Bio-ethanol Industry Regional Market Share

Geographic Coverage of North America Bio-ethanol Industry

North America Bio-ethanol Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels

- 3.3. Market Restrains

- 3.3.1. Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bio-ethanol Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 5.1.1. Sugarcane

- 5.1.2. Corn

- 5.1.3. Wheat

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6. United States North America Bio-ethanol Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6.1.1. Sugarcane

- 6.1.2. Corn

- 6.1.3. Wheat

- 6.1.4. Other Feedstocks

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive and Transportation

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7. Canada North America Bio-ethanol Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7.1.1. Sugarcane

- 7.1.2. Corn

- 7.1.3. Wheat

- 7.1.4. Other Feedstocks

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive and Transportation

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8. Mexico North America Bio-ethanol Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8.1.1. Sugarcane

- 8.1.2. Corn

- 8.1.3. Wheat

- 8.1.4. Other Feedstocks

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive and Transportation

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ADM

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cenovus Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Cropenergies AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Henan Tianguan Group Co Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Alto Ingredients Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Green Plains Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Suncor Energy Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Valero

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ethanol Technologies

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Verbio Vereinigte Bioenergie AG*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Abengoa

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Granbio Investimentos SA

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Sekab

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Blue Bio Fuels Inc

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Lantmannen

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Cristalco

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Poet LLC

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 Jilin Fuel Ethanol Co Ltd

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 Raizen

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 KWST

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.1 ADM

List of Figures

- Figure 1: North America Bio-ethanol Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Bio-ethanol Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2020 & 2033

- Table 2: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Bio-ethanol Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2020 & 2033

- Table 6: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2020 & 2033

- Table 10: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2020 & 2033

- Table 14: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bio-ethanol Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the North America Bio-ethanol Industry?

Key companies in the market include ADM, Cenovus Inc, Cropenergies AG, Henan Tianguan Group Co Ltd, Alto Ingredients Inc, Green Plains Inc, Suncor Energy Inc, Valero, Ethanol Technologies, Verbio Vereinigte Bioenergie AG*List Not Exhaustive, Abengoa, Granbio Investimentos SA, Sekab, Blue Bio Fuels Inc, Lantmannen, Cristalco, Poet LLC, Jilin Fuel Ethanol Co Ltd, Raizen, KWST.

3. What are the main segments of the North America Bio-ethanol Industry?

The market segments include Feedstock Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels.

6. What are the notable trends driving market growth?

Automotive and Transportation Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol.

8. Can you provide examples of recent developments in the market?

May 2022: VERBIO AG opened the first cellulosic RNG plant in the United States, achieving full-scale production of 7 million ethanol gallons equivalent (EGE) of RNG annually by mid-summer 2022. In 2023, this project is expected to start functioning as a biorefinery, producing 60 million gallons of corn-based ethanol annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bio-ethanol Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bio-ethanol Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bio-ethanol Industry?

To stay informed about further developments, trends, and reports in the North America Bio-ethanol Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence