Key Insights

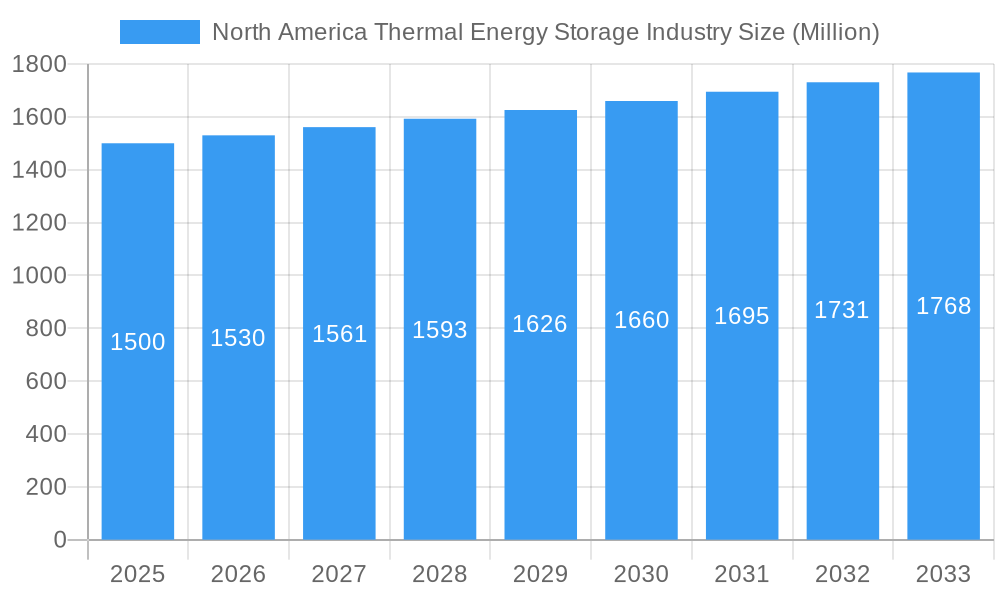

The North American Thermal Energy Storage (TES) market, estimated at $4.72 billion in 2025, is poised for substantial expansion. Projecting a Compound Annual Growth Rate (CAGR) of 7.21%, the market is set to grow significantly through 2033. This growth is primarily driven by the imperative to integrate intermittent renewable energy sources and the increasing demand for enhanced energy efficiency. The widespread adoption of solar and wind power necessitates robust TES solutions for grid stability and reliability. Additionally, government mandates supporting energy independence and carbon emission reduction are stimulating investment in TES technologies.

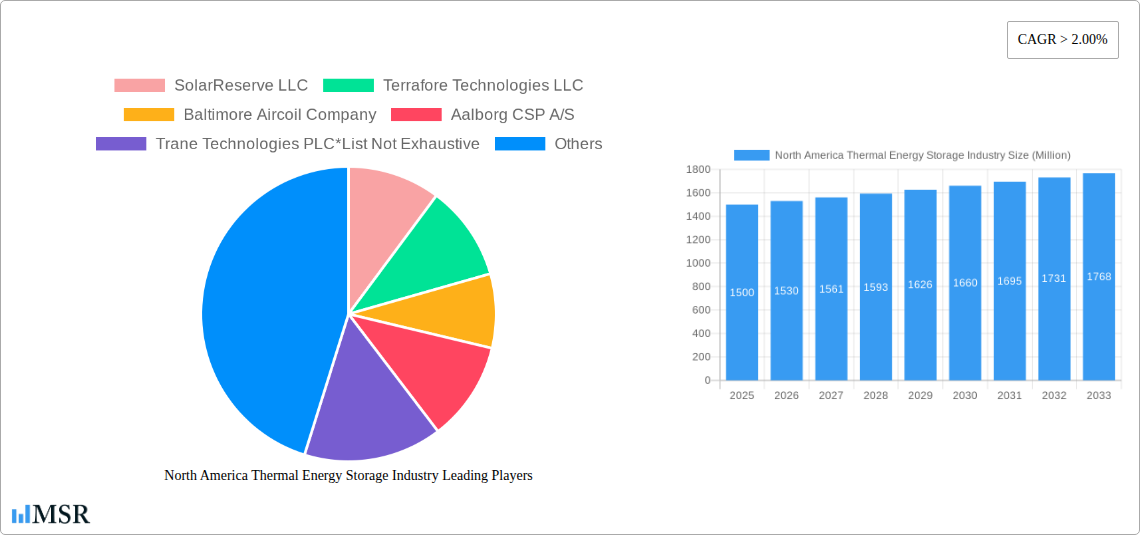

North America Thermal Energy Storage Industry Market Size (In Billion)

The market is segmented by storage type, including molten salt, chilled water, heat, and ice. Key applications span power generation and heating & cooling. Within technology, sensible heat storage, latent heat storage, and thermochemical heat storage are prominent. The power generation sector exhibits particularly strong growth, fueled by utility-scale projects leveraging TES to optimize dispatch capabilities and decrease reliance on fossil fuels.

North America Thermal Energy Storage Industry Company Market Share

While significant upfront capital investment presents a challenge, ongoing technological advancements and declining storage costs are expected to enhance the economic viability of TES across a broader spectrum of applications.

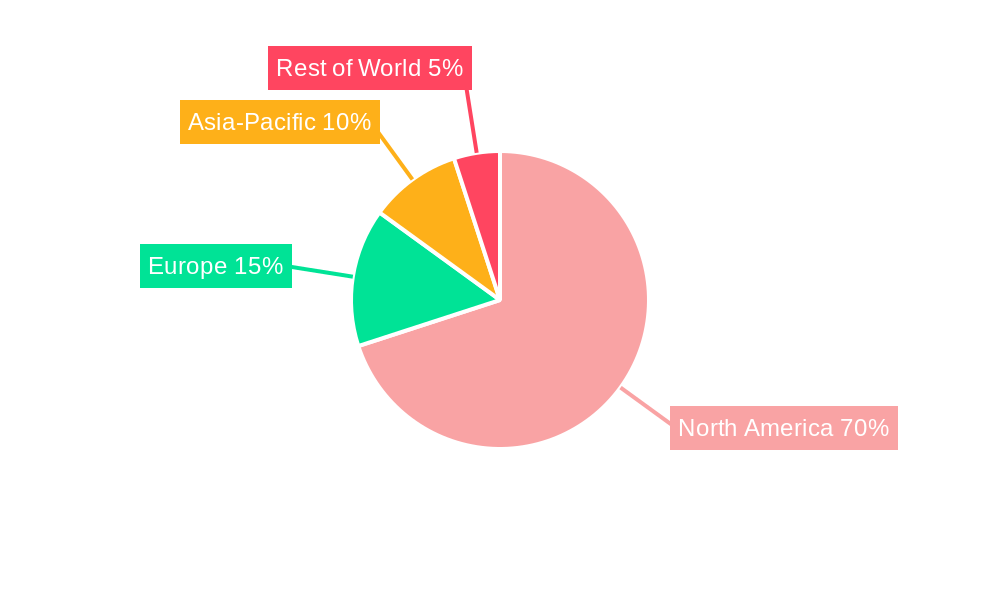

The United States leads the North American TES market, followed by Canada and Mexico. This regional dominance is attributed to substantial investments in renewable energy infrastructure and supportive governmental policies within the US. Advancements in latent heat storage technology are anticipated to gain momentum due to their superior energy density compared to sensible heat storage.

A competitive landscape, featuring established entities such as SolarReserve LLC, Terrafore Technologies LLC, and Trane Technologies PLC, alongside emerging innovative companies, is a key catalyst for market expansion and technological progress. This dynamic ecosystem fosters continuous innovation and cost optimization within the North American TES market.

North America Thermal Energy Storage Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the North America thermal energy storage industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The North American thermal energy storage market is poised for significant expansion, driven by factors such as increasing renewable energy adoption, stringent environmental regulations, and advancements in storage technologies. This report unveils the potential of this burgeoning market and identifies key opportunities for strategic investment and growth.

North America Thermal Energy Storage Industry Market Concentration & Dynamics

The North American thermal energy storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is dynamic, characterized by ongoing innovation, mergers and acquisitions (M&A) activity, and evolving regulatory frameworks. The market share of the top five players in 2025 is estimated at xx%, indicating room for growth and competition amongst smaller players. Innovation ecosystems are developing rapidly, driven by government incentives and private investment in research and development of next-generation storage solutions.

- Market Concentration: The top 5 companies hold an estimated xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals were recorded in the historical period (2019-2024), signaling consolidation within the industry.

- Regulatory Landscape: Government regulations promoting renewable energy integration and energy efficiency are key drivers, influencing technology adoption and market growth. However, navigating varying state and federal regulations presents a challenge for market participants.

- Substitute Products: Competition exists from other energy storage technologies, such as batteries, but thermal storage offers unique advantages in certain applications (e.g., concentrated solar power).

- End-User Trends: Increasing demand for reliable and cost-effective energy solutions, particularly in industrial settings and renewable energy projects, is driving growth.

North America Thermal Energy Storage Industry Industry Insights & Trends

The North America thermal energy storage market is experiencing robust growth, driven by a confluence of factors. The market size in 2025 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by the increasing adoption of renewable energy sources, necessitating efficient energy storage solutions. Technological advancements, including improvements in material science and control systems, are continuously enhancing the performance and cost-effectiveness of thermal energy storage systems. Furthermore, evolving consumer behaviors, marked by a growing awareness of environmental sustainability, are propelling demand for cleaner energy solutions. The rising need for grid stabilization and peak demand management is also contributing to the market's expansion. Specific technological disruptions include the development of advanced phase-change materials and innovative thermal storage designs that optimize performance across various applications.

Key Markets & Segments Leading North America Thermal Energy Storage Industry

The dominant segments within the North American thermal energy storage market vary by application and technology. While the precise market share of each segment is complex and data-driven, this report will provide insights based on available data and industry expertise.

By Type:

- Molten Salt: This segment is experiencing significant growth, driven by its suitability for high-temperature applications, particularly in concentrated solar power (CSP) plants.

- Chilled Water: This technology is widely used in building cooling applications, benefiting from established infrastructure and ease of integration.

- Heat: Heat storage is crucial for industrial processes and district heating systems, showcasing ongoing demand.

- Ice: Ice thermal storage plays a key role in air conditioning and peak-shaving strategies.

- Others: This category encompasses emerging technologies and niche applications.

By Application:

- Power Generation: The integration of thermal storage in renewable energy projects significantly boosts grid stability and reliability.

- Heating & Cooling: Thermal energy storage is increasingly adopted in buildings and industrial facilities to optimize energy consumption.

By Technology:

- Sensible Heat Storage: This technology remains dominant, benefiting from its relative maturity and cost-effectiveness.

- Latent Heat Storage: This is an emerging technology offering higher energy density, leading to research and development activity.

- Thermochemical Heat Storage: This technology holds long-term potential but faces challenges in terms of cost and commercial maturity.

Regional Dominance: The Southwest and California are key regions driving market growth due to high solar irradiance and supportive renewable energy policies. States with substantial renewable energy targets are showing accelerated growth in thermal energy storage deployment.

North America Thermal Energy Storage Industry Product Developments

Recent product developments focus on increasing efficiency, lowering costs, and expanding application versatility. Advancements include the development of novel phase-change materials, improved insulation technologies, and more sophisticated control systems. These innovations are enhancing the performance and competitiveness of thermal energy storage systems, broadening their appeal across various sectors. For instance, the development of more efficient molten salt systems is improving cost competitiveness in power generation applications.

Challenges in the North America Thermal Energy Storage Industry Market

The North American thermal energy storage market faces challenges including high upfront capital costs, the need for specialized infrastructure, and the variability of regulatory landscapes across different regions. Supply chain constraints for certain materials can also impact project timelines and costs. Competition from other energy storage technologies, such as batteries, further influences market dynamics. The cumulative effect of these challenges may temporarily impede market growth in specific niches.

Forces Driving North America Thermal Energy Storage Industry Growth

Several factors contribute to the growth of this sector, including increasing demand for renewable energy integration, stringent environmental regulations that favor energy efficiency and carbon reduction, and government incentives aimed at promoting renewable energy adoption and grid modernization. Technological advancements, such as improved materials and control systems, are also driving down costs and increasing the efficiency of thermal energy storage systems. The growing need for grid stability and peak load management significantly adds to the positive growth trajectory.

Long-Term Growth Catalysts in the North America Thermal Energy Storage Industry

Long-term growth will be fueled by continued innovation, strategic partnerships between technology providers and energy companies, and the expansion of thermal energy storage applications into new markets such as transportation and industrial processes. The development of more cost-effective and scalable thermal storage systems, combined with supportive policy frameworks and growing customer demand, will drive sustained growth.

Emerging Opportunities in North America Thermal Energy Storage Industry

Emerging opportunities exist in the integration of thermal storage with other renewable energy technologies (e.g., geothermal), the development of hybrid energy storage systems combining thermal and battery storage, and the expansion into niche markets such as cold chain logistics and process heating in industrial settings. Exploring novel applications for waste heat recovery using thermal storage also represents significant potential.

Leading Players in the North America Thermal Energy Storage Industry Sector

- SolarReserve LLC

- Terrafore Technologies LLC

- Baltimore Aircoil Company

- Aalborg CSP A/S

- Trane Technologies PLC

- SaltX Technology Holding AB

- Abengoa SA

- Burns & McDonnell

- BrightSource Energy Inc

Key Milestones in North America Thermal Energy Storage Industry Industry

- 2020: Significant policy changes in several states incentivize thermal storage deployments.

- 2021: Launch of a major new molten salt thermal storage project in California.

- 2022: Several M&A deals reshape the competitive landscape.

- 2023: Introduction of a new, more efficient chilled water storage technology.

- 2024: Increased investment in research and development for advanced materials and systems.

Strategic Outlook for North America Thermal Energy Storage Industry Market

The North American thermal energy storage market is poised for considerable growth, driven by strong underlying market forces. Continued technological advancements, supportive policy frameworks, and increasing environmental awareness will drive demand. Strategic opportunities exist for companies to capitalize on this growth through innovation, strategic partnerships, and expansion into emerging market segments. The long-term outlook for this sector remains extremely positive.

North America Thermal Energy Storage Industry Segmentation

-

1. Type

- 1.1. Molten Salt

- 1.2. Chilled Water

- 1.3. Heat

- 1.4. Ice

- 1.5. Others

-

2. Application

- 2.1. Power Generation

- 2.2. Heating & Cooling

-

3. Technology

- 3.1. Sensible Heat Storage

- 3.2. Latent Heat Storage

- 3.3. Thermochemical Heat Storage

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Thermal Energy Storage Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of North America Thermal Energy Storage Industry

North America Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities

- 3.3. Market Restrains

- 3.3.1. 4.; Rising adoption of cleaner alternatives

- 3.4. Market Trends

- 3.4.1. Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Molten Salt

- 5.1.2. Chilled Water

- 5.1.3. Heat

- 5.1.4. Ice

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation

- 5.2.2. Heating & Cooling

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Sensible Heat Storage

- 5.3.2. Latent Heat Storage

- 5.3.3. Thermochemical Heat Storage

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Molten Salt

- 6.1.2. Chilled Water

- 6.1.3. Heat

- 6.1.4. Ice

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation

- 6.2.2. Heating & Cooling

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Sensible Heat Storage

- 6.3.2. Latent Heat Storage

- 6.3.3. Thermochemical Heat Storage

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Molten Salt

- 7.1.2. Chilled Water

- 7.1.3. Heat

- 7.1.4. Ice

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation

- 7.2.2. Heating & Cooling

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Sensible Heat Storage

- 7.3.2. Latent Heat Storage

- 7.3.3. Thermochemical Heat Storage

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Molten Salt

- 8.1.2. Chilled Water

- 8.1.3. Heat

- 8.1.4. Ice

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation

- 8.2.2. Heating & Cooling

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Sensible Heat Storage

- 8.3.2. Latent Heat Storage

- 8.3.3. Thermochemical Heat Storage

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SolarReserve LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Terrafore Technologies LLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Baltimore Aircoil Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Aalborg CSP A/S

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Trane Technologies PLC*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SaltX Technology Holding AB

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Abengoa SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Burns & McDonnell

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BrightSource Energy Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SolarReserve LLC

List of Figures

- Figure 1: North America Thermal Energy Storage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Thermal Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Thermal Energy Storage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Thermal Energy Storage Industry?

The projected CAGR is approximately 7.21%.

2. Which companies are prominent players in the North America Thermal Energy Storage Industry?

Key companies in the market include SolarReserve LLC, Terrafore Technologies LLC, Baltimore Aircoil Company, Aalborg CSP A/S, Trane Technologies PLC*List Not Exhaustive, SaltX Technology Holding AB, Abengoa SA, Burns & McDonnell, BrightSource Energy Inc.

3. What are the main segments of the North America Thermal Energy Storage Industry?

The market segments include Type, Application, Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.72 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities.

6. What are the notable trends driving market growth?

Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising adoption of cleaner alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the North America Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence