Key Insights

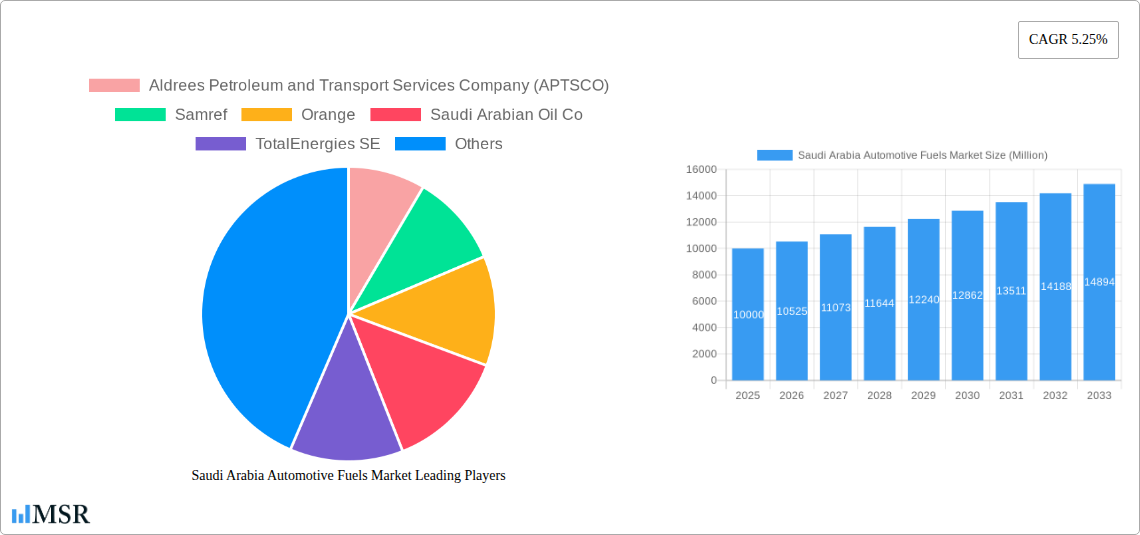

The Saudi Arabian automotive fuels market, valued at $13.23 million in 2024, is projected for significant expansion with a Compound Annual Growth Rate (CAGR) of 7.5% from 2024 to 2033. This growth is underpinned by a rapidly expanding automotive sector, driven by population increase and rising consumer spending. Government initiatives, including extensive infrastructure development aligned with Vision 2030, further bolster fuel demand. The continued dominance of gasoline and diesel vehicles, despite evolving energy trends, also sustains market momentum. Key challenges include the volatility of global crude oil prices and the national push for energy diversification and sustainable transport solutions. Gasoline and diesel remain the primary fuel segments, with competitive dynamics shaped by major stakeholders like Saudi Aramco and TotalEnergies, alongside regional distributors.

Saudi Arabia Automotive Fuels Market Market Size (In Million)

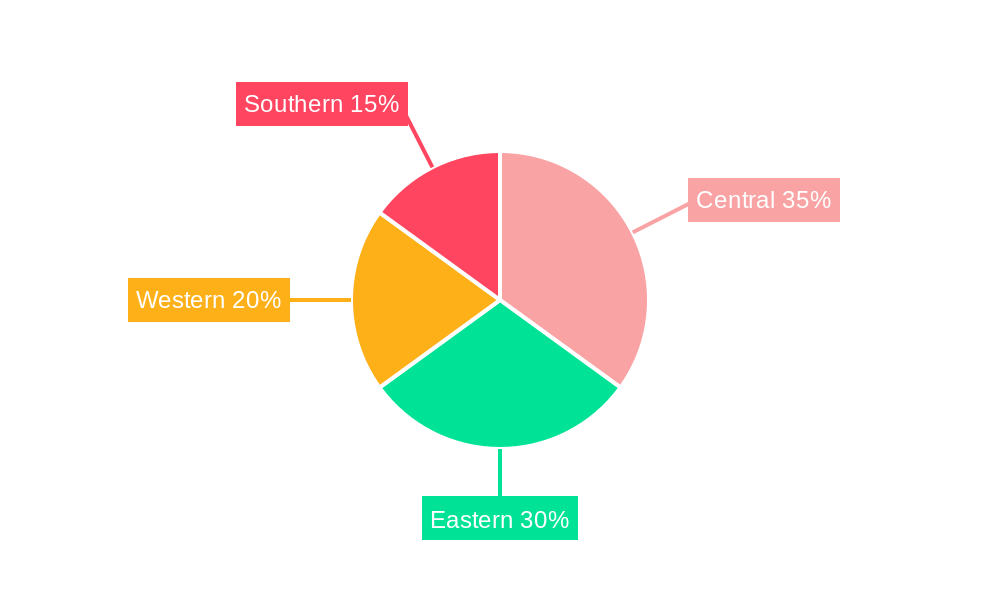

Consumption patterns are expected to vary regionally, with higher demand concentrated in the Central and Eastern regions due to population density, contrasting with lower consumption in the Western and Southern areas. This necessitates tailored market strategies for industry participants. The historical period (2019-2024) likely experienced more moderate growth, influenced by global economic conditions and the nascent stages of Vision 2030. Future market performance will be shaped by the advancement of Vision 2030's transport goals, global energy market shifts, and the integration of electric vehicles and alternative fuels in the Kingdom. Strategic insights into these factors are vital for market success and investment.

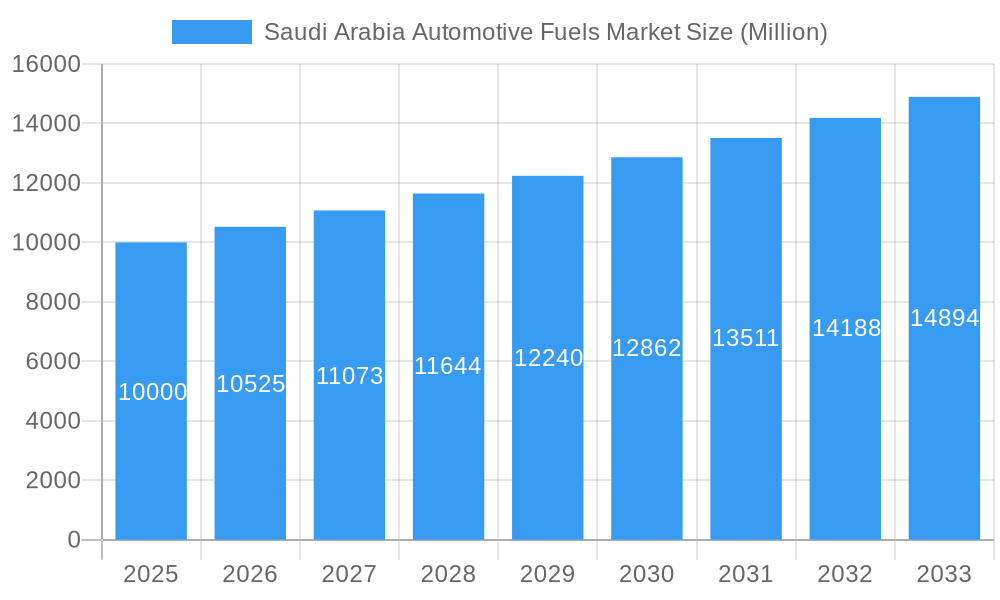

Saudi Arabia Automotive Fuels Market Company Market Share

Saudi Arabia Automotive Fuels Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia Automotive Fuels Market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, key trends, and future growth prospects. The analysis incorporates data on fuel types (Gasoline, PG95 Premium Grade Gasoline, Diesel) and leading players including Aldrees Petroleum and Transport Services Company (APTSCO), Samref, Orange, Saudi Arabian Oil Co, TotalEnergies SE, NAFT Services Company Limited, Liter Group, Arabian Petroleum Supply Company, Al-Dabbagh Group, and Alitco Group. The report leverages extensive data and analysis to forecast market size and CAGR, providing actionable intelligence for navigating this dynamic sector.

Saudi Arabia Automotive Fuels Market Market Concentration & Dynamics

This section analyzes the competitive landscape, regulatory environment, and market forces shaping the Saudi Arabia Automotive Fuels Market. The market demonstrates a moderately concentrated structure with a few dominant players holding significant market share. However, the presence of numerous smaller players contributes to competitive intensity.

- Market Concentration: The top five players account for approximately xx% of the total market share in 2025 (Estimated Year).

- Innovation Ecosystems: Government initiatives and investments in renewable energy are fostering innovation in alternative fuels, potentially disrupting the traditional automotive fuels market.

- Regulatory Frameworks: Stringent environmental regulations and fuel quality standards are driving the adoption of cleaner fuels and impacting market dynamics.

- Substitute Products: The emergence of electric vehicles (EVs) and hybrid vehicles poses a long-term threat to the traditional automotive fuels market, although penetration remains relatively low in 2025.

- End-User Trends: Rising vehicle ownership and increasing urbanization are driving fuel demand, particularly in major cities. However, shifting consumer preferences towards fuel-efficient vehicles and alternative transportation options represent a notable challenge.

- M&A Activities: The historical period (2019-2024) witnessed xx M&A deals in the Saudi Arabia Automotive Fuels Market. This activity is expected to remain moderate in the forecast period (2025-2033), primarily driven by strategic consolidation among existing players.

Saudi Arabia Automotive Fuels Market Industry Insights & Trends

The Saudi Arabia Automotive Fuels Market exhibits significant growth potential driven by various factors. The market size was valued at approximately xx Million in 2025 (Estimated Year) and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Several key trends are shaping market growth:

- Government Policies: Government investments in infrastructure development and initiatives to promote sustainable transportation are significantly influencing market dynamics.

- Economic Growth: Sustained economic growth in Saudi Arabia fuels increasing demand for personal and commercial vehicles, directly impacting fuel consumption.

- Technological Disruptions: The introduction of advanced fuel technologies and the development of biofuels are expected to alter the market landscape.

- Consumer Behavior: Changing consumer preferences towards fuel-efficient vehicles and environmentally friendly fuels are shaping the demand for specific fuel types.

- Geopolitical Factors: Global geopolitical events and fluctuations in crude oil prices significantly influence the cost and availability of automotive fuels.

Key Markets & Segments Leading Saudi Arabia Automotive Fuels Market

The gasoline segment holds the largest market share among automotive fuel types in Saudi Arabia, followed by diesel and PG95 Premium Grade Gasoline.

- Gasoline: This segment dominates due to its widespread use in passenger vehicles and its established distribution network. Drivers include:

- High vehicle ownership rates in urban areas.

- Robust economic growth driving vehicle sales.

- Well-established refueling infrastructure.

- Diesel: The diesel segment shows strong growth, fueled by the increasing demand from the transportation sector, including heavy-duty vehicles and commercial fleets.

- PG95 Premium Grade Gasoline: This segment shows steady growth driven by high-income consumers seeking enhanced vehicle performance.

The dominance of gasoline is further strengthened by the extensive network of petrol stations across the country, ensuring accessibility for consumers.

Saudi Arabia Automotive Fuels Market Product Developments

Significant advancements in fuel technology include the development of cleaner-burning gasoline blends to meet increasingly stringent environmental standards. Companies are also exploring the potential of biofuels and alternative fuels to diversify their product portfolio and improve sustainability. This focus on product innovation enhances competitiveness and addresses evolving consumer and regulatory demands.

Challenges in the Saudi Arabia Automotive Fuels Market Market

Challenges include fluctuating crude oil prices impacting fuel costs and profitability. Supply chain vulnerabilities related to global events and geopolitical instability also pose risks. Furthermore, the rising adoption of electric vehicles presents a significant long-term competitive pressure on the traditional automotive fuels market. The government's commitment to renewable energy may also disrupt the market's traditional structure. These factors collectively impact market growth and necessitate strategic adaptations by industry players.

Forces Driving Saudi Arabia Automotive Fuels Market Growth

Key growth drivers include rising vehicle ownership, expanding infrastructure, and increasing government investments in transportation sectors. Government initiatives promoting sustainable transportation, while presenting challenges, also create opportunities for innovative fuel solutions. Furthermore, economic growth and urbanization contribute substantially to the demand for automotive fuels.

Long-Term Growth Catalysts in the Saudi Arabia Automotive Fuels Market

Long-term growth hinges on strategic partnerships fostering innovation in alternative fuels, such as biofuels and hydrogen. Government initiatives supporting the development and adoption of cleaner fuels will be crucial. Moreover, expanding into new markets and diversifying fuel offerings, including premium grades, will contribute significantly to market expansion in the long term.

Emerging Opportunities in Saudi Arabia Automotive Fuels Market

Opportunities exist in developing and implementing sustainable fuel solutions to meet environmental targets. The growth of the commercial fleet and heavy-duty vehicle segments presents significant potential. Furthermore, exploring partnerships for the introduction of advanced fuel technologies, such as biofuels and hydrogen, will open new avenues for growth. Finally, catering to the rising demand for premium fuel grades by high-income consumers also represents a promising opportunity.

Leading Players in the Saudi Arabia Automotive Fuels Market Sector

- Aldrees Petroleum and Transport Services Company (APTSCO)

- Samref

- Orange

- Saudi Arabian Oil Co (Aramco)

- TotalEnergies SE

- NAFT Services Company Limited

- Liter Group

- Arabian Petroleum Supply Company

- Al-Dabbagh Group

- Alitco Group

Key Milestones in Saudi Arabia Automotive Fuels Market Industry

- July 2023: Saudi Arabia's fuel oil imports from Russia hit a record high of 193,000 barrels per day (bpd), driven by reduced crude oil production and increased summer electricity demand. This highlights the Kingdom's reliance on imported fuel and the impact of global energy dynamics.

- March 2023: A collaboration agreement between Saudi Arabia's national oil producer, Geely Automobile Holdings, and Renault SA for developing gasoline, alternative fuel, and hybrid engine technologies signifies a significant move toward diversifying the automotive fuel landscape and embracing technological advancements.

Strategic Outlook for Saudi Arabia Automotive Fuels Market Market

The Saudi Arabia Automotive Fuels Market is poised for continued growth, driven by a combination of factors including rising vehicle ownership, infrastructure development, and ongoing government support for the transportation sector. Strategic opportunities lie in embracing sustainable fuel technologies, leveraging partnerships for innovation, and capitalizing on the growing demand for premium fuel grades. Companies should focus on adapting to evolving consumer preferences and regulatory pressures to ensure long-term success.

Saudi Arabia Automotive Fuels Market Segmentation

-

1. Fuel Type

-

1.1. Gasoline

- 1.1.1. PG91 Regular Grade Gasoline

- 1.1.2. PG95 Premium Grade Gasoline

- 1.2. Diesel

-

1.1. Gasoline

Saudi Arabia Automotive Fuels Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Automotive Fuels Market Regional Market Share

Geographic Coverage of Saudi Arabia Automotive Fuels Market

Saudi Arabia Automotive Fuels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Automotive Sales in Saudi Arabia to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Automotive Fuels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Gasoline

- 5.1.1.1. PG91 Regular Grade Gasoline

- 5.1.1.2. PG95 Premium Grade Gasoline

- 5.1.2. Diesel

- 5.1.1. Gasoline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samref

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saudi Arabian Oil Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NAFT Services Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Liter Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arabian Petroleum Supply Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Dabbagh Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alitco Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

List of Figures

- Figure 1: Saudi Arabia Automotive Fuels Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Automotive Fuels Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 2: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Fuel Type 2020 & 2033

- Table 3: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 6: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Fuel Type 2020 & 2033

- Table 7: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Automotive Fuels Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Saudi Arabia Automotive Fuels Market?

Key companies in the market include Aldrees Petroleum and Transport Services Company (APTSCO), Samref, Orange, Saudi Arabian Oil Co, TotalEnergies SE, NAFT Services Company Limited, Liter Group, Arabian Petroleum Supply Company, Al-Dabbagh Group, Alitco Group.

3. What are the main segments of the Saudi Arabia Automotive Fuels Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.23 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Increasing Automotive Sales in Saudi Arabia to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

Jul 2023: Saudi Arabia reached a new high in fuel oil imports from Russia, amounting to 193,000 barrels per day (bpd). Fuel oil demand is being driven by the Kingdom's reduction in crude oil production as well as an anticipated increase in summertime electricity consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Automotive Fuels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Automotive Fuels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Automotive Fuels Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Automotive Fuels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence