Key Insights

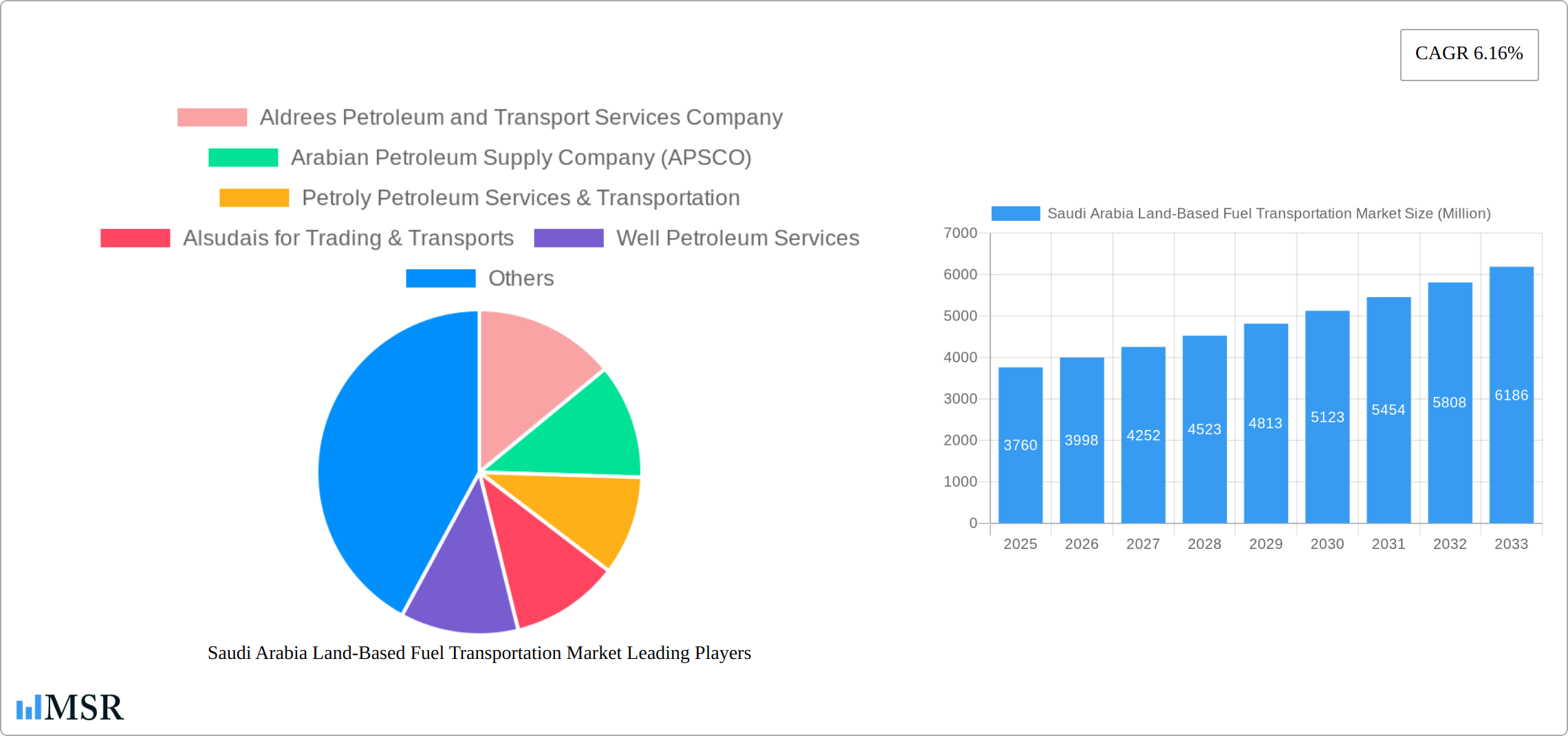

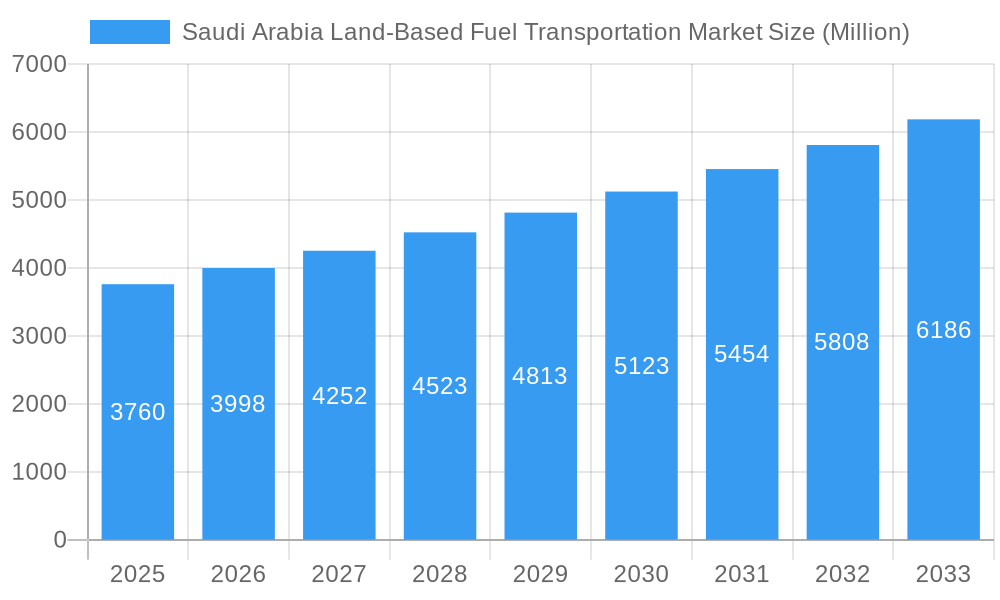

The Saudi Arabia land-based fuel transportation market, valued at $3.76 billion in 2025, is projected to experience robust growth, driven by the nation's expanding energy sector and increasing fuel consumption. A compound annual growth rate (CAGR) of 6.16% from 2025 to 2033 indicates a significant market expansion. This growth is fueled by several factors, including large-scale infrastructure projects, rising urbanization leading to increased fuel demand in transportation, and government initiatives promoting economic diversification, all contributing to higher fuel transportation needs. Key players like Aldrees Petroleum, APSCO, and Petroly Petroleum Services are leveraging technological advancements to enhance efficiency and safety in their operations, adopting strategies such as optimized routing, improved fleet management, and the use of specialized fuel tankers. The market is segmented by fuel type (gasoline, diesel, etc.), transportation mode (tanker trucks, rail), and geographical region, offering diverse opportunities for market participants. Competitive pressures are driving innovation and investment in safer, more efficient, and environmentally friendly fuel transportation solutions.

Saudi Arabia Land-Based Fuel Transportation Market Market Size (In Billion)

Despite the positive outlook, challenges exist. These include fluctuating oil prices impacting fuel transport costs, stringent government regulations regarding safety and environmental standards, and the need for continuous investment in infrastructure to support the growing volume of fuel transportation. The market is anticipated to witness consolidation, with larger players potentially acquiring smaller firms to gain market share and enhance operational capabilities. Further, the adoption of sustainable practices in fuel transportation, such as using alternative fuels and promoting environmentally friendly logistics solutions, will influence market trends in the coming years. This will see increased demand for companies specializing in the logistics of renewable energy sources, in line with Saudi Arabia’s Vision 2030.

Saudi Arabia Land-Based Fuel Transportation Market Company Market Share

Saudi Arabia Land-Based Fuel Transportation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia land-based fuel transportation market, covering the period 2019-2033. It offers crucial insights into market dynamics, growth drivers, key players, and future opportunities, equipping stakeholders with the knowledge needed to navigate this dynamic sector. The report utilizes data from the base year 2025 and forecasts up to 2033, incorporating historical data from 2019-2024. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Saudi Arabia Land-Based Fuel Transportation Market Market Concentration & Dynamics

The Saudi Arabia land-based fuel transportation market is characterized by a moderately concentrated competitive landscape. A select group of prominent companies holds a substantial share, with the top 5 players accounting for approximately xx% of the market in 2024. The remaining market share is fragmented among a multitude of smaller operators. Innovation within the sector is predominantly driven by advancements in fleet management technologies, the implementation of fuel efficiency measures, and the continuous enhancement of safety standards. The regulatory environment is dynamic, with a strong emphasis on bolstering safety protocols, ensuring environmental protection, and optimizing logistics operations. While alternative transportation methods such as pipelines exist, their application is often restricted by geographical limitations. End-user preferences are shifting towards dependable and cost-effective transportation solutions. Furthermore, the sector has observed a notable trend of consolidation, with xx Mergers & Acquisitions (M&A) deals recorded over the past five years, underscoring a drive towards increased market efficiency and synergy.

- Market Concentration: The top 5 key players collectively hold approximately xx% of the overall market share as of 2024.

- Innovation Focus: Key areas of innovation include advanced fleet management systems, strategies for improving fuel efficiency, and the integration of cutting-edge safety technologies.

- Regulatory Framework: The governing regulations are actively evolving, with a primary focus on stringent safety measures, environmental sustainability, and the efficient organization of logistics.

- Substitute Products: Alternative transportation methods, primarily pipelines, are available but their reach is constrained by the specific geographical characteristics of the region.

- End-User Trends: A growing demand for transportation solutions that are both reliable and economically viable is evident among end-users.

- M&A Activity: The market has witnessed xx M&A deals within the last five years, signifying a trend towards market consolidation.

Saudi Arabia Land-Based Fuel Transportation Market Industry Insights & Trends

The Saudi Arabian land-based fuel transportation market is experiencing robust growth, driven by several key factors. The expanding oil and gas sector, coupled with increased domestic consumption and infrastructure development projects, is fueling demand for efficient fuel transportation. Technological advancements, including the adoption of GPS tracking, telematics, and advanced safety features, are enhancing operational efficiency and reducing costs. Evolving consumer behaviors, including rising environmental awareness, are also driving demand for cleaner and more sustainable transportation solutions. The market size is estimated at xx Million in 2025, demonstrating significant growth from xx Million in 2019. This substantial growth is projected to continue, with a CAGR of xx% anticipated from 2025 to 2033. The increasing adoption of fuel-efficient vehicles and optimization of transportation routes further contribute to this expansion. Government initiatives aimed at diversifying the economy and modernizing the logistics sector also play a significant role.

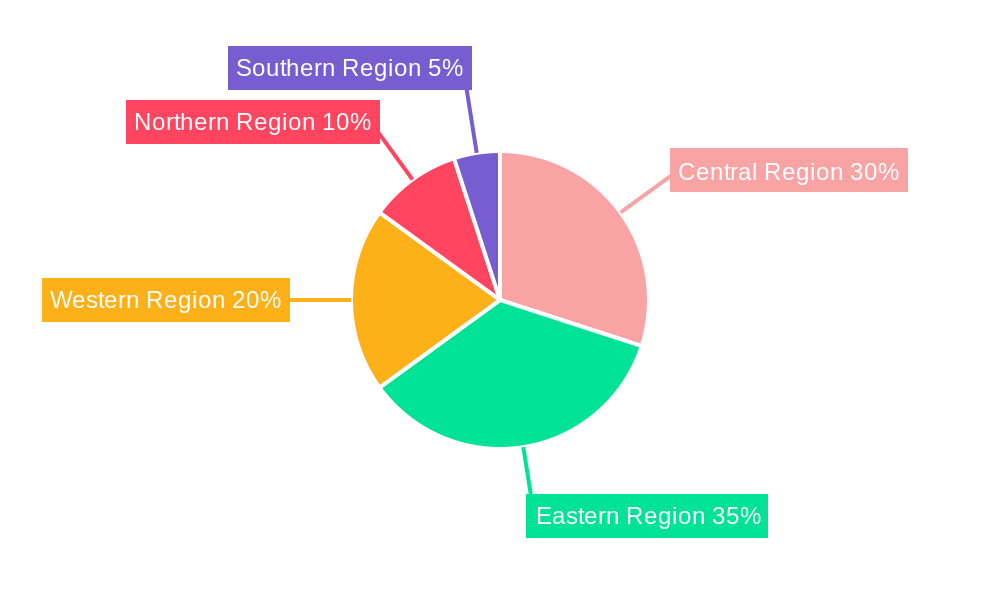

Key Markets & Segments Leading Saudi Arabia Land-Based Fuel Transportation Market

The Eastern Province stands out as the preeminent region within the Saudi Arabia land-based fuel transportation market. This dominance is directly attributable to the region's dense concentration of energy infrastructure, including refineries, petrochemical plants, and extensive oil fields. These critical industrial assets necessitate substantial and consistent fuel transportation services, thereby positioning the Eastern Province as the primary hub for such activities.

- Factors Driving Eastern Province's Leadership:

- A high density of refineries, petrochemical facilities, and operational oil fields.

- Significant industrial output and a well-established energy infrastructure.

- Strategic proximity to major seaports and vital transportation networks.

- In-depth Regional Dominance Analysis: The robust industrial ecosystem and strategically advantageous infrastructure within the Eastern Province create an exceptionally high demand for efficient and dependable fuel transportation services. This sustained demand directly translates into a commanding market share for the businesses operating within this key geographical area.

Saudi Arabia Land-Based Fuel Transportation Market Product Developments

Recent advancements in product development within the Saudi Arabia land-based fuel transportation market have primarily concentrated on enhancing fuel efficiency, bolstering safety features in vehicles and operations, and integrating sophisticated technologies such as telematics and advanced GPS tracking systems. These innovations are strategically designed to streamline logistics, reduce operational expenditures, and ensure strict adherence to increasingly rigorous safety regulations. The market relevance of these developments is significant, as they directly address critical industry challenges and contribute to a more efficient and sustainable fuel transportation ecosystem.

Challenges in the Saudi Arabia Land-Based Fuel Transportation Market Market

The market faces challenges including stringent regulatory compliance requirements, potential supply chain disruptions, and intense competition among established and emerging players. These factors can impact operational costs and profitability. The fluctuating global fuel prices further add complexity to the market's dynamic.

Forces Driving Saudi Arabia Land-Based Fuel Transportation Market Growth

The expansion of the oil and gas sector, coupled with rising domestic fuel consumption, plays a pivotal role in driving market growth. Additionally, ongoing infrastructure development projects and supportive government initiatives aimed at fostering economic diversification and improving logistical capabilities are significant contributing factors to the market's upward trajectory.

Long-Term Growth Catalysts in the Saudi Arabia Land-Based Fuel Transportation Market

Long-term growth will be propelled by continuous technological advancements in fleet management, the adoption of alternative fuels, strategic partnerships between transportation companies and energy producers, and expansion into new geographic markets.

Emerging Opportunities in Saudi Arabia Land-Based Fuel Transportation Market

Emerging opportunities lie in the adoption of sustainable and environmentally friendly transportation solutions, such as electric or hybrid vehicles, as well as the integration of advanced technologies like AI and machine learning for improved route optimization and predictive maintenance.

Leading Players in the Saudi Arabia Land-Based Fuel Transportation Market Sector

- Aldrees Petroleum and Transport Services Company

- Arabian Petroleum Supply Company (APSCO)

- Petroly Petroleum Services & Transportation

- Alsudais for Trading & Transports

- Well Petroleum Services

- Alayed Group

- M S Al-meshri & Bros Co

- Abed Abdulrahman Al Sobhi & Sons Ltd Co

- Al-deyabi Group

- Flsarabia (Fuel Logistics Services EST)

- List Not Exhaustive

Key Milestones in Saudi Arabia Land-Based Fuel Transportation Market Industry

- August 2024: Arrival of 100 advanced oil tank trucks from CSCTRUCK Limited, operated by Aramco, significantly enhancing oil infrastructure and aligning logistics with global market demands.

- July 2024: Circle K and Alsulaiman Group's MOU to establish a network of fuel stations, aligning with Saudi Vision 2030 and attracting global investment.

- March 2024: OOMCO's expansion strategy for retail service stations in Saudi Arabia, indicating increased market potential and opportunities for fuel transporters.

Strategic Outlook for Saudi Arabia Land-Based Fuel Transportation Market Market

The Saudi Arabia land-based fuel transportation market is poised for considerable long-term growth. This optimistic outlook is underpinned by sustained economic development, ambitious infrastructure projects, and the continuous expansion of the nation's vital energy sector. Strategic opportunities abound for companies that prioritize technological innovation, optimize their logistics operations, and embrace sustainable practices. By focusing on these key areas, businesses can effectively capitalize on the expanding opportunities within this dynamic market.

Saudi Arabia Land-Based Fuel Transportation Market Segmentation

-

1. Fuel Type

- 1.1. Octane 91

- 1.2. Octane 95

- 1.3. Diesel

- 1.4. Jet-A1

- 1.5. Other Fuel Types

Saudi Arabia Land-Based Fuel Transportation Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Land-Based Fuel Transportation Market Regional Market Share

Geographic Coverage of Saudi Arabia Land-Based Fuel Transportation Market

Saudi Arabia Land-Based Fuel Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure

- 3.4. Market Trends

- 3.4.1. Octane 91 Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Land-Based Fuel Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Octane 91

- 5.1.2. Octane 95

- 5.1.3. Diesel

- 5.1.4. Jet-A1

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aldrees Petroleum and Transport Services Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arabian Petroleum Supply Company (APSCO)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Petroly Petroleum Services & Transportation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alsudais for Trading & Transports

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Well Petroleum Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alayed Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M S Al-meshri & Bros Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abed Abdulrahman Al Sobhi & Sons Ltd Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-deyabi Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Flsarabia (Fuel Logistics Services EST)*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aldrees Petroleum and Transport Services Company

List of Figures

- Figure 1: Saudi Arabia Land-Based Fuel Transportation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Land-Based Fuel Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 2: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 6: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 7: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Land-Based Fuel Transportation Market?

The projected CAGR is approximately 6.16%.

2. Which companies are prominent players in the Saudi Arabia Land-Based Fuel Transportation Market?

Key companies in the market include Aldrees Petroleum and Transport Services Company, Arabian Petroleum Supply Company (APSCO), Petroly Petroleum Services & Transportation, Alsudais for Trading & Transports, Well Petroleum Services, Alayed Group, M S Al-meshri & Bros Co, Abed Abdulrahman Al Sobhi & Sons Ltd Co, Al-deyabi Group, Flsarabia (Fuel Logistics Services EST)*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi.

3. What are the main segments of the Saudi Arabia Land-Based Fuel Transportation Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.76 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure.

6. What are the notable trends driving market growth?

Octane 91 Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure.

8. Can you provide examples of recent developments in the market?

August 2024: Saudi Arabia took a significant step forward in bolstering its oil infrastructure with the arrival of a state-of-the-art fleet of oil tank trucks produced by CSCTRUCK Limited. Officially welcomed at a ceremony at Jeddah Port, this new fleet comprises 100 advanced oil tank trucks. Saudi Arabian Oil Company (Aramco) will operate these trucks as it diligently aligns its logistics and transportation network with the surging demands of the global oil market.July 2024: Circle K and Alsulaiman Group, under the sponsorship of the Ministry of Energy - Saudi Arabia, signed an MOU to set up a network of Circle K-branded fuel stations across the country. This agreement is key in the ministry's vision to elevate the services and fuel station sectors by welcoming leading global corporations to invest. This initiative aligns with policy enhancements, strategic development initiatives, and transformation plans, all aimed at realizing the objectives of Saudi Vision 2030.March 2024: Oman Oil Marketing Company (OOMCO) unveiled its strategy to bolster its network of retail service stations in Oman, Saudi Arabia, and Tanzania, all identified as pivotal growth markets. Currently, OOMCO boasts a total of 277 service stations spread across these three nations: 235 in Oman, 30 in Saudi Arabia, and 12 in Tanzania. Such strategic investments are poised to create lucrative opportunities for players in the land-based fuel transportation market in Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Land-Based Fuel Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Land-Based Fuel Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Land-Based Fuel Transportation Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Land-Based Fuel Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence