Key Insights

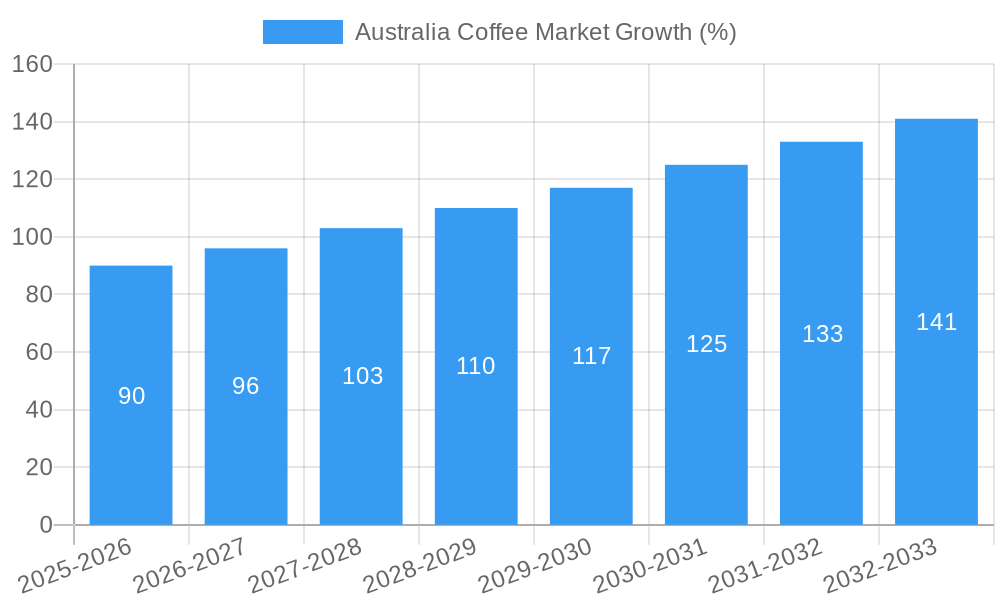

The Australian coffee market, valued at $1.55 billion in 2025, is projected to experience robust growth, driven by rising disposable incomes, a strong café culture, and increasing consumer preference for premium coffee beans and innovative brewing methods. The market's Compound Annual Growth Rate (CAGR) of 5.73% from 2019 to 2024 indicates a consistent upward trajectory, expected to continue through 2033. Key growth drivers include the expansion of specialty coffee shops catering to diverse consumer tastes, the rise of online coffee retail, and the increasing popularity of convenient coffee pod and capsule systems. While potential restraints such as fluctuating coffee bean prices and economic downturns exist, the market's resilience and adaptability suggest a continued positive outlook. The market segmentation reveals strong performance across various product types, with whole bean coffee maintaining a significant share, followed by ground coffee and the rapidly growing segment of coffee pods and capsules. Distribution channels show a healthy mix, with hypermarkets/supermarkets holding a dominant position, complemented by the significant growth in online retail sales, indicating consumer preference for convenience and diverse purchasing options. Leading players such as JAB Holding Company, Nestle SA, and Vittoria Coffee Pty Ltd are actively shaping market trends through product innovation, brand building, and strategic distribution partnerships.

The Australian coffee market’s segmentation offers valuable insights. The popularity of whole bean coffee reflects a consumer base increasingly interested in quality and freshness. Ground coffee remains a staple, while the explosive growth of coffee pods and capsules points to the strong consumer demand for convenience. The distribution channel analysis highlights the significance of both traditional retail outlets and the rapidly growing e-commerce segment, reflecting shifting consumer behaviour. The presence of established international players alongside successful local roasters signifies a competitive market driven by both established brands and emerging local innovations. This dynamic landscape presents significant opportunities for both established and emerging players to capitalize on the market’s strong growth potential. Strategic investments in premium products, innovative brewing technologies, and targeted marketing campaigns will be crucial for achieving market leadership in the years to come.

Australia Coffee Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Australian coffee market, offering invaluable insights for industry stakeholders, investors, and businesses looking to navigate this dynamic sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Discover key trends, market dynamics, and future opportunities within the Australian coffee landscape. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Australia Coffee Market Market Concentration & Dynamics

The Australian coffee market is characterized by a mix of both large multinational corporations and smaller, specialized roasters. Market concentration is moderate, with the top 5 players holding an estimated xx% market share in 2025. Innovation is a key driver, with companies continuously introducing new product formats, blends, and brewing technologies. The regulatory framework is relatively stable, though evolving sustainability concerns are influencing industry practices. Substitute products, such as tea and other beverages, pose a moderate competitive threat. End-user trends show a growing preference for ethically sourced, specialty coffee and convenient brewing methods. M&A activity has been relatively low in recent years, with only xx deals recorded between 2019 and 2024.

- Market Share: Top 5 players - xx% (2025 est.)

- M&A Activity: xx deals (2019-2024)

- Key Trends: Ethical sourcing, specialty coffee, convenience

Australia Coffee Market Industry Insights & Trends

The Australian coffee market has experienced robust growth over the past few years, driven by factors such as rising disposable incomes, changing consumer preferences, and the increasing popularity of coffee culture. Technological advancements in brewing methods and packaging have also contributed to market expansion. Consumers are increasingly demanding high-quality, sustainably sourced coffee, leading to a shift towards specialty coffee and single-origin beans. The market exhibits a strong preference for convenient formats, such as coffee pods and capsules, which are driving significant growth in this segment. The overall market size is projected to expand significantly, fueled by the rising demand for both in-home and out-of-home consumption.

Key Markets & Segments Leading Australia Coffee Market

Dominant Segments:

- Product Type: Ground coffee currently holds the largest market share, followed by whole bean coffee and coffee pods and capsules. Instant coffee maintains a significant presence, though growth is slower compared to other segments. The growth of coffee pods and capsules is driven by convenience and consistent quality.

- Distribution Channel: Hypermarkets/supermarkets continue to dominate distribution, offering a wide range of products and brands. Convenience/grocery stores and online retail stores are experiencing substantial growth, particularly for specialty and niche brands. Other distribution channels, such as cafes and restaurants, also play a vital role.

Drivers:

- Economic Growth: Rising disposable incomes drive increased coffee consumption.

- Coffee Culture: The strong coffee culture in Australia fuels demand.

- Convenience: Ready-to-drink and pod-based systems boost consumption.

Dominance Analysis: The dominance of ground coffee reflects its established popularity and wide availability. However, the rapid growth of coffee pods and capsules, driven by convenience and increasing demand for premium at-home experiences, indicates a shifting market landscape. The online retail channel's expansion provides access to a wider variety of products, fueling market growth.

Australia Coffee Market Product Developments

Recent product innovations focus on convenience, sustainability, and premium experiences. This includes the rise of single-serve coffee pods, innovative brewing technologies, and a greater focus on ethically sourced beans. The market is witnessing increased diversification in flavors and roasts, catering to evolving consumer preferences. Technological advancements in brewing, such as smart coffee machines, and sustainable packaging solutions are crucial differentiators in this competitive landscape.

Challenges in the Australia Coffee Market Market

The Australian coffee market faces challenges including volatile coffee bean prices, increasing competition from substitute beverages, and the growing pressure to adopt sustainable practices throughout the supply chain. Regulatory changes regarding labeling and packaging can also impact businesses. These factors can contribute to unpredictable cost fluctuations and require businesses to adapt strategically.

Forces Driving Australia Coffee Market Growth

Key growth drivers include rising disposable incomes, increasing urbanization, and the expanding café culture. Technological advancements in brewing methods and packaging, combined with the growing popularity of convenient options like coffee pods and capsules, significantly contribute to market expansion. Government initiatives promoting sustainable practices within the industry also encourage positive growth.

Challenges in the Australia Coffee Market Market (Long-Term Growth Catalysts)

Long-term growth hinges on innovation within sustainable practices, premium product development, and strategic partnerships that bolster supply chain resilience and distribution efficiency. Expanding into new product categories, such as ready-to-drink coffee beverages, or exploring export markets, also offers significant growth potential.

Emerging Opportunities in Australia Coffee Market

Emerging opportunities include the increasing demand for plant-based milks in coffee, the rise of specialty coffee shops offering unique brewing methods, and the growth of the at-home coffee experience market. The focus on sustainability and ethical sourcing presents opportunities for brands that prioritize these values.

Leading Players in the Australia Coffee Market Sector

- JAB Holding Company

- Nestle SA (Nestle SA)

- FreshFood Services Pty Ltd

- DC Roasters Pty Ltd

- Vittoria Coffee Pty Ltd

- Sensory Lab Australia Pty Ltd

- Illycaffè SpA (Illycaffè SpA)

- St Ali Pty Ltd

- Republica Coffee Pty Ltd

- Luigi Lavazza SpA (Luigi Lavazza SpA)

Key Milestones in Australia Coffee Market Industry

- May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also launched its Espresso Barista coffee range. This highlights successful brand collaborations expanding product offerings.

- April 2024: Nescafe and Arnott's launched a Nescafe White Choc Mocha, capitalizing on existing brand recognition to extend product lines and appeal to existing consumer bases.

- February 2024: L’OR Espresso partnered with Ferrari, leveraging brand recognition for a wider market appeal. This demonstrates strategic partnerships aimed at elevating brand image and reaching new customer segments.

Strategic Outlook for Australia Coffee Market Market

The Australian coffee market presents significant growth opportunities for companies that can innovate, adapt to changing consumer preferences, and embrace sustainable practices. Focusing on premiumization, convenience, and ethical sourcing will be key to capturing market share and driving long-term success. Strategic partnerships and investments in technology will also play a crucial role in shaping the future of this dynamic market.

Australia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Hypermarkets/ Supermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Australia Coffee Market Segmentation By Geography

- 1. Australia

Australia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 There is a growing trend towards specialty coffee

- 3.2.2 with consumers increasingly seeking out single-origin beans

- 3.2.3 artisanal roasting

- 3.2.4 and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend.

- 3.3. Market Restrains

- 3.3.1 The Australian coffee market is highly competitive

- 3.3.2 with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold.

- 3.4. Market Trends

- 3.4.1 The demand for fair-trade

- 3.4.2 organic

- 3.4.3 and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/ Supermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JAB Holding Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FreshFood Services Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DC Roasters Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vittoria Coffee Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sensory Lab Australia Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Illycaffè SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Ali Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Republica Coffee Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luigi Lavazza SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JAB Holding Company

List of Figures

- Figure 1: Australia Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Australia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Australia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Coffee Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Australia Coffee Market?

Key companies in the market include JAB Holding Company, Nestle SA, FreshFood Services Pty Ltd, DC Roasters Pty Ltd, Vittoria Coffee Pty Ltd, Sensory Lab Australia Pty Ltd, Illycaffè SpA, St Ali Pty Ltd, Republica Coffee Pty Ltd, Luigi Lavazza SpA.

3. What are the main segments of the Australia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.55 Million as of 2022.

5. What are some drivers contributing to market growth?

There is a growing trend towards specialty coffee. with consumers increasingly seeking out single-origin beans. artisanal roasting. and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend..

6. What are the notable trends driving market growth?

The demand for fair-trade. organic. and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values..

7. Are there any restraints impacting market growth?

The Australian coffee market is highly competitive. with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold..

8. Can you provide examples of recent developments in the market?

May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also offers the Espresso Barista coffee range, which uses beans from Central and South America, Africa, and Asia and has aromatic notes of flowers, cocoa, and wood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Coffee Market?

To stay informed about further developments, trends, and reports in the Australia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence