Key Insights

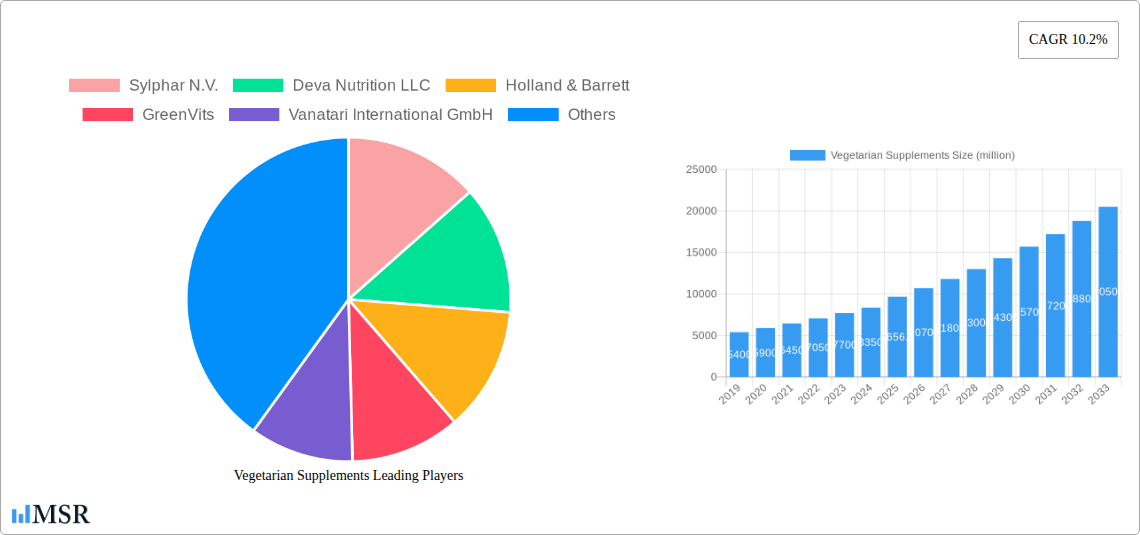

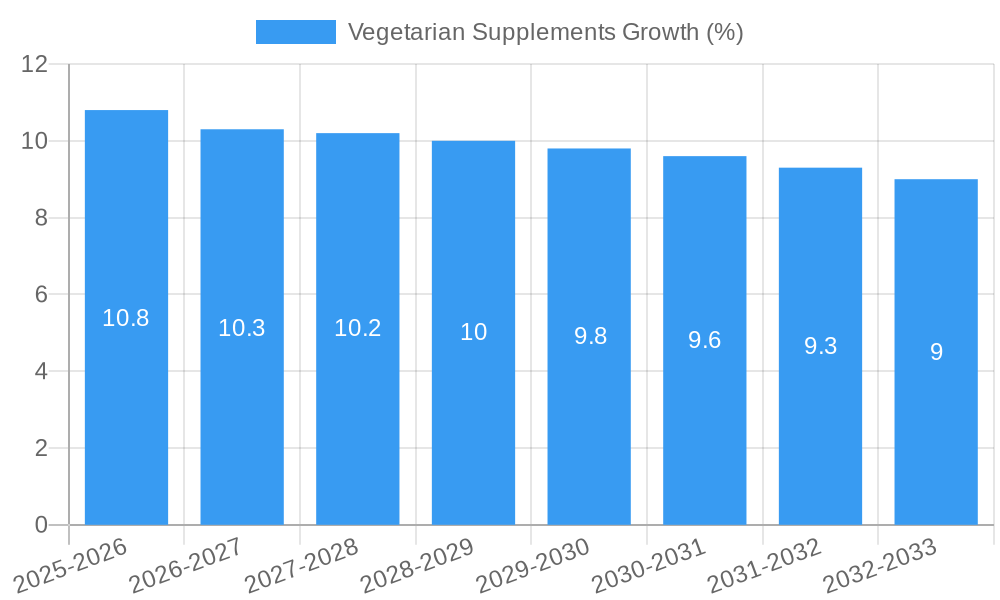

The global vegetarian supplements market is poised for substantial growth, projected to reach an estimated USD 9656.1 million by 2025. This expansion is driven by an increasing consumer preference for plant-based diets and lifestyles, fueled by growing awareness of health benefits, ethical considerations, and environmental sustainability. The market's robust Compound Annual Growth Rate (CAGR) of 10.2% over the forecast period (2025-2033) underscores its dynamic nature and significant potential. Key drivers include the rising prevalence of chronic diseases, a proactive approach to preventative healthcare, and the continuous innovation in product formulations offering enhanced bioavailability and diverse nutrient profiles. The accessibility of vegetarian supplements through both online and offline sales channels further facilitates market penetration, catering to a broad spectrum of consumer purchasing habits and preferences.

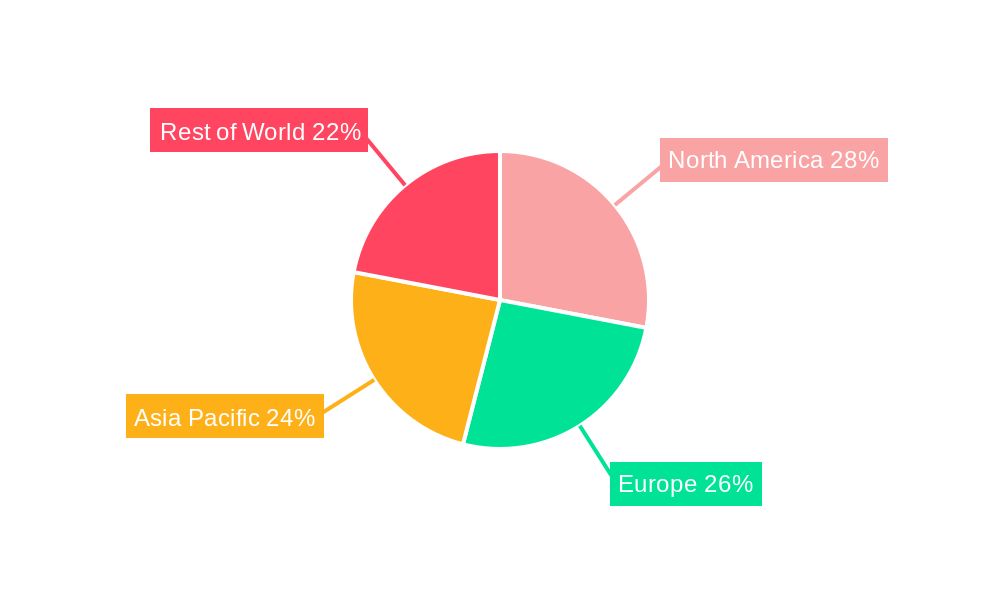

The market segmentation reveals a dynamic landscape, with Vitamins and Proteins representing prominent categories within the broader "Others" segment, reflecting the diverse nutritional needs of a vegetarian population. For instance, the increasing demand for Vitamin B12, iron, and omega-3 fatty acids, often harder to obtain in sufficient quantities from a purely vegetarian diet, is a significant growth catalyst. Similarly, the booming protein supplement market, driven by fitness enthusiasts and those seeking convenient protein sources, plays a crucial role. Geographically, North America and Europe are expected to lead market share due to well-established distribution networks and a high concentration of health-conscious consumers. However, the Asia Pacific region presents a substantial growth opportunity, with rapidly increasing adoption of vegetarianism and a burgeoning middle class with greater disposable income for health and wellness products. Emerging trends include a focus on personalized nutrition, the integration of functional ingredients, and the development of sustainable and eco-friendly packaging solutions by key players like Sylphar N.V., Deva Nutrition LLC, and Holland & Barrett, further solidifying the market's upward trajectory.

Unveiling the Powerhouse: Vegetarian Supplements Market Poised for Explosive Growth

This comprehensive report, "Vegetarian Supplements Market: Global Analysis, Trends, and Forecast (2019–2033)," offers an in-depth exploration of the rapidly expanding vegetarian supplements industry. Delve into market dynamics, growth drivers, segmentation, and the competitive landscape of this multi-million dollar sector. With the base year at 2025 and a robust forecast period extending to 2033, this analysis provides invaluable insights for industry stakeholders, investors, and product developers seeking to capitalize on this booming market. Covering historical trends from 2019–2024 and estimated figures for 2025, this report equips you with the knowledge to navigate and thrive in the global vegetarian supplements market.

Vegetarian Supplements Market Concentration & Dynamics

The global vegetarian supplements market is characterized by a moderate to high concentration, with key players like Sylphar N.V., Deva Nutrition LLC, and Holland & Barrett holding significant market share. Innovation ecosystems are thriving, driven by advancements in plant-based sourcing, formulation technologies, and the increasing demand for personalized nutrition. Regulatory frameworks globally are evolving to ensure product safety and efficacy, influencing market entry and product development. Substitute products, while present in the broader supplement market, are increasingly being challenged by the growing preference for vegetarian and vegan alternatives. End-user trends highlight a surge in health-conscious consumers seeking ethically sourced and environmentally sustainable products. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with approximately 30 M&A deals recorded over the historical period, indicating consolidation and strategic expansion among leading companies. Market share estimations place major players within a 10-15% range individually.

Vegetarian Supplements Industry Insights & Trends

The vegetarian supplements industry is experiencing unprecedented growth, fueled by a confluence of powerful market drivers. A projected market size exceeding $50 billion by the end of the forecast period underscores its significant economic impact. The Compound Annual Growth Rate (CAGR) is estimated at a robust 12.5% from 2025 to 2033. Technological disruptions are playing a pivotal role, with advancements in bioavailability enhancement, novel ingredient extraction, and sustainable manufacturing processes. Personalized nutrition platforms are also gaining traction, allowing consumers to tailor their supplement intake based on individual needs and genetic predispositions. Evolving consumer behaviors are central to this growth, driven by increasing awareness of the health benefits associated with plant-based diets, ethical considerations regarding animal welfare, and a growing concern for environmental sustainability. The "plant-based" movement, once a niche trend, has now permeated mainstream consumer consciousness, leading to a sustained demand for vegetarian and vegan-friendly nutritional solutions. Furthermore, the rising prevalence of lifestyle diseases, coupled with an aging global population, is propelling the demand for supplements that support overall well-being, immune function, and chronic disease prevention. The digital transformation of the retail landscape, with a significant shift towards online sales channels, is also a key trend, making vegetarian supplements more accessible than ever before. This accessibility, combined with a growing body of scientific research supporting the efficacy of various vegetarian ingredients, is solidifying the market's upward trajectory.

Key Markets & Segments Leading Vegetarian Supplements

The Online Sales segment is a dominant force in the vegetarian supplements market, projected to account for over 60% of total sales by 2033. This dominance is driven by unparalleled convenience, a wider product selection, and competitive pricing offered by e-commerce platforms.

- Drivers for Online Sales Dominance:

- Economic Growth: Increasing disposable incomes globally enable greater spending on health and wellness products.

- Infrastructure Development: Widespread internet penetration and efficient logistics networks facilitate seamless online purchasing.

- Digital Literacy: A growing tech-savvy population is comfortable with online transactions.

- Targeted Marketing: Online platforms allow for highly personalized marketing campaigns reaching specific consumer demographics.

Within product types, Vitamin supplements continue to lead the market, holding an estimated 45% share. This segment's strength lies in its broad appeal, addressing foundational nutritional needs across various age groups and health goals.

- Drivers for Vitamin Segment Dominance:

- Health Awareness: Widespread understanding of essential vitamin functions for bodily health.

- Preventative Healthcare: Consumers actively seek vitamins to bolster immunity and prevent deficiencies.

- Product Variety: A vast array of vitamin formulations cater to diverse needs (e.g., Vitamin D for bone health, B vitamins for energy).

- Trusted Brands: Established brands in the vitamin segment enjoy high consumer trust.

The Protein segment is exhibiting remarkable growth, projected to capture 30% of the market by 2033, driven by the rising popularity of plant-based diets among athletes, fitness enthusiasts, and those seeking muscle support and satiety. Others, encompassing minerals, herbal extracts, and specialized formulations, are expected to grow steadily, driven by niche demands and ongoing research into novel botanicals. Geographically, North America and Europe currently lead the market due to high consumer awareness and purchasing power, but the Asia-Pacific region is anticipated to witness the fastest growth in the coming years, propelled by increasing adoption of Western dietary trends and a burgeoning middle class.

Vegetarian Supplements Product Developments

Product innovation in vegetarian supplements is characterized by a relentless pursuit of enhanced efficacy and consumer appeal. Companies are focusing on developing novel delivery systems, such as chewable tablets, effervescent powders, and advanced capsules for improved absorption. The integration of adaptogens, nootropics, and probiotics into vegetarian formulations is a significant trend, catering to growing consumer interest in mental well-being, stress management, and gut health. Furthermore, the emphasis on clean-label products, free from artificial additives and allergens, is driving the development of naturally sourced and minimally processed supplements. This focus on quality and transparency is a key competitive edge in the discerning vegetarian supplement market.

Challenges in the Vegetarian Supplements Market

Despite robust growth, the vegetarian supplements market faces several challenges. Regulatory Hurdles in certain regions can slow down product approvals and market entry. Supply Chain Issues, particularly concerning the consistent sourcing of high-quality plant-based ingredients, can impact product availability and cost. Competitive Pressures from both established players and new entrants, alongside the proliferation of similar products, necessitate continuous innovation and effective differentiation. The market also grapples with consumer skepticism regarding the efficacy of certain supplements, requiring robust scientific backing and transparent communication.

Forces Driving Vegetarian Supplements Growth

Several key forces are propelling the vegetarian supplements market forward. The undeniable Rising Health Consciousness among consumers, coupled with a growing global preference for plant-based diets, is a primary driver. Technological Advancements in formulation and extraction are improving product quality and bioavailability. Favorable Regulatory Environments in many key markets are encouraging innovation and market expansion. Furthermore, the Growing Awareness of Environmental Sustainability aligns perfectly with the ethical appeal of vegetarian products, attracting a significant consumer base.

Challenges in the Vegetarian Supplements Market

Long-term growth catalysts in the vegetarian supplements market are deeply rooted in innovation and market expansion. Continued Investment in Research and Development for novel, science-backed vegetarian ingredients will solidify consumer trust and product efficacy. Strategic Partnerships with healthcare professionals and influencers can effectively disseminate accurate information and build credibility. Market Expansions into Emerging Economies, where the adoption of healthy lifestyles is on the rise, presents significant untapped potential. Furthermore, the development of Sustainable and Ethical Sourcing Practices will not only resonate with the core consumer base but also create a strong brand identity.

Emerging Opportunities in Vegetarian Supplements

Emerging opportunities in the vegetarian supplements market are abundant. The burgeoning demand for Personalized Nutrition solutions, leveraging AI and genetic testing, offers a vast potential for tailored supplement regimens. Innovations in Gut Health and the microbiome are creating new product categories focused on prebiotics, probiotics, and postbiotics derived from plant sources. The integration of Functional Ingredients into everyday food and beverage products, beyond traditional supplement formats, presents a significant avenue for growth. Furthermore, the development of Sustainable Packaging Solutions and circular economy models will further enhance the appeal of vegetarian supplements to environmentally conscious consumers.

Leading Players in the Vegetarian Supplements Sector

- Sylphar N.V.

- Deva Nutrition LLC

- Holland & Barrett

- GreenVits

- Vanatari International GmbH

- Vitamin Buddy Limited.

- MONK Nutrition Europe

- Glanbia Plc

Key Milestones in Vegetarian Supplements Industry

- 2019: Increased research publications highlighting the benefits of plant-based vitamins and minerals.

- 2020: Significant surge in online sales of vegetarian supplements due to global health concerns.

- 2021: Launch of innovative plant-based protein isolate formulations by major players.

- 2022: Growing consumer demand for adaptogen-infused vegetarian supplements for stress management.

- 2023: Expansion of Holland & Barrett's vegan-exclusive product lines.

- 2024: Vanatari International GmbH announces strategic investment in sustainable ingredient sourcing.

- 2025 (Base Year): Estimated market size exceeding $40 billion, with robust growth trajectory.

Strategic Outlook for Vegetarian Supplements Market

The strategic outlook for the vegetarian supplements market is exceptionally positive, driven by sustained consumer demand for health and wellness solutions that align with ethical and environmental values. Growth accelerators include ongoing innovation in product formulations, particularly in areas like personalized nutrition and gut health. Strategic expansions into rapidly developing geographical markets will unlock new revenue streams. Companies focusing on transparent sourcing, scientific validation, and effective digital marketing will be best positioned to capture market share. The market's inherent adaptability to evolving consumer preferences and its alignment with global megatrends like plant-based living and sustainable consumption ensure its continued prominence and profitability.

Vegetarian Supplements Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Vitamin

- 2.2. Protein

- 2.3. Others

Vegetarian Supplements Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vegetarian Supplements REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vegetarian Supplements Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Vitamin

- 5.2.2. Protein

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vegetarian Supplements Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Vitamin

- 6.2.2. Protein

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Vegetarian Supplements Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Vitamin

- 7.2.2. Protein

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Vegetarian Supplements Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Vitamin

- 8.2.2. Protein

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Vegetarian Supplements Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Vitamin

- 9.2.2. Protein

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Vegetarian Supplements Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Vitamin

- 10.2.2. Protein

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sylphar N.V.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Deva Nutrition LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Holland & Barrett

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GreenVits

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vanatari International GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vitamin Buddy Limited.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MONK Nutrition Europe

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Glanbia Plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Sylphar N.V.

List of Figures

- Figure 1: Global Vegetarian Supplements Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Vegetarian Supplements Revenue (million), by Application 2024 & 2032

- Figure 3: North America Vegetarian Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Vegetarian Supplements Revenue (million), by Types 2024 & 2032

- Figure 5: North America Vegetarian Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Vegetarian Supplements Revenue (million), by Country 2024 & 2032

- Figure 7: North America Vegetarian Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Vegetarian Supplements Revenue (million), by Application 2024 & 2032

- Figure 9: South America Vegetarian Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Vegetarian Supplements Revenue (million), by Types 2024 & 2032

- Figure 11: South America Vegetarian Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Vegetarian Supplements Revenue (million), by Country 2024 & 2032

- Figure 13: South America Vegetarian Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Vegetarian Supplements Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Vegetarian Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Vegetarian Supplements Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Vegetarian Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Vegetarian Supplements Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Vegetarian Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Vegetarian Supplements Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Vegetarian Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Vegetarian Supplements Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Vegetarian Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Vegetarian Supplements Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Vegetarian Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Vegetarian Supplements Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Vegetarian Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Vegetarian Supplements Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Vegetarian Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Vegetarian Supplements Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Vegetarian Supplements Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vegetarian Supplements Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vegetarian Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Vegetarian Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Vegetarian Supplements Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Vegetarian Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Vegetarian Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Vegetarian Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Vegetarian Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Vegetarian Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Vegetarian Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Vegetarian Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Vegetarian Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Vegetarian Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Vegetarian Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Vegetarian Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Vegetarian Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Vegetarian Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Vegetarian Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Vegetarian Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Vegetarian Supplements Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vegetarian Supplements?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Vegetarian Supplements?

Key companies in the market include Sylphar N.V., Deva Nutrition LLC, Holland & Barrett, GreenVits, Vanatari International GmbH, Vitamin Buddy Limited., MONK Nutrition Europe, Glanbia Plc.

3. What are the main segments of the Vegetarian Supplements?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 9656.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vegetarian Supplements," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vegetarian Supplements report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vegetarian Supplements?

To stay informed about further developments, trends, and reports in the Vegetarian Supplements, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence