Key Insights

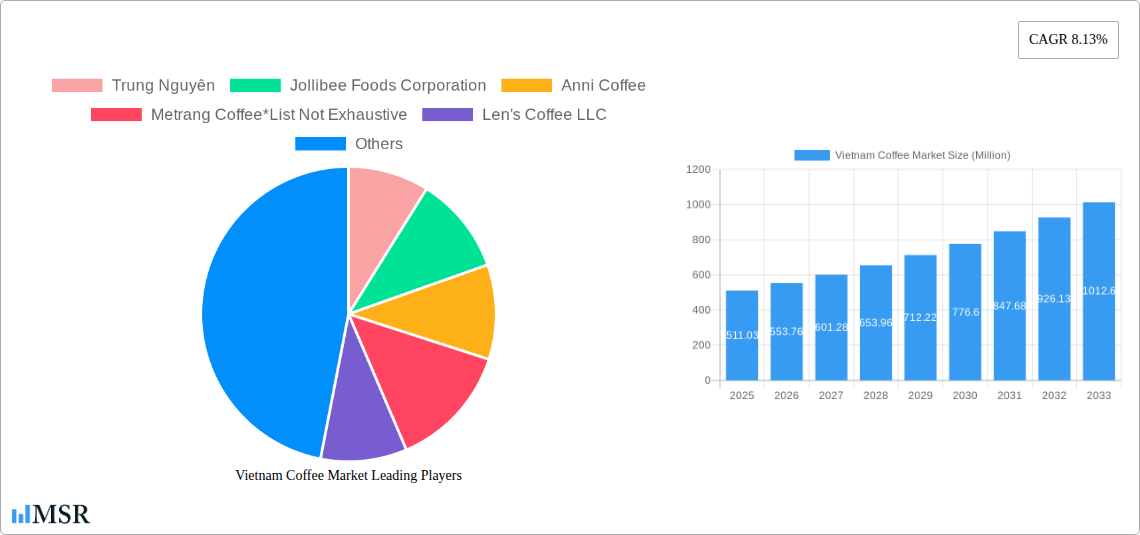

The Vietnam coffee market, valued at $511.03 million in 2025, is projected to experience robust growth, driven by increasing domestic consumption and rising export demand. A compound annual growth rate (CAGR) of 8.13% from 2025 to 2033 indicates a significant expansion potential. Key drivers include the rising popularity of specialty coffee, a growing middle class with increased disposable income, and a surge in coffee shop culture, particularly among younger demographics. The market is segmented by distribution channel (on-trade and off-trade) and product type (whole bean, ground coffee, and instant coffee), with on-trade channels experiencing strong growth due to the proliferation of cafes and restaurants. While the dominance of traditional coffee consumption persists, a notable trend is the increasing preference for premium, high-quality coffee beans and specialty brews, creating opportunities for higher-margin products. Potential restraints include fluctuating global coffee prices, competition from international brands, and the need for sustainable and ethical sourcing practices to address growing consumer concerns. Leading players like Trung Nguyên, Jollibee Foods Corporation, and Nestlé S.A. are actively shaping the market landscape through strategic expansions, product innovation, and brand building initiatives. The market's future growth will depend on sustained domestic demand, effective export strategies, and the ability of companies to cater to evolving consumer preferences.

Vietnam Coffee Market Market Size (In Million)

The strong growth trajectory of the Vietnamese coffee market is further supported by government initiatives promoting the coffee industry and technological advancements in coffee cultivation and processing. The increasing popularity of Vietnamese coffee internationally, especially in Asian markets, presents a significant opportunity for expansion. However, maintaining consistent product quality and addressing potential challenges related to climate change and resource management remain critical for sustained long-term growth. The robust presence of both domestic and international players ensures a competitive yet dynamic landscape, fostering innovation and ultimately benefiting consumers with a wide range of coffee choices. The forecast period of 2025-2033 anticipates further market consolidation and diversification, with a growing emphasis on premiumization and value-added offerings. This presents significant opportunities for investment and further growth within the sector.

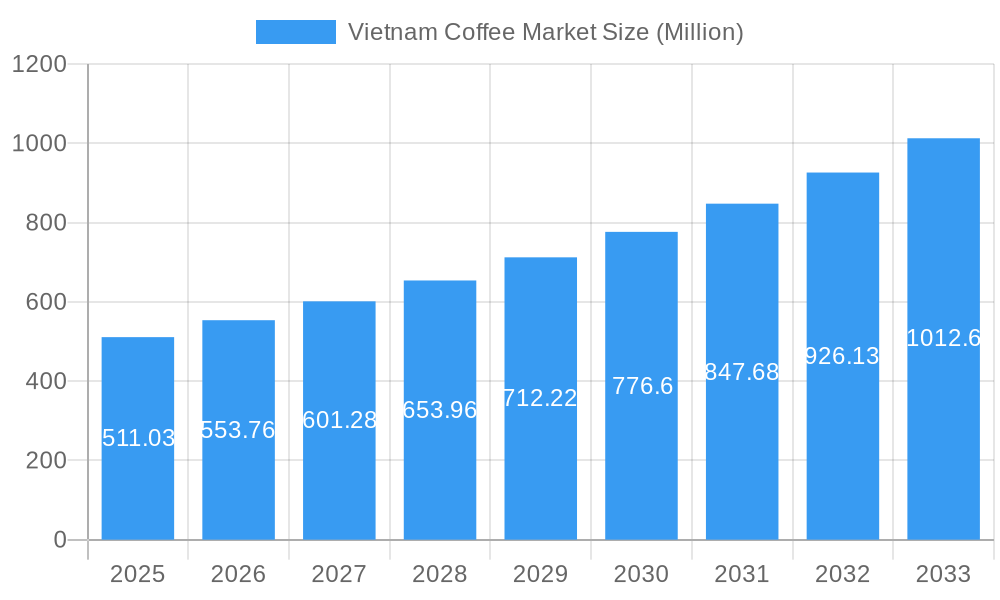

Vietnam Coffee Market Company Market Share

Vietnam Coffee Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam coffee market, encompassing market dynamics, industry trends, key players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period from 2025-2033. Discover actionable insights to navigate this dynamic market and capitalize on emerging opportunities. The report uses USD Million for all values.

Vietnam Coffee Market Market Concentration & Dynamics

The Vietnam coffee market exhibits a dynamic interplay of established players and emerging brands. Market concentration is moderate, with several large players holding significant market share, but also allowing for smaller, specialized businesses to thrive. Key players like Trung Nguyên, Jollibee Foods Corporation, and Starbucks Corporation compete fiercely, driving innovation and shaping market trends. The regulatory framework, while generally supportive of the coffee industry, presents certain compliance challenges for businesses. Substitute products, such as tea and other beverages, exert some competitive pressure. Consumer trends, including increasing demand for premium and specialty coffee, are reshaping the market landscape.

- Market Share: Trung Nguyên holds an estimated xx% market share, followed by Nestlé S.A. at xx%, and Starbucks at xx%. (Exact figures require further proprietary data).

- M&A Activity: The market has witnessed significant M&A activity in recent years, with notable deals including Masan Group's acquisition of Phuc Long Coffee & Tea (USD 453 Million). The number of M&A deals between 2019-2024 is estimated at xx.

- Innovation Ecosystem: The market exhibits a robust innovation ecosystem, with companies continuously introducing new product varieties, brewing methods, and distribution models. This reflects the dynamic nature of consumer preferences and the competition to maintain brand loyalty.

Vietnam Coffee Market Industry Insights & Trends

The Vietnam coffee market is experiencing robust growth, driven by a combination of factors. The market size in 2024 was estimated at USD xx Million, exhibiting a CAGR of xx% during the historical period (2019-2024). This growth is fueled by rising disposable incomes, increasing urbanization, and a growing preference for premium coffee experiences among Vietnamese consumers. Technological advancements, including improved processing techniques and innovative brewing technologies, are further enhancing the quality and appeal of coffee products. Changing consumer behaviors, with a shift towards ready-to-drink and convenient coffee options, presents both opportunities and challenges for market participants. The estimated market size in 2025 is USD xx Million and is projected to reach USD xx Million by 2033.

Key Markets & Segments Leading Vietnam Coffee Market

The Vietnamese coffee market exhibits strong growth across various segments. Both on-trade and off-trade channels contribute significantly to overall market revenue. The off-trade segment, encompassing supermarkets, convenience stores, and online retailers, is experiencing faster growth due to increasing convenience and accessibility. Within product types, instant coffee maintains significant popularity due to its affordability and convenience. However, the whole bean and ground coffee segments are experiencing increased growth, driven by rising demand for premium quality and specialty coffee.

- Distribution Channel:

- On-trade: Growth drivers include increasing tourism and the rising number of cafes and restaurants.

- Off-trade: Growth is driven by expansion of retail channels and increased online sales.

- Product Type:

- Instant Coffee: Dominates the market due to convenience and affordability.

- Ground Coffee: Growth is fueled by the growing preference for higher quality coffee.

- Whole Bean Coffee: Increasing demand from specialty coffee shops and discerning consumers.

Vietnam Coffee Market Product Developments

Recent product innovations center on convenience, premiumization, and sustainability. Companies are introducing ready-to-drink (RTD) coffee options, single-serve pods, and organic or ethically sourced coffee to cater to evolving consumer preferences. Technological advancements in processing and packaging enhance product quality, shelf life, and sustainability. These innovations contribute to increased market competitiveness and provide consumers with a wider range of choices.

Challenges in the Vietnam Coffee Market Market

The Vietnam coffee market faces challenges related to fluctuating coffee bean prices, supply chain disruptions, and increasing competition from both domestic and international brands. These factors can impact profitability and market share. Furthermore, regulatory compliance and sustainability concerns pose ongoing challenges for businesses.

Forces Driving Vietnam Coffee Market Growth

Key growth drivers include rising disposable incomes, increasing urbanization, and a growing young population with a strong preference for coffee. The expanding middle class is fueling the demand for premium and specialty coffee products. Furthermore, government support for the coffee industry and investment in infrastructure are contributing to the market's positive outlook.

Long-Term Growth Catalysts in the Vietnam Coffee Market

Long-term growth will be driven by continued innovation, strategic partnerships (such as Nestle and Starbucks collaboration), and expansion into new market segments. The focus on sustainability and ethical sourcing will also play a crucial role in shaping future growth. Investing in technology and building strong supply chains will be essential for sustained success.

Emerging Opportunities in Vietnam Coffee Market

Emerging opportunities exist in the specialty coffee segment, the expansion of e-commerce channels, and the growing interest in sustainable and ethically sourced coffee. Companies that can effectively cater to these trends will be well-positioned for future growth. Innovation in packaging and brewing methods offers further opportunities to differentiate and capture market share.

Leading Players in the Vietnam Coffee Market Sector

- Trung Nguyên

- Jollibee Foods Corporation

- Anni Coffee

- Metrang Coffee

- Len's Coffee LLC

- Masan Group (Bien Hoa Vinacafe Joint Stock Company)

- Starbucks Corporation

- Me Trang Coffee Joint Stock Company

- Retail Food Group Limited (Gloria Jeans)

- Nestlé S.A

Key Milestones in Vietnam Coffee Market Industry

- July 2022: Nestlé and Starbucks launched 'Starbucks At Home' and 'We Proudly Serve Starbucks Coffee Program' in Vietnam.

- August 2022: Masan Group completed its acquisition of Phuc Long Coffee & Tea for USD 453 Million.

- October 2022: Nestlé's Nescafé announced a USD 1.02 Billion investment to support sustainable coffee farming.

- January 2023: Starbucks opened its 100th store in Vietnam, adding 13 new locations.

Strategic Outlook for Vietnam Coffee Market Market

The Vietnam coffee market presents significant growth potential in the coming years. Strategic opportunities lie in leveraging technological advancements, expanding distribution networks, and developing innovative products that cater to evolving consumer preferences. Companies that prioritize sustainability, ethical sourcing, and brand building will be best positioned to capture market share and drive long-term growth.

Vietnam Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarket/Hypermarket

- 2.2.2. Specialty Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Distribution Channels

Vietnam Coffee Market Segmentation By Geography

- 1. Vietnam

Vietnam Coffee Market Regional Market Share

Geographic Coverage of Vietnam Coffee Market

Vietnam Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Specialty

- 3.2.2 Organic

- 3.2.3 and Green Coffee; Growing In-House Production of Coffee in the Country

- 3.3. Market Restrains

- 3.3.1. Change in Climatic Conditions Impacting Coffee Plantations

- 3.4. Market Trends

- 3.4.1 Increasing Demand For Specialty

- 3.4.2 Organic

- 3.4.3 And Green Coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarket/Hypermarket

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trung Nguyên

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jollibee Foods Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anni Coffee

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Metrang Coffee*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Len's Coffee LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Masan Group (Bien Hoa Vinacafe Joint Stock Company)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Starbucks Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Me Trang Coffee Joint Stock Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Retail Food Group Limited (Gloria Jeans)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nestlé S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trung Nguyên

List of Figures

- Figure 1: Vietnam Coffee Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Vietnam Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Vietnam Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Vietnam Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Vietnam Coffee Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Coffee Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Vietnam Coffee Market?

Key companies in the market include Trung Nguyên, Jollibee Foods Corporation, Anni Coffee, Metrang Coffee*List Not Exhaustive, Len's Coffee LLC, Masan Group (Bien Hoa Vinacafe Joint Stock Company), Starbucks Corporation, Me Trang Coffee Joint Stock Company, Retail Food Group Limited (Gloria Jeans), Nestlé S A.

3. What are the main segments of the Vietnam Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 511.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Specialty. Organic. and Green Coffee; Growing In-House Production of Coffee in the Country.

6. What are the notable trends driving market growth?

Increasing Demand For Specialty. Organic. And Green Coffee.

7. Are there any restraints impacting market growth?

Change in Climatic Conditions Impacting Coffee Plantations.

8. Can you provide examples of recent developments in the market?

January 2023: Starbucks Corporation further expanded its presence in Vietnam by inaugurating its 100th store in the country. The newly established stores are situated in Binh Duong and Quy Nhon provinces, adding a total of 13 new locations to Vietnam.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Coffee Market?

To stay informed about further developments, trends, and reports in the Vietnam Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence