Key Insights

The European tofu market is projected to reach $2.97 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 5.08% through 2033. This expansion is driven by shifting consumer preferences towards healthier and more sustainable food choices. The increasing demand for plant-based proteins, as consumers seek alternatives to meat and dairy, is a key factor. Growing environmental awareness further fuels this trend, positioning tofu as a versatile and eco-friendly protein source. Enhanced accessibility through online channels and retail supermarkets is also contributing to market growth, with a wider product assortment making tofu more mainstream.

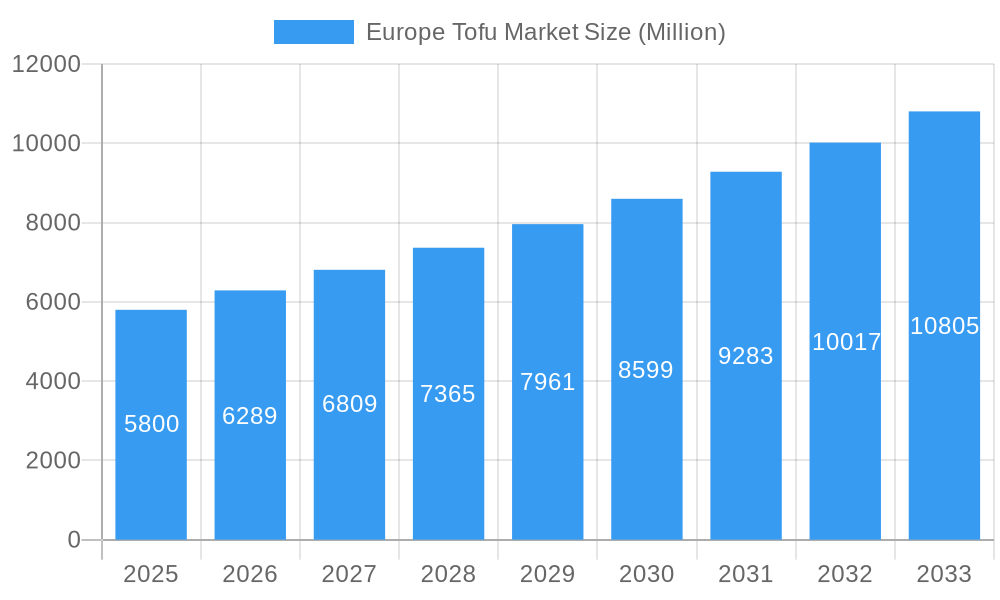

Europe Tofu Market Market Size (In Billion)

Innovation in product development is a significant driver in the European tofu market. Manufacturers are introducing a variety of seasoned, flavored, and pre-marinated tofu products to meet evolving culinary tastes and convenience needs. Strategic partnerships and mergers are also consolidating market positions and expanding product offerings. Challenges include overcoming the perception of tofu as bland or unfamiliar, requiring sustained marketing and education. Fluctuations in soybean prices can also impact production costs and affordability. Despite these hurdles, the positive consumer sentiment towards plant-based diets and ongoing industry innovation indicate a strong future for the European tofu market.

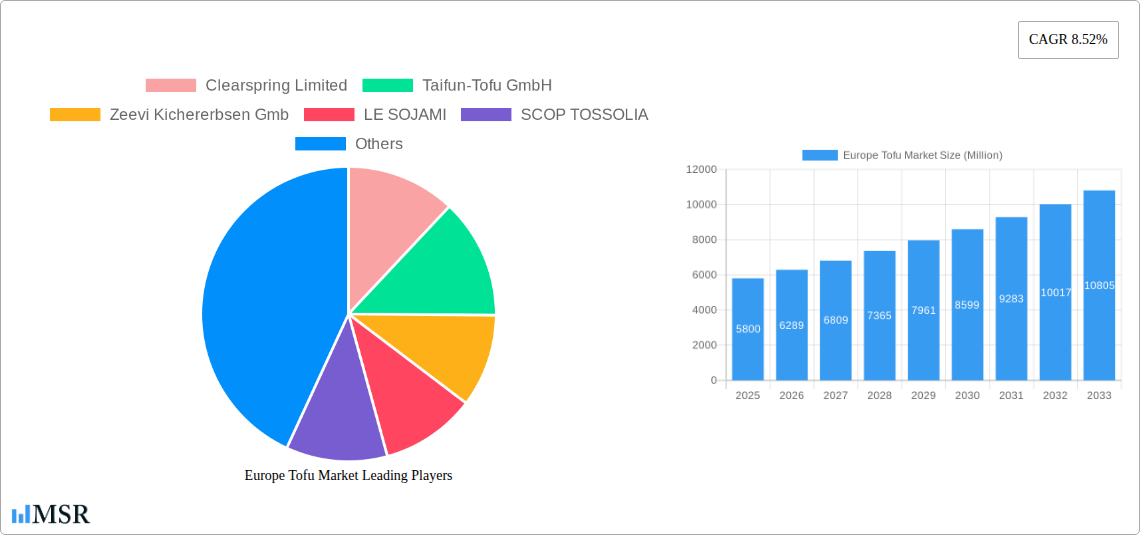

Europe Tofu Market Company Market Share

Europe Tofu Market Report: Growth Drivers, Innovations, and Strategic Outlook (2019-2033)

Explore the dynamic Europe Tofu Market, projected to reach US$ XX Million by 2025 with a robust CAGR of XX% during the forecast period 2025-2033. This comprehensive report, covering the historical period 2019-2024 and a detailed study period 2019-2033, offers actionable insights into market concentration, industry trends, key segments, product developments, challenges, growth drivers, emerging opportunities, leading players, and crucial industry milestones. Discover the evolving landscape of plant-based protein, driven by rising veganism, health consciousness, and sustainability concerns.

Europe Tofu Market Market Concentration & Dynamics

The Europe Tofu Market exhibits a moderate concentration, with a blend of established global players and agile regional manufacturers vying for market share. Innovation plays a pivotal role, fostering a vibrant ecosystem where companies like Clearspring Limited, Taifun-Tofu GmbH, and LE SOJAMI are continuously introducing novel product formulations and applications. Regulatory frameworks surrounding food safety and labeling in the EU are becoming increasingly stringent, influencing product development and market entry strategies. Substitute products, including other plant-based proteins like tempeh and seitan, pose a competitive challenge, though tofu's versatility and perceived health benefits often give it an edge. End-user trends are strongly leaning towards health-conscious and ethically-minded consumers, driving demand for organic and non-GMO tofu options. Mergers and acquisitions (M&A) activities are present, albeit at a moderate pace, as larger entities seek to consolidate their market position or acquire innovative smaller players. The market share of leading players is estimated to be around XX% combined, with a growing number of smaller, niche brands gaining traction. M&A deal counts are projected to remain steady at around X-Y deals annually, focusing on strategic acquisitions for technological or geographical expansion.

Europe Tofu Market Industry Insights & Trends

The Europe Tofu Market is experiencing significant expansion, fueled by a confluence of powerful growth drivers. The escalating adoption of vegan and vegetarian diets across the continent, driven by environmental consciousness, ethical considerations, and perceived health benefits, is a primary catalyst. This trend is further amplified by increased consumer awareness regarding the health implications of traditional protein sources, positioning tofu as a preferred, nutritious alternative. Technological disruptions are also shaping the market, with advancements in production techniques leading to improved texture, flavor, and shelf-life of tofu products, making them more appealing to a wider consumer base. Innovations in processing, such as advanced extrusion and fermentation methods, are enabling the creation of diverse tofu formats, catering to various culinary preferences and applications. Evolving consumer behaviors, including a growing demand for convenient, ready-to-eat plant-based meals and snacks, are prompting manufacturers to diversify their product portfolios. The market size for tofu in Europe is estimated at US$ XX Million in the base year 2025, with projections indicating substantial growth. The Compound Annual Growth Rate (CAGR) is anticipated to be XX% over the forecast period 2025-2033, signifying a dynamic and expanding market. Consumers are increasingly seeking transparency in food production, demanding information about sourcing, ingredients, and sustainability practices, which is influencing brand loyalty and product development strategies. The rise of online grocery shopping and direct-to-consumer models is also facilitating greater accessibility to a wider range of tofu products, further contributing to market penetration.

Key Markets & Segments Leading Europe Tofu Market

The Europe Tofu Market is significantly driven by the Off-Trade distribution channel, with Supermarkets and Hypermarkets emerging as the dominant segment. This dominance is attributed to several factors, including widespread consumer accessibility, greater product variety, and competitive pricing offered by these retail giants. The economic growth in key European nations, coupled with well-established retail infrastructure, facilitates high sales volumes through this channel. The Online Channel is rapidly gaining traction, driven by the convenience of home delivery and the increasing adoption of e-commerce for grocery shopping. This segment is particularly attractive to consumers seeking niche or specialized tofu products not always available in physical stores.

- Off-Trade Dominance Drivers:

- Extensive store networks across Europe.

- Competitive pricing strategies and promotional activities.

- Consumer preference for one-stop shopping for groceries.

- Growing availability of diverse tofu product ranges.

The On-Trade segment, encompassing restaurants, cafes, and food service providers, also contributes to market growth, albeit to a lesser extent. The increasing inclusion of plant-based options on menus in the hospitality sector reflects evolving consumer demand and a growing awareness of dietary trends among foodservice establishments. Convenience Stores represent a growing, albeit smaller, segment within Off-Trade, catering to impulse purchases and quick meal solutions.

Germany, the United Kingdom, and France are currently leading the Europe Tofu Market in terms of consumption and sales value. Germany, in particular, boasts a mature plant-based food market and a strong consumer base for tofu products. Factors such as high disposable incomes, supportive government initiatives for sustainable food consumption, and a robust network of specialty food stores contribute to the strong performance of these key markets.

Europe Tofu Market Product Developments

Product innovation is a cornerstone of the Europe Tofu Market. Manufacturers are actively developing novel tofu formulations to cater to diverse consumer preferences and culinary trends. Recent developments include the introduction of flavored tofu, such as Dörte Ulrich und Freddy Ulrich's launch of tofu chunks masala in November 2023, appealing to a wider palate and simplifying meal preparation. Furthermore, the market is witnessing an expansion in tofu applications, moving beyond traditional uses to encompass ingredients for snacks, desserts, and even meat alternatives. The focus on plant-based ingredients and their perceived health benefits continues to drive the development of innovative tofu-based products with improved textures and nutritional profiles, offering a competitive edge to early adopters.

Challenges in the Europe Tofu Market Market

Despite robust growth, the Europe Tofu Market faces several challenges. Regulatory hurdles related to food additive approvals and stringent labeling requirements can pose a barrier for new entrants and necessitate significant investment in compliance. Supply chain complexities, particularly in sourcing high-quality, non-GMO soybeans consistently and sustainably across the continent, can impact production costs and availability. Competitive pressures from other plant-based protein alternatives, as well as from conventional protein sources, demand continuous innovation and effective marketing strategies to maintain market share.

Forces Driving Europe Tofu Market Growth

Several powerful forces are driving the Europe Tofu Market forward. The accelerating adoption of vegan and vegetarian lifestyles, fueled by ethical, environmental, and health concerns, is a primary growth engine. Increased consumer awareness of the health benefits associated with plant-based diets, including reduced risk of chronic diseases, further boosts demand for tofu as a lean protein source. Technological advancements in tofu production are enhancing its appeal by improving texture, taste, and versatility, making it a more attractive option for a wider range of consumers and culinary applications. Supportive government policies and initiatives promoting sustainable food systems and plant-based diets in several European countries also contribute to market expansion.

Challenges in the Europe Tofu Market Market

The long-term growth catalysts for the Europe Tofu Market lie in its inherent adaptability and evolving consumer perception. Continued innovation in product diversification, including the development of novel flavors, textures, and ready-to-eat formats, will be crucial in attracting and retaining consumers. Strategic partnerships between tofu manufacturers and foodservice providers, as well as retailers, can expand market reach and accessibility. Furthermore, ongoing market expansions into emerging European economies, coupled with targeted marketing campaigns highlighting tofu's nutritional and environmental benefits, will solidify its position as a staple plant-based protein.

Emerging Opportunities in Europe Tofu Market

Emerging opportunities in the Europe Tofu Market are abundant. The growing demand for fortified and functional tofu products, offering added nutritional benefits like increased protein content or added vitamins, presents a significant avenue for growth. Expansion into new geographical markets within Europe, particularly in regions with nascent plant-based food cultures, offers untapped potential. The development of innovative tofu-based ingredients for the food processing industry, catering to the burgeoning demand for plant-based alternatives in processed foods, is another key opportunity. Furthermore, leveraging sustainable sourcing and transparent production practices can create brand loyalty and tap into the ethically-conscious consumer segment.

Leading Players in the Europe Tofu Market Sector

- Clearspring Limited

- Taifun-Tofu GmbH

- Zeevi Kichererbsen GmbH

- LE SOJAMI

- SCOP TOSSOLIA

- Pulmuone Corporate

- House Foods Group Inc

- Morinaga Milk Industry Co Ltd

- Dragonfly Foods Ltd

- The Tofoo Co Ltd

- Tazaki Foods Limited

- Dörte Ulrich und Freddy Ulrich - Lord of Tofu

Key Milestones in Europe Tofu Market Industry

- November 2023: Dörte Ulrich und Freddy Ulrich launched tofu chunks masala, expanding their flavorful tofu product line.

- July 2023: Zeevi Kichererbsen GmbH made a significant investment at their production site in Berlin-Lichtenberg, solidifying their role as a regional value partner for processed chickpeas.

- May 2023: Dörte Ulrich und Freddy Ulrich introduced a new vegan BBQ range, offering a diverse selection of tofu products to cater to outdoor cooking and social gatherings.

Strategic Outlook for Europe Tofu Market Market

The strategic outlook for the Europe Tofu Market is highly promising, characterized by sustained growth driven by evolving consumer preferences and a commitment to sustainability. Key growth accelerators include continued product innovation, focusing on convenience, flavor diversity, and enhanced nutritional profiles to appeal to a broader demographic. Strategic partnerships across the value chain, from ingredient suppliers to foodservice providers and retailers, will be instrumental in expanding market penetration and accessibility. Furthermore, leveraging advancements in production technology to improve efficiency and reduce environmental impact will solidify the market's long-term viability and appeal to environmentally conscious consumers. The market is poised for continued expansion as plant-based eating becomes increasingly mainstream.

Europe Tofu Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Channel

- 1.1.3. Supermarkets and Hypermarkets

- 1.1.4. Others

- 1.2. On-Trade

-

1.1. Off-Trade

Europe Tofu Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

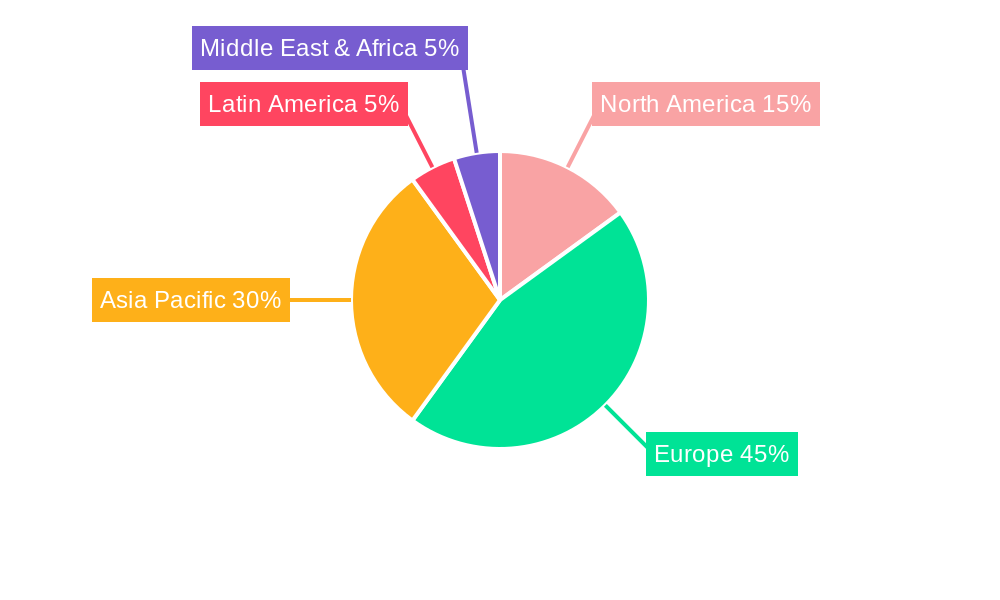

Europe Tofu Market Regional Market Share

Geographic Coverage of Europe Tofu Market

Europe Tofu Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Rising vegan population in the region drives market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Tofu Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Channel

- 5.1.1.3. Supermarkets and Hypermarkets

- 5.1.1.4. Others

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Clearspring Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Taifun-Tofu GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zeevi Kichererbsen Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LE SOJAMI

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SCOP TOSSOLIA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pulmuone Corporate

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 House Foods Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Morinaga Milk Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dragonfly Foods Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Tofoo Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tazaki Foods Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dörte Ulrich und Freddy Ulrich - Lord of Tofu

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Clearspring Limited

List of Figures

- Figure 1: Europe Tofu Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Tofu Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Tofu Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Europe Tofu Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Tofu Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Tofu Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Tofu Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Tofu Market?

The projected CAGR is approximately 5.08%.

2. Which companies are prominent players in the Europe Tofu Market?

Key companies in the market include Clearspring Limited, Taifun-Tofu GmbH, Zeevi Kichererbsen Gmb, LE SOJAMI, SCOP TOSSOLIA, Pulmuone Corporate, House Foods Group Inc, Morinaga Milk Industry Co Ltd, Dragonfly Foods Ltd, The Tofoo Co Ltd, Tazaki Foods Limited, Dörte Ulrich und Freddy Ulrich - Lord of Tofu.

3. What are the main segments of the Europe Tofu Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Rising vegan population in the region drives market growth.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

November 2023: Dörte Ulrich und Freddy Ulrich launched tofu chunks masala.July 2023: Zeevi Kichererbsen GmbH has invested at the production site in Berlin-Lichtenberg, the new regional value partner of processed chickpeas.May 2023: Dörte Ulrich und Freddy Ulrich launched vegan bbq which offers variety of tofu products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Tofu Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Tofu Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Tofu Market?

To stay informed about further developments, trends, and reports in the Europe Tofu Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence