Key Insights

The Japan Sodium Reduction Ingredient Market is projected to reach ¥1.9 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 11.7% from a 2025 base year. This robust growth is attributed to escalating consumer health consciousness regarding sodium intake and the rising incidence of lifestyle diseases such as hypertension, particularly within Japan's aging population. Food manufacturers are actively pursuing advanced sodium reduction ingredients to enhance product reformulation while preserving taste and texture. Key application segments, including condiments, seasonings, sauces, snacks, and savory products, are expected to drive demand for lower-sodium alternatives.

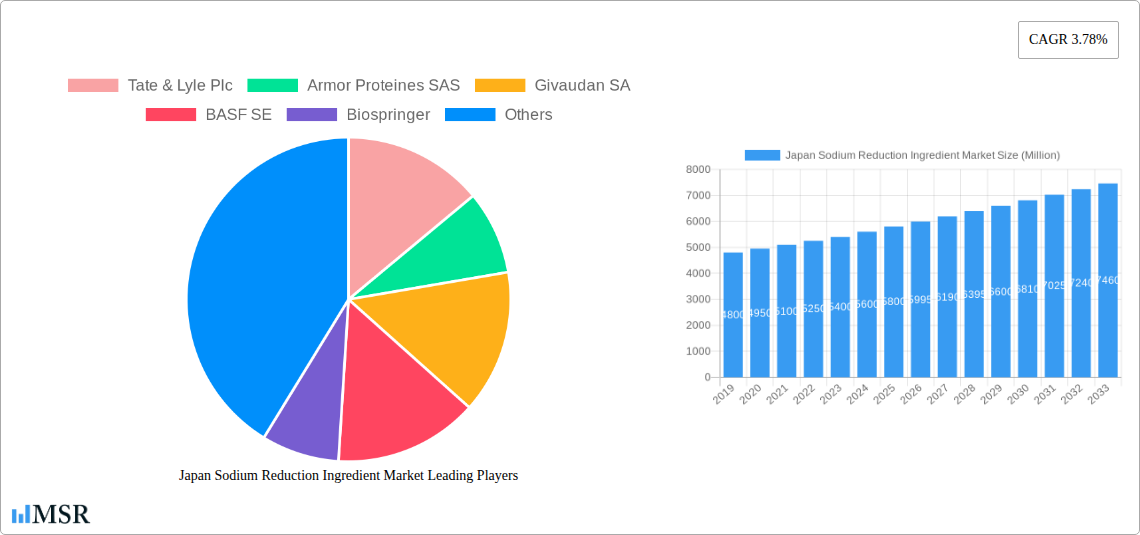

Japan Sodium Reduction Ingredient Market Market Size (In Billion)

Ongoing innovation in ingredient technology and an expanding portfolio of solutions are supporting the market's expansion. Mineral salts and yeast extracts are anticipated to gain traction for their ability to replicate the savory profile of sodium chloride. While opportunities abound, ingredient suppliers must address challenges such as potential taste profile alterations and the cost of new ingredient integration. Leading global and domestic companies, including Ajinomoto Co., Inc., Cargill Inc., and Tate & Lyle Plc, are investing in research and development to deliver cost-effective, high-performance sodium reduction solutions compliant with Japanese market preferences and regulations.

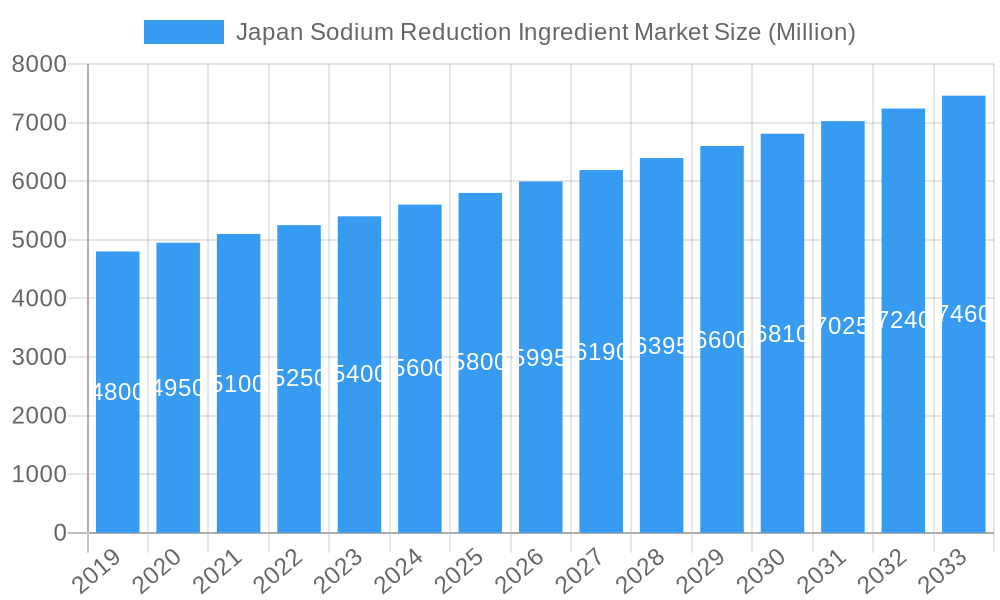

Japan Sodium Reduction Ingredient Market Company Market Share

Japan Sodium Reduction Ingredient Market: Comprehensive Insights & Strategic Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Japan Sodium Reduction Ingredient Market, offering unparalleled insights into growth drivers, key trends, and competitive dynamics. Discover the strategic landscape for sodium reduction ingredients in Japan, a nation increasingly focused on public health and dietary well-being. Our comprehensive study covers the study period 2019–2033, with a deep dive into the base year 2025 and forecast period 2025–2033. We meticulously analyze the historical period 2019–2024, providing a robust foundation for understanding market evolution. The market size for Japan's sodium reduction ingredient sector is projected to reach XX Million by 2025, with an estimated CAGR of XX% during the forecast period.

Japan Sodium Reduction Ingredient Market Market Concentration & Dynamics

The Japan Sodium Reduction Ingredient Market exhibits a moderate market concentration, characterized by the presence of both global and domestic players vying for market share. Innovation ecosystems are burgeoning, driven by increasing consumer demand for healthier food options and stringent government initiatives promoting reduced sodium intake. Regulatory frameworks are pivotal, with health authorities actively encouraging and, in some cases, mandating lower sodium levels in processed foods. Substitute products, such as potassium chloride-based salt replacers and natural flavor enhancers, pose a competitive challenge, although their efficacy and consumer acceptance vary across applications. End-user trends clearly indicate a preference for clean-label sodium reduction ingredients that offer transparency and natural sourcing. Merger and acquisition (M&A) activities are anticipated to increase as larger corporations seek to expand their portfolios and gain access to innovative technologies in the food ingredient market. Key players are actively investing in R&D to develop novel solutions that replicate the taste and functionality of salt without compromising consumer experience. The market share of leading players will be closely monitored, alongside the number of M&A deals shaping the competitive landscape.

Japan Sodium Reduction Ingredient Market Industry Insights & Trends

The Japan Sodium Reduction Ingredient Market is experiencing robust growth, fueled by a confluence of factors centered on public health consciousness and evolving consumer preferences. The market size is projected to reach XX Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is primarily driven by the escalating awareness among Japanese consumers regarding the adverse health effects of excessive sodium intake, including hypertension and cardiovascular diseases. Consequently, there is a significant surge in demand for food products with reduced sodium content, prompting food manufacturers to actively seek effective sodium reduction solutions.

Technological disruptions are playing a crucial role, with continuous advancements in the development of novel sodium reduction ingredients. These innovations aim to mimic the taste, texture, and functional properties of traditional salt, thereby minimizing sensory trade-offs for consumers. The integration of amino acids & glutamates, mineral salts, and yeast extracts as key ingredients in salt reduction strategies is becoming increasingly prevalent. Furthermore, the emergence of specialized ingredient blends and sophisticated processing techniques are enhancing the efficacy of these solutions across a wide array of food applications.

Evolving consumer behaviors are a cornerstone of market expansion. There is a growing preference for clean-label products, demanding natural, recognizable ingredients with minimal processing. This trend is pushing ingredient suppliers to focus on developing naturally derived or bio-based sodium reduction solutions. Consumers are also becoming more discerning about taste and palatability, necessitating sodium reduction ingredients that deliver superior sensory experiences without compromising health benefits. The market's dynamism is further amplified by the increasing prevalence of processed foods, where sodium reduction is a critical concern for both manufacturers and consumers. The Japan Sodium Reduction Ingredient Market is thus poised for sustained growth as it caters to these multifaceted demands.

Key Markets & Segments Leading Japan Sodium Reduction Ingredient Market

The Japan Sodium Reduction Ingredient Market is experiencing significant momentum across various segments, with particular dominance observed in Condiments, Seasonings & Sauces and Snacks and Savoury Products. These categories are at the forefront due to their high consumption rates and the inherent need for sodium reduction in their formulations.

Product Type Dominance:

- Amino Acids & Glutamates: This segment leads due to their well-established efficacy in enhancing umami taste, which can compensate for the reduced saltiness. Their versatility in various food applications makes them a preferred choice for sodium reduction.

- Mineral Salts: While potassium chloride and other mineral salts are crucial, their application is often balanced with taste masking technologies to mitigate any potential bitter aftertaste, contributing to their steady market presence.

- Yeast Extracts: These ingredients offer a natural flavor enhancement and contribute to umami, making them increasingly popular in the clean-label ingredient space, driving their growth.

- Others: This diverse category encompasses novel ingredients and blends that are gaining traction for their unique functionalities.

Application Dominance:

- Condiments, Seasonings & Sauces: This segment represents a substantial portion of the market. The high sodium content traditionally found in soy sauce, dressings, and marinades creates a strong demand for effective salt reduction solutions. Economic growth and evolving culinary trends in Japan further bolster this segment.

- Snacks and Savoury Products: With the popularity of chips, crackers, and other savory snacks, manufacturers are under pressure to offer healthier alternatives. The implementation of sodium reduction ingredients in these products is a key strategy for market penetration and consumer appeal. The robust domestic demand for these products fuels this segment's leadership.

- Bakery & Confectionery: While generally lower in sodium than savoury products, there is a growing awareness and demand for reduced-sodium options even in this segment, contributing to its steady expansion.

- Dairy & Frozen Foods: As consumers prioritize healthier choices, this segment is witnessing increased adoption of sodium reduction strategies to align with dietary guidelines.

- Meat & Seafood Products: The natural presence of sodium in these products necessitates innovative approaches to reduction, driving the demand for specialized sodium reduction ingredients.

The dominance of these segments is underpinned by strong economic growth within Japan, a highly developed food processing industry, and robust consumer awareness campaigns promoting healthier lifestyles. Infrastructure supporting the development and distribution of specialized ingredients further facilitates market penetration.

Japan Sodium Reduction Ingredient Market Product Developments

Product innovation is a critical driver in the Japan Sodium Reduction Ingredient Market. Leading companies are actively developing and launching novel clean-label sodium reduction ingredients that aim to replicate the taste and functional properties of salt without compromising on health. These advancements include improved flavor modulation technologies, encapsulation techniques for slow release of flavor enhancers, and the utilization of fermentation-derived ingredients. Applications are expanding beyond traditional savory products to include processed meats, baked goods, and dairy alternatives, catering to a broader consumer base seeking healthier options. The market relevance of these developments lies in their ability to provide effective, palatable, and consumer-friendly solutions for achieving lower sodium levels in a wide array of food products, thereby enhancing the competitive edge of manufacturers utilizing these innovations.

Challenges in the Japan Sodium Reduction Ingredient Market Market

Despite its promising growth, the Japan Sodium Reduction Ingredient Market faces several challenges. One significant barrier is the potential for sensory trade-offs, where reducing sodium can impact taste, texture, and mouthfeel, leading to consumer rejection if not managed effectively. Achieving palatable sodium reduction requires sophisticated ingredient solutions and formulation expertise. Regulatory hurdles, though generally supportive of health initiatives, can involve complex labeling requirements and varying standards for different ingredient types. Supply chain complexities, particularly for specialized or novel sodium reduction ingredients, can lead to price volatility and availability issues, impacting manufacturers’ production costs and timelines. Competitive pressures from established salt producers and the constant need for innovation to meet evolving consumer demands also present ongoing challenges to market players.

Forces Driving Japan Sodium Reduction Ingredient Market Growth

The growth of the Japan Sodium Reduction Ingredient Market is propelled by several key forces. Primarily, the increasing public health awareness regarding the detrimental effects of high sodium consumption, such as hypertension and cardiovascular diseases, is a major catalyst. This heightened awareness is further amplified by government initiatives and public health campaigns promoting healthier dietary habits. Technological advancements in developing effective sodium reduction ingredients that mimic the taste and functionality of salt without compromising palatability are also crucial. Furthermore, the evolving preferences of Japanese consumers for clean-label and healthier food options are compelling food manufacturers to reformulate their products, thereby driving the demand for innovative salt reduction solutions. The expanding processed food industry also necessitates the integration of these ingredients to meet both consumer demand and regulatory guidelines.

Challenges in the Japan Sodium Reduction Ingredient Market Market

Long-term growth catalysts in the Japan Sodium Reduction Ingredient Market are intrinsically linked to sustained innovation and strategic market expansion. The ongoing development of novel sodium reduction technologies, particularly those that offer superior taste masking capabilities and enhanced functional properties, will be pivotal in overcoming existing sensory challenges. Strategic partnerships between food manufacturers and ingredient suppliers are crucial for developing customized solutions tailored to specific product applications and consumer preferences, fostering deeper market penetration. Government investments in research and development for more efficient and cost-effective sodium reduction methods will further accelerate market adoption. Moreover, exploring untapped segments within the broader food industry and expanding the application of existing sodium reduction ingredients into new product categories will unlock significant future growth potential.

Emerging Opportunities in Japan Sodium Reduction Ingredient Market

Emerging opportunities in the Japan Sodium Reduction Ingredient Market are abundant, driven by evolving consumer trends and technological advancements. The growing demand for plant-based and alternative protein products presents a significant avenue for sodium reduction ingredient integration, as these categories often require flavor enhancement. The increasing focus on personalized nutrition and functional foods also opens doors for specialized sodium reduction solutions that can be tailored to specific health needs. Furthermore, the global push towards sustainable food systems creates opportunities for ingredients derived from renewable resources and produced through environmentally friendly processes. The continuous development of next-generation sodium reduction ingredients with improved sensory profiles and cost-effectiveness will unlock new market segments and solidify the growth trajectory of the industry.

Leading Players in the Japan Sodium Reduction Ingredient Market Sector

- Tate & Lyle Plc

- Armor Proteines SAS

- Givaudan SA

- BASF SE

- Biospringer

- Sensient Technologies Corp

- Cargill Inc

- Ajinomoto Co., Inc.

- Nippon Shokubai Co., Ltd.

- Kikkoman Corporation

Key Milestones in Japan Sodium Reduction Ingredient Market Industry

- 2020: Launch of new clean-label sodium reduction ingredients by major players, responding to growing consumer demand for healthier options.

- 2021: Partnerships between food manufacturers and ingredient suppliers for custom sodium reduction solutions, enabling tailored product development.

- 2022: Government investment in research and development of novel sodium reduction technologies, signaling a strong commitment to public health.

- 2023: Introduction of innovative yeast extract-based sodium reduction solutions offering enhanced umami flavor profiles.

- 2024: Increased adoption of mineral salt blends with improved taste masking properties by key food processors.

Strategic Outlook for Japan Sodium Reduction Ingredient Market Market

The strategic outlook for the Japan Sodium Reduction Ingredient Market is exceptionally positive, driven by sustained consumer demand for healthier food choices and supportive government policies. Future growth accelerators will center on continuous innovation in developing taste-neutral and highly functional sodium replacers, alongside expanded applications across diverse food categories. Strategic collaborations between ingredient manufacturers and food producers will be paramount in co-creating tailored sodium reduction solutions. The market's future hinges on its ability to effectively address sensory challenges while maintaining cost-effectiveness, ensuring widespread adoption and contributing significantly to public health objectives in Japan. The increasing emphasis on clean-label and natural ingredients will further shape product development and market strategies.

Japan Sodium Reduction Ingredient Market Segmentation

-

1. Product Type

- 1.1. Amino Acids & Glutamates

- 1.2. Mineral Salts

- 1.3. Yeast Extracts

- 1.4. Others

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Condiments, Seasonings & Sauces

- 2.3. Dairy & Frozen Foods

- 2.4. Meat & Seafood Products

- 2.5. Snacks and Savoury Products

- 2.6. Others

Japan Sodium Reduction Ingredient Market Segmentation By Geography

- 1. Japan

Japan Sodium Reduction Ingredient Market Regional Market Share

Geographic Coverage of Japan Sodium Reduction Ingredient Market

Japan Sodium Reduction Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Growing Consumer Awareness Toward High Sodium Intake

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids & Glutamates

- 5.1.2. Mineral Salts

- 5.1.3. Yeast Extracts

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Condiments, Seasonings & Sauces

- 5.2.3. Dairy & Frozen Foods

- 5.2.4. Meat & Seafood Products

- 5.2.5. Snacks and Savoury Products

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tate & Lyle Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Armor Proteines SAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Givaudan SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Biospringer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sensient Technologies Corp*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ajinomoto Co. Inc.

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Shokubai Co. Ltd.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kikkoman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tate & Lyle Plc

List of Figures

- Figure 1: Japan Sodium Reduction Ingredient Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Sodium Reduction Ingredient Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Sodium Reduction Ingredient Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Japan Sodium Reduction Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Japan Sodium Reduction Ingredient Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Japan Sodium Reduction Ingredient Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Japan Sodium Reduction Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Japan Sodium Reduction Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Sodium Reduction Ingredient Market?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Japan Sodium Reduction Ingredient Market?

Key companies in the market include Tate & Lyle Plc, Armor Proteines SAS, Givaudan SA, BASF SE, Biospringer, Sensient Technologies Corp*List Not Exhaustive, Cargill Inc, Ajinomoto Co., Inc. , Nippon Shokubai Co., Ltd. , Kikkoman Corporation.

3. What are the main segments of the Japan Sodium Reduction Ingredient Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Growing Consumer Awareness Toward High Sodium Intake.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

Launch of new clean-label sodium reduction ingredients by major players.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Sodium Reduction Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Sodium Reduction Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Sodium Reduction Ingredient Market?

To stay informed about further developments, trends, and reports in the Japan Sodium Reduction Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence