Key Insights

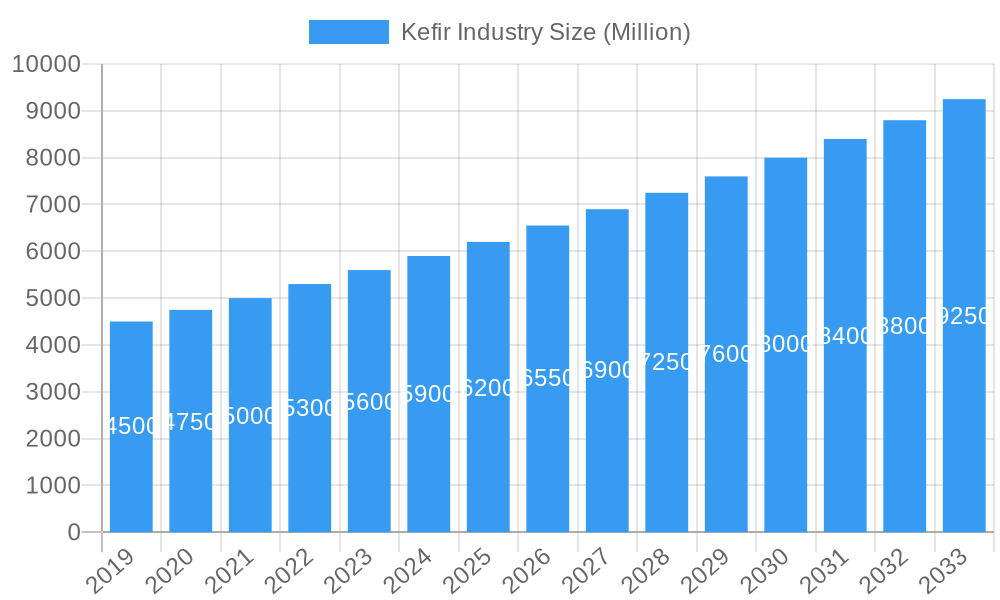

The global Kefir market is poised for significant expansion, projected to reach an estimated market size of approximately $6,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.40% expected to propel it through 2033. This impressive growth is primarily fueled by increasing consumer awareness regarding the health benefits associated with kefir, particularly its probiotic content that supports gut health and immunity. The rising demand for functional foods and beverages, coupled with a growing preference for organic and natural products, further bolsters market expansion. Key market drivers include the growing vegan and lactose-intolerant population seeking dairy-free alternatives, leading to a surge in non-dairy based milk kefir and water kefir products. Innovations in flavor profiles and convenient packaging are also attracting a broader consumer base.

Kefir Industry Market Size (In Billion)

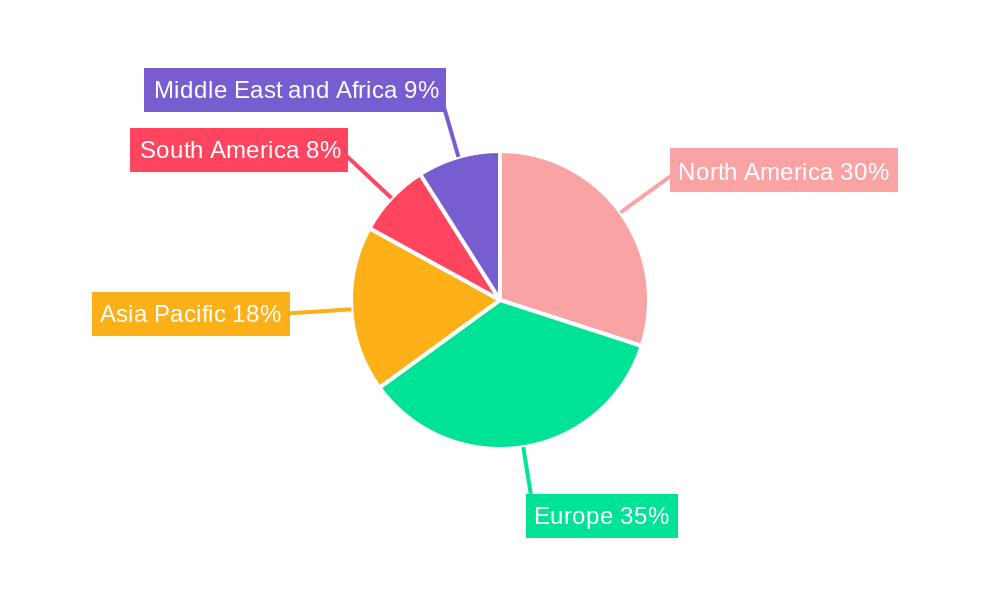

The market is segmented by form into organic and conventional kefir, with a notable trend towards organic options driven by health-conscious consumers. In terms of category, both flavored and non-flavored kefir are witnessing steady demand, though flavored varieties are gaining traction due to their appeal to a wider palate. Product types like milk kefir (both dairy-based and non-dairy based) and water kefir are key segments, with non-dairy milk kefir experiencing accelerated growth. Distribution channels are evolving, with online retail stores emerging as a significant contributor alongside traditional supermarkets and hypermarkets. Geographically, North America and Europe currently lead the market, driven by established health food trends, but the Asia Pacific region is expected to exhibit the fastest growth due to increasing disposable incomes and rising health consciousness. However, challenges such as limited product awareness in certain developing regions and the availability of competing probiotic-rich products could temper growth in some segments.

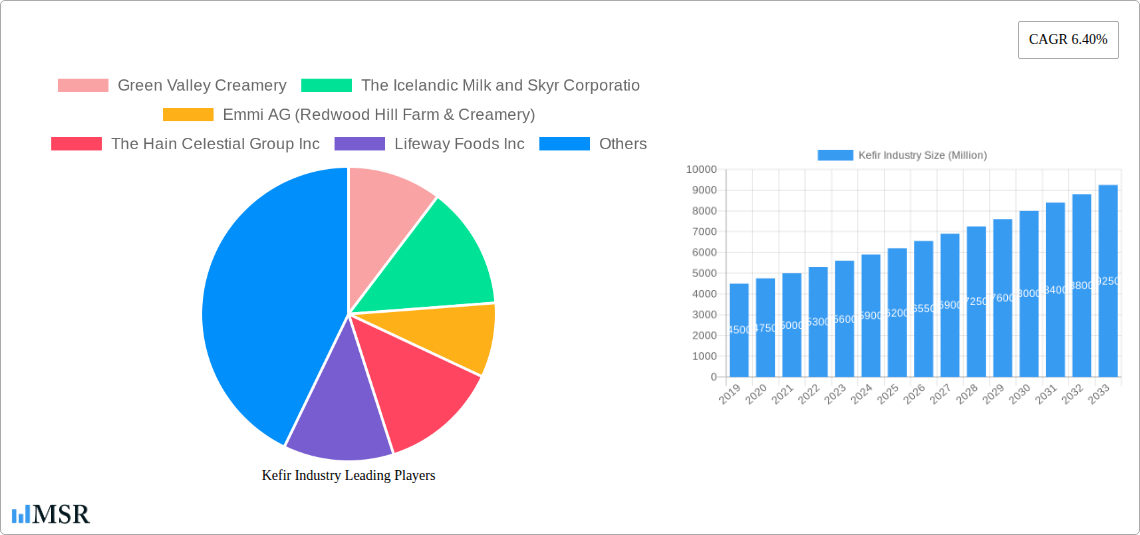

Kefir Industry Company Market Share

Sure, here is an SEO-optimized, engaging report description for the Kefir Industry, embedding high-ranking keywords and structured as requested.

Kefir Industry Market Concentration & Dynamics

The global Kefir Industry is exhibiting moderate market concentration with key players like Danone S.A., Nestlé S.A., and Lifeway Foods Inc. holding significant market shares, estimated at over $15 Billion in 2025. The innovation ecosystem is vibrant, driven by increasing R&D investments in novel formulations and non-dairy alternatives. Regulatory frameworks, particularly those pertaining to food safety and labeling of probiotic content, are becoming more stringent globally, influencing product development and market entry strategies. Substitute products, such as yogurt and other fermented dairy drinks, pose a competitive challenge, but kefir's unique probiotic profile and perceived health benefits differentiate it. End-user trends show a strong preference for organic kefir and flavored kefir varieties, fueled by health-conscious consumers and a growing demand for convenient, nutritious beverages. Merger and acquisition (M&A) activities, while not at hyper-consolidation levels, are strategically important for market expansion and product portfolio diversification. We anticipate approximately 20-30 M&A deals annually, ranging in value from tens of millions to over a Billion dollars, primarily targeting innovative startups and regional players to enhance market reach and technological capabilities.

Kefir Industry Industry Insights & Trends

The Kefir Industry is poised for significant expansion, driven by a growing global awareness of its probiotic benefits and digestive health advantages. The market size for kefir is projected to reach an estimated $25 Billion by 2025, experiencing a robust Compound Annual Growth Rate (CAGR) of approximately 8% during the forecast period of 2025–2033. Technological disruptions are emerging in the form of advanced fermentation techniques, leading to improved shelf-life, enhanced probiotic viability, and a wider range of flavor profiles. The development of non-dairy based milk kefir and water kefir is a pivotal trend, catering to the growing vegan and lactose-intolerant populations. Consumer behaviors are evolving rapidly, with a pronounced shift towards healthy lifestyle choices, natural ingredients, and functional foods. This is further amplified by increasing disposable incomes in emerging economies, enabling wider consumer access to premium products like organic kefir. Online retail stores are becoming increasingly important distribution channels, offering convenience and wider product selection, supplementing traditional supermarkets/hypermarkets and convenience stores. The integration of kefir into various food applications beyond beverages, such as smoothies, baked goods, and culinary ingredients, is also a significant trend contributing to market growth.

Key Markets & Segments Leading Kefir Industry

The North America region currently dominates the Kefir Industry, driven by high consumer awareness of health and wellness trends and a well-established dairy and alternative dairy market. The United States stands as the leading country within this region.

Dominant Segments:

Form:

- Organic Kefir: This segment is experiencing exceptionally high growth due to increasing consumer demand for natural and sustainably produced food products. The market penetration of organic kefir is significantly higher in developed economies, reflecting a stronger consumer willingness to pay a premium for organic certifications.

- Conventional Kefir: While organic holds strong growth, conventional kefir maintains a substantial market share due to its wider availability and more accessible price point, particularly in emerging markets.

Category:

- Flavored Kefir: This category is a major growth engine, appealing to a broader consumer base, including children and those new to kefir. Popular flavors like strawberry, blueberry, and vanilla are driving sales, with continuous innovation in unique and exotic flavor combinations.

- Non-flavored Kefir: This segment caters to purists and those seeking maximum probiotic benefits without added sugars or flavorings. It is particularly strong in health-conscious demographics and in regions with traditional kefir consumption habits.

Product Type:

- Milk Kefir (Dairy based): This remains the cornerstone of the kefir market, benefiting from the familiar taste profile and established production infrastructure.

- Milk Kefir (Non-dairy based): This is the fastest-growing sub-segment, leveraging plant-based milk alternatives like almond, coconut, and oat milk. It is crucial for capturing the vegan, vegetarian, and lactose-intolerant consumer segments.

- Water Kefir: Growing in popularity as a refreshing, low-calorie, and naturally fermented beverage alternative to traditional soft drinks and juices. Its perceived health benefits and unique effervescence are key drivers.

Distribution Channel:

- Supermarkets/Hypermarkets: These continue to be the primary distribution channels, offering broad reach and consumer convenience. The expansion of in-store health food sections further boosts kefir sales.

- Online Retail Stores: This channel is rapidly gaining prominence, offering consumers a convenient way to access a wider variety of brands and products, including specialty and niche kefir options. The ease of home delivery is a significant advantage.

- Convenience Stores: Increasingly stocking kefir as consumers seek healthier on-the-go options, especially in urban areas.

- Other Distribution Channels: Includes health food stores, specialty shops, and direct-to-consumer models, catering to niche markets and loyal customer bases.

Kefir Industry Product Developments

Product innovation in the Kefir Industry is primarily focused on enhancing consumer appeal and expanding market reach. Key developments include the introduction of a wider array of organic kefir and non-dairy based milk kefir options, catering to growing health and dietary preferences. Advanced encapsulation technologies are being employed to improve the survivability of probiotics throughout the digestive tract, thereby amplifying health benefits. The market is also witnessing a surge in novel flavored kefir varieties, incorporating exotic fruits and botanical infusions. These advancements not only diversify product offerings but also position kefir as a versatile functional food ingredient, moving beyond its traditional beverage role into functional snacks and meal components, offering a competitive edge in a dynamic marketplace.

Challenges in the Kefir Industry Market

The Kefir Industry faces several challenges that could temper its growth trajectory. Regulatory hurdles, particularly concerning health claims associated with probiotics, can limit marketing efforts. Supply chain volatility for key ingredients, especially specialized cultures and alternative milk bases, can impact production costs and availability. Intense competition from established dairy products like yogurt and burgeoning plant-based alternatives requires continuous innovation and effective marketing to maintain market share. Furthermore, consumer education remains a critical factor, as some consumers still perceive kefir as an acquired taste or are unaware of its full range of health benefits, which can limit adoption.

Forces Driving Kefir Industry Growth

Several forces are propelling the growth of the Kefir Industry. The increasing global emphasis on gut health and the recognition of probiotics as key to a healthy microbiome is a primary driver. Rising consumer demand for natural and functional foods aligns perfectly with kefir's inherent properties. The continuous innovation in product development, particularly in non-dairy kefir and organic kefir segments, is expanding the consumer base. Economic growth in emerging markets is increasing disposable incomes, allowing more consumers to access premium health products. Furthermore, the expansion of online retail channels is making kefir more accessible than ever before.

Challenges in the Kefir Industry Market

The long-term growth of the Kefir Industry is underpinned by significant technological advancements in fermentation processes, leading to enhanced product quality and shelf-life. Strategic partnerships between ingredient suppliers and kefir manufacturers are fostering innovation and cost efficiencies. Market expansions into untapped geographical regions, particularly in Asia and Latin America, represent substantial growth opportunities. The increasing acceptance of kefir as a key component in functional food and beverage formulations further solidifies its long-term growth potential, driven by a commitment to consumer well-being and product diversification.

Emerging Opportunities in Kefir Industry

Emerging opportunities in the Kefir Industry are abundant and diverse. The development of kefir-infused functional beverages with added vitamins and minerals presents a significant avenue for growth. Innovations in shelf-stable kefir formulations will expand accessibility and reduce logistical challenges. Exploring novel plant-based kefir sources beyond almond and coconut, such as hemp and cashew, will cater to evolving consumer preferences. Furthermore, the integration of kefir into dietary supplements and cosmetic products highlights untapped potential and diversification strategies for industry players.

Leading Players in the Kefir Industry Sector

- Green Valley Creamery

- The Icelandic Milk and Skyr Corporation

- Emmi AG (Redwood Hill Farm & Creamery)

- The Hain Celestial Group Inc

- Lifeway Foods Inc

- Danone S A

- Maple Hill Creamery LLC

- Biotiful Dairy

- Evolve Kefir

- Nestlé S A

Key Milestones in Kefir Industry Industry

- 2019: Increased investment in R&D for non-dairy kefir formulations.

- 2020: Growth in online sales channels for kefir, accelerated by global health trends.

- 2021: Introduction of novel flavored kefir varieties with exotic fruit blends.

- 2022: Regulatory bodies begin to provide clearer guidelines on probiotic health claims.

- 2023: Lifeway Foods Inc. announces expansion plans into new international markets.

- 2024: Biotiful Dairy secures significant funding for further product development and market penetration.

- 2025: Forecasted significant market growth for organic and non-dairy kefir segments.

- 2026-2033: Continued innovation in functional kefir, expansion into emerging economies, and potential consolidation through strategic M&A activities.

Strategic Outlook for Kefir Industry Market

The strategic outlook for the Kefir Industry is highly positive, characterized by continuous innovation and expanding consumer adoption. Growth accelerators include the increasing demand for organic kefir and plant-based alternatives, alongside advancements in probiotic technology that enhance efficacy. Strategic opportunities lie in expanding into emerging markets with tailored product offerings and leveraging digital marketing to educate consumers about kefir's diverse health benefits. The industry is well-positioned to capitalize on the global shift towards healthier lifestyles, ensuring sustained growth and market leadership in the functional beverage and dairy-alternative sectors.

Kefir Industry Segmentation

-

1. Form

- 1.1. Organic

- 1.2. Conventional

-

2. Category

- 2.1. Flavored kefir

- 2.2. Non-flavored kefir

-

3. Product Type

-

3.1. Milk Kefir

- 3.1.1. Dairy based

- 3.1.2. Non-dairy based

- 3.2. Water Kefir

-

3.1. Milk Kefir

-

4. Distribution Channel

- 4.1. Supermarkets/Hypermarkets

- 4.2. Convenience Stores

- 4.3. Online Retail Stores

- 4.4. Other Distribution Channels

Kefir Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. Spain

- 2.5. France

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Kefir Industry Regional Market Share

Geographic Coverage of Kefir Industry

Kefir Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Probiotics Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Kefir Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Organic

- 5.1.2. Conventional

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Flavored kefir

- 5.2.2. Non-flavored kefir

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Milk Kefir

- 5.3.1.1. Dairy based

- 5.3.1.2. Non-dairy based

- 5.3.2. Water Kefir

- 5.3.1. Milk Kefir

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Supermarkets/Hypermarkets

- 5.4.2. Convenience Stores

- 5.4.3. Online Retail Stores

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America Kefir Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Organic

- 6.1.2. Conventional

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Flavored kefir

- 6.2.2. Non-flavored kefir

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Milk Kefir

- 6.3.1.1. Dairy based

- 6.3.1.2. Non-dairy based

- 6.3.2. Water Kefir

- 6.3.1. Milk Kefir

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Supermarkets/Hypermarkets

- 6.4.2. Convenience Stores

- 6.4.3. Online Retail Stores

- 6.4.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Europe Kefir Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Organic

- 7.1.2. Conventional

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Flavored kefir

- 7.2.2. Non-flavored kefir

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Milk Kefir

- 7.3.1.1. Dairy based

- 7.3.1.2. Non-dairy based

- 7.3.2. Water Kefir

- 7.3.1. Milk Kefir

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Supermarkets/Hypermarkets

- 7.4.2. Convenience Stores

- 7.4.3. Online Retail Stores

- 7.4.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Asia Pacific Kefir Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Organic

- 8.1.2. Conventional

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Flavored kefir

- 8.2.2. Non-flavored kefir

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Milk Kefir

- 8.3.1.1. Dairy based

- 8.3.1.2. Non-dairy based

- 8.3.2. Water Kefir

- 8.3.1. Milk Kefir

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Supermarkets/Hypermarkets

- 8.4.2. Convenience Stores

- 8.4.3. Online Retail Stores

- 8.4.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Kefir Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Organic

- 9.1.2. Conventional

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Flavored kefir

- 9.2.2. Non-flavored kefir

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Milk Kefir

- 9.3.1.1. Dairy based

- 9.3.1.2. Non-dairy based

- 9.3.2. Water Kefir

- 9.3.1. Milk Kefir

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Supermarkets/Hypermarkets

- 9.4.2. Convenience Stores

- 9.4.3. Online Retail Stores

- 9.4.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East and Africa Kefir Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Organic

- 10.1.2. Conventional

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Flavored kefir

- 10.2.2. Non-flavored kefir

- 10.3. Market Analysis, Insights and Forecast - by Product Type

- 10.3.1. Milk Kefir

- 10.3.1.1. Dairy based

- 10.3.1.2. Non-dairy based

- 10.3.2. Water Kefir

- 10.3.1. Milk Kefir

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Supermarkets/Hypermarkets

- 10.4.2. Convenience Stores

- 10.4.3. Online Retail Stores

- 10.4.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Green Valley Creamery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Icelandic Milk and Skyr Corporatio

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emmi AG (Redwood Hill Farm & Creamery)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Hain Celestial Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lifeway Foods Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danone S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maple Hill Creamery LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Biotiful Dairy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evolve Kefir

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nestlé S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Green Valley Creamery

List of Figures

- Figure 1: Global Kefir Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Kefir Industry Revenue (Million), by Form 2025 & 2033

- Figure 3: North America Kefir Industry Revenue Share (%), by Form 2025 & 2033

- Figure 4: North America Kefir Industry Revenue (Million), by Category 2025 & 2033

- Figure 5: North America Kefir Industry Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Kefir Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 7: North America Kefir Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Kefir Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America Kefir Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Kefir Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Kefir Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Kefir Industry Revenue (Million), by Form 2025 & 2033

- Figure 13: Europe Kefir Industry Revenue Share (%), by Form 2025 & 2033

- Figure 14: Europe Kefir Industry Revenue (Million), by Category 2025 & 2033

- Figure 15: Europe Kefir Industry Revenue Share (%), by Category 2025 & 2033

- Figure 16: Europe Kefir Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Europe Kefir Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Kefir Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 19: Europe Kefir Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Europe Kefir Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Kefir Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Kefir Industry Revenue (Million), by Form 2025 & 2033

- Figure 23: Asia Pacific Kefir Industry Revenue Share (%), by Form 2025 & 2033

- Figure 24: Asia Pacific Kefir Industry Revenue (Million), by Category 2025 & 2033

- Figure 25: Asia Pacific Kefir Industry Revenue Share (%), by Category 2025 & 2033

- Figure 26: Asia Pacific Kefir Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Kefir Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Kefir Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Kefir Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Kefir Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Kefir Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Kefir Industry Revenue (Million), by Form 2025 & 2033

- Figure 33: South America Kefir Industry Revenue Share (%), by Form 2025 & 2033

- Figure 34: South America Kefir Industry Revenue (Million), by Category 2025 & 2033

- Figure 35: South America Kefir Industry Revenue Share (%), by Category 2025 & 2033

- Figure 36: South America Kefir Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: South America Kefir Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: South America Kefir Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: South America Kefir Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Kefir Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Kefir Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Kefir Industry Revenue (Million), by Form 2025 & 2033

- Figure 43: Middle East and Africa Kefir Industry Revenue Share (%), by Form 2025 & 2033

- Figure 44: Middle East and Africa Kefir Industry Revenue (Million), by Category 2025 & 2033

- Figure 45: Middle East and Africa Kefir Industry Revenue Share (%), by Category 2025 & 2033

- Figure 46: Middle East and Africa Kefir Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 47: Middle East and Africa Kefir Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 48: Middle East and Africa Kefir Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 49: Middle East and Africa Kefir Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Middle East and Africa Kefir Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Kefir Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Kefir Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Global Kefir Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Global Kefir Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Kefir Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Kefir Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Kefir Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 7: Global Kefir Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 8: Global Kefir Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Kefir Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Kefir Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Kefir Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 16: Global Kefir Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 17: Global Kefir Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global Kefir Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Kefir Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Russia Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Kefir Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 28: Global Kefir Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 29: Global Kefir Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Kefir Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Kefir Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: China Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Japan Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Australia Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Asia Pacific Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Kefir Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 38: Global Kefir Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 39: Global Kefir Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Kefir Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Kefir Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Brazil Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Argentina Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Kefir Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 46: Global Kefir Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 47: Global Kefir Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 48: Global Kefir Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Kefir Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: South Africa Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: United Arab Emirates Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Middle East and Africa Kefir Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kefir Industry?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Kefir Industry?

Key companies in the market include Green Valley Creamery, The Icelandic Milk and Skyr Corporatio, Emmi AG (Redwood Hill Farm & Creamery), The Hain Celestial Group Inc, Lifeway Foods Inc, Danone S A, Maple Hill Creamery LLC, Biotiful Dairy, Evolve Kefir, Nestlé S A.

3. What are the main segments of the Kefir Industry?

The market segments include Form, Category, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Increasing Demand For Probiotics Drinks.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kefir Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kefir Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kefir Industry?

To stay informed about further developments, trends, and reports in the Kefir Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence